I will discuss some of the Best Decentralized Exchanges (DEXs) available in this article.

With the advent of DEX, users have been offered an improved trading experience, including the security of their money and features they would like.

These platforms meet various trading needs, such as automated market makers and cross-chain compatibility, making them relevant to both new and seasoned traders.

What is a Decentralized Exchange?

Decentralized exchanges (DEXs) have revolutionized the finance sector and completely changed the way transactions are conducted in the world of cryptocurrency.

In simple terms, a decentralized exchange is an internet-based market that allows users to transact cryptocurrencies directly with each other safely and without intermediaries.

14 Best Decentralized Exchanges In 2024

| Platform | Key Point |

|---|---|

| Bybit | |

| Bitrue | Welcome gifts for new Signups |

| Slingshot | A user-friendly DeFi trading platform offering price comparisons across various decentralized exchanges. |

| Uniswap | One of the largest decentralized exchanges, utilizing an automated market maker (AMM) model for token swaps. |

| CowSwap | Focuses on minimizing transaction fees using batch auction mechanisms for gasless trading. |

| 1inch | An aggregator that sources liquidity from multiple DEXes to find the best rates for users. |

| Velodrome | A decentralized exchange on Optimism, designed to offer low fees and deep liquidity incentives. |

| Matcha | A DEX aggregator by 0x, providing users with the best prices across different decentralized exchanges. |

| Raydium | An AMM and liquidity provider on the Solana blockchain, integrating with Serum’s order book. |

| Kamino Finance | Automated yield management platform optimizing liquidity positions for DeFi users. |

| Sushi | A multi-chain DEX and DeFi suite offering swaps, yield farming, and staking across various blockchains. |

| dYdX | A decentralized exchange offering advanced features like perpetual trading and margin trading. |

| Yield Yak | A DeFi yield optimizer on Avalanche, allowing users to auto-compound yields from various protocols. |

14 Best Decentralized Exchanges In 2025

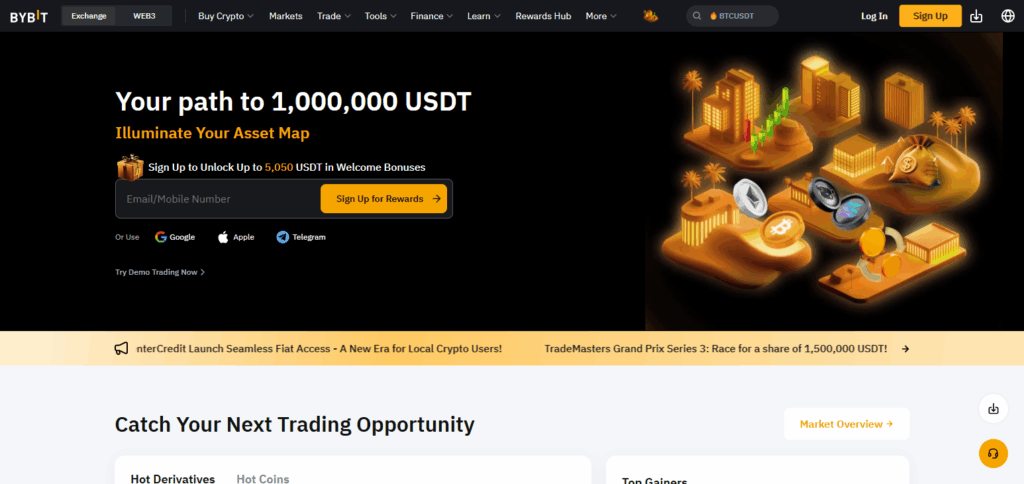

1.Bybit

Founded in 2018, Bybit is often compared to the best exchanges even though it’s not a decentralized one. customers appreciate user privacy features and non-custodial services. It offers several cryptocurrencies including BTC, ETH, USDT, and other popular altcoins.

Users can deposit through crypto and fiat via Banxa, MoonPay, or Advcash. Withdrawal processing is done swiftly in crypto. Even though centralized, Bybit allows P2P trading and basic KYC for mere identification which is appealing to many users. Stringent security measures paired with round-the-clock support makes it a go-to exchange for crypto traders.

2. Bitrue

Bitrue Crypto Exchange: Claim Your Share Of $12,000 Now!

Bitrue has shaken up the crypto market with their New Users Campaign, where they are giving away $12,000 just for making your first Futures Trade!

It’s as easy as it sounds—if you trade over $250 in Futures, you are rewarded by randomly being selected for a token airdrop worth anywhere from $5 – $20. For new or seasoned trades alike, this is a great opportunity to earn free crypto while utilizing Bitrue’s powerful trading platform.

? What to consider when Joining Bitrue:

✅ Welcome gifts for new Signups

✅ Zero hassle when it comes to security and Futures trading

✅ Great fee structure with high liquidity

What are you waiting for? Go grab your free airdrop today! If you haven’t yet signed up, do it with my link and start trading straight away:

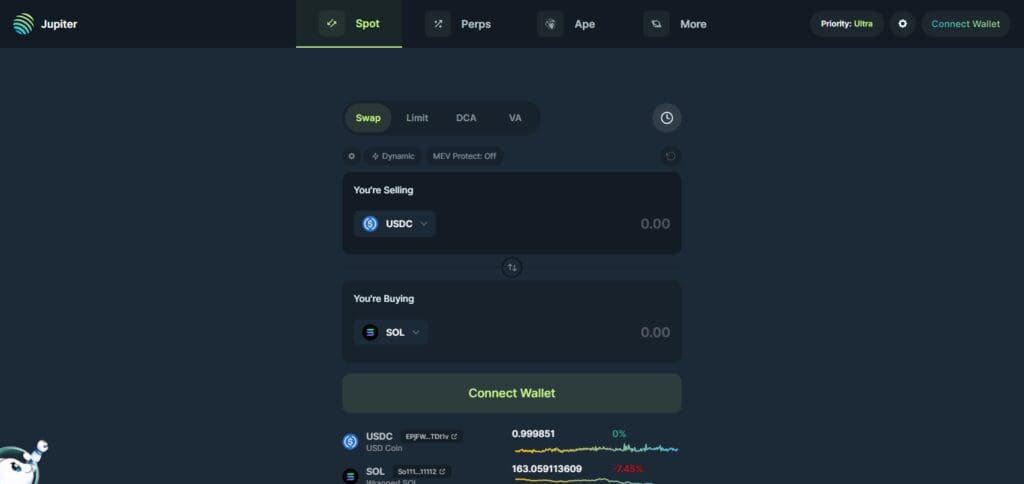

3. Jupiter

A potent liquidity aggregator for the Solana ecosystem, Jupiter serves all your trading requirements by linking investments to numerous decentralized exchanges.

By sourcing liquidity from various sources, Jupi2er allows slippage-free trade execution while ensuring users don’t have to go through complicated processes.

Jupiter appeals to both casual and more advanced traders due to the incredible synergy offered by built-in support for decentralized finance (DeFi) services.

With its simplistic design, Jupiter is now becoming a go-to for people interested in trading on the Solana chain.

Jupiter Features

- Liquidity Aggregation: Aggregates liquidities from various platforms to yield the best ADC prices.

- Low Fees: Transactions are offered at competitive prices, enabling users to realize profits from their trades.

- User-Friendly Interface: Unique and simplified for ease of navigation and quick trades.

- Advanced Security: Strong security mechanisms are employed to ensure the safety of users’ funds.

- High-Speed Transactions: Ensures better and faster order execution with the least waiting times.

4. Slingshot

A trading interface built around users, not traders, Slingshot smoothens the process of buying and selling cryptocurrency for other goods and services.

Users can compare prices between multiple decentralized exchanges to find the best rates promptly.

Slingshot offers an unmatched interface, allowing a non-trader to jump in and out without getting lost in the intricacies of DeFi trading.

The content also draws on other value-rich features to drive interaction and guarantees transparency with real-time data and analytics, which is essential in decision-making.

A crisp user interface also appeals to traders, so Slingshot has been steadily building up its user base and becoming a go-to option for trading in DeFi.

Slingshot Features

- Dynamic Pricing: Displays competitive quotes sourced from multiple liquidity providers in real-time.

- Gas Fee Minimization: Provides an efficient routing leading to lower gas rates and costs.

- Cross-Chain Functionality: Allows users to trade across multiple blockchain networks with ease.

- Design for the User: A straightforward, clean interface enables efficient and fast trading activities.

- Incentive Program: Addresses active trading with bonuses and incentives, encouraging users to trade frequently.

- All-round Protection: Ensures the safety and security of user funds and transactions through various security measures.

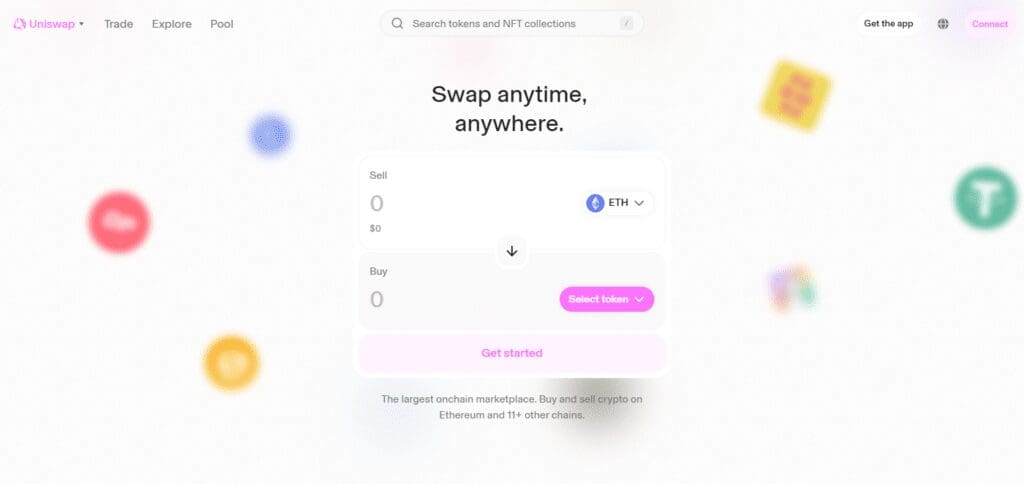

5. Uniswap

Users can exchange ERC-20 tokens from their wallets directly without relying on any third parties or order books.

Uniswap is one of the first decentralized exchanges to employ the automated market maker (AMM) model for token-to-token swaps.

This enhances efficiency in trading as transactions can be conducted effortlessly and within the shortest time possible.

Uniswap’s system of providing liquidity is based on the premise that users who contribute their tokens will earn fees from other transactions.

As a result, given its popularity and convenience, Uniswap has become a dominant feature of the DeFi space and constantly develops to evolve with user needs and improve its operations.

Uniswap Features

- Automated Market Maker (AMM): Employs AMM technology for effective, non-restricted token exchange.

- Liquidity Pools: Allows participants to supply liquidity and obtain interest on the amount pooled.

- Broad Token Support: Provides access to many ERC-20 tokens in the Ethereum network.

- User-Friendly Interface: Put in place to be straightforward and fluid in trading.

- Decentralized Governance: Operating on a chokehold-the-voter basis where the holders make new changes.

- High Liquidity: It is well recognized as having high liquidity, making it easy to execute large volumes of trades with very little slippage.

6. CowSwap

CowSwap is unique in its offerings owing to its use of a batch auction mechanism, which helps eliminate high transaction costs and allows gasless trading.

The Executingerous trades through aggregation into batches leads to increased efficiency and user cost reduction, making it ideal for traders who ing to minimize their trading costs.

The platform also strives to maintain reasonable prices by leveraging a unique model that fluctuates fairly with the market.

With CowSwap’s approach to customer service and overall efficiency of price manipulation, it can quickly become one of the top competitors in decentralized exchanges.

It makes sense, therefore, for traders who seek an effective solution to conventional problems associated with DEX trading methods.

CowSwap Features

- Batch Trading Mechanism: Combine several orders to achieve the best order depths, reducing transaction costs and gas expenditures.

- MEV Protection: Protects users against Miner Extractable Value (MEV) abuse, thereby providing better pricing.

- Gasless Orders: Customers do not pay gas for services in advance; sucrose expenses are covered by the cost of trade.

- Slippage-Free Trades: Ensures that trades are executed at confirmed prices, avoiding slippage from expectations.

- Multi-DEX Integration: Combines multiple DEX’s liquidity to achieve the best execution for the trade.

7. 1inch

1inch Users can best source their digital assets through the 1inch decentralized exchange aggregator.

This is made possible by sourcing liquidity from numerous decentralized exchanges and utilizing an order-splitting system that nearly eliminates market slippage.

SmarThe platform’s smart routing technology allows users to get the best prices by directing trades to the most effective channels.

In addition, first-timers will find it easy to make transactions on the platform, which provides an intuitive interface for all users.

Users’ demands for simplicity and dynamic technology helped 1inch reach the market’s expectations.

1inch Features

- DEX Aggregation: Collecting liquidity across various DEXs to always quote the most favourable price on a trade.

- Pathfinder Algorithm: Advanced routing algorithms ensure efficient token swap paths.

- Limit Order Protocol: A system that permits users to issue limit orders to allow for trades at predetermined prices.

- Cross-Chain Compatibility: Enables the inclusion of other chains for effective cross-trade.

- Privacy-Focused Transactions: Offering stealth transactions helps enhance user privacy in any trading.

8. Velodrome

Velodrome is a decentralized exchange that runs on top of the Optimism layer two solutions for users who appreciate lower fees and greater liquidity.

The Optimism layer’s concentrated efforts to increase transaction speed and decrease cost benefit traders.

Users will find the interface intuitive and the ease of trading appealing, making Velodrome a key competitor in the DeFi market.

It is worth mentioning that Velodrome is constantly pushing innovation to the forefront, and as a result, the platform can increase the liquidity supply.

As interest in inefficient and efficient trading solutions is on the rise, Vel the drone has much to offer.

Velodrome Features

- They encouraged Liquidity Provision Aimed to improve capital usage through incentivized liquidity placement.

- Voting Platform: UserUsers can see where the incentives go, enabling community-oriented provliquidity.

- Stablecoin Centric: Built to support swapping stablecoins and their affiliated assets without high slippage.

- Dual Tokens Available: Users can receive rewards from Velodrome and partner tokens in liquidity provision.

- Trading Fees Re-distribution: LoBTT provisions of trading fees are returned to LiF, creating more fruitful reward cycles.

9. Matcha

Designed by 0x, Matcha is now an evolving decentralized exchange that emphasises the on-site user experience through its easy-to-surface.

To swap tokens, the exchange finds liquidity on multiple DEXs to guarantee the users get the best prices.

To ensure the ers always get the most up-to-date and relevant information, MatcMatcha’s core focus is updating real-time information and analytics.

The platform stays relevant to the times since the integration, while offering several blockchains to users, magnifies the platform’s usability.

Matcha’s vision is to ensure that you enjoy all facets of trading. With a focus on authority and speed, the platform is sure to attract more traders willing to have an easy time.

Matcha Features

- The Intelligent Order Routing—T feature allows trades to be executed across several venues to ensure the best price.

- User-Friendly Design – Neat and streamlined interface designed for traders’ ease.

- Price Transparency— Provides clients with a breakdown of prices, costs, and slippage rates, including detailed fees before and after executing trades.

- Multi-Chain Support – Provides the option to trade on Ethereum and Binance Smart Chain, among others.

- Non-Custodial Trading – Users do not have to deposit money but can always control their assets.

10. Raydium

Raydium, on the other hand, is a decentralized exchange and liquidity pool derived from the effective SolaSolana blockchain, which senses low transaction costs and high transaction speeds.

Additionally, through Serum’s integration, Raydium enables users to enjoy the benefits of both liquidity and market depth, making trades optimal in execution.

With AMM, the platform focuses on efficiency in interactions, enabling users to swap to tokens and providing liquidity without any complexities.

Containing all the necessary tools ensures that benefits are shared among traders and liquidity providers, and holding such tools, in turn, promotes the growth of an ecosecosystemer’s exploit.

As more tools become necessary within the Solana ecosystem, Raydium continues to be attractive to users.

Raydium Features

- AMM on Solana: Constructed on Solana, where transactions are done at high speed and low cost.

- Serum Integration: This allows better liquidity and price discovery because it allows access to Serum’s order book for constant limit orders.

- Opportunities for Yield Farming: Users can get reward tokens from providing liquidity or staking LP tokens.

- Quick token swap: This makes the tokens swapping fast with little slippage.

- Dual Yield Rewards: Provide two reward incentives on selected pools for better earnings.

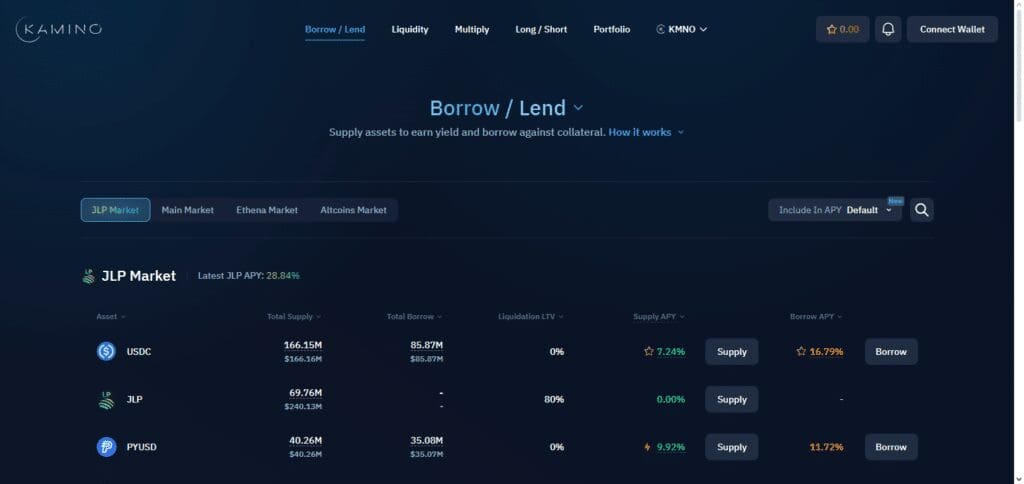

11. Kamino Finance

Kamino Finance aims to allow DeFi users to engage in yield farming without worry, pushing its liquidity-aware yield management platform to the forefront.

It assists in adjusting strategies to maximize yield through the various asset derivative market opportunities.

Liquidity providers can now deposit their assets to be managed by Kamino as it optimizes their yield, freeing them to explore other investment avenues.

Given its design, automation, and simplicity features, experts or novices seek to earn a passive income in the more expansive DeFi space.

In concert with the development of the DeFi projects’ ecosystems, Kamino will be a relevant participant in automatic yield management solutions.

Kamino Finance Features

- Impermanent Loss Protection: Enhances the liquidity providers’ capability to suffer from Impermanent loss.

- Single-Sided Liquidity Pools: Allows liquidity with only one type of token, thus making it more accessible.

- Yield Aggregation: Makes automatic compounding of rewards, thus increasing total returns for users.

- Cross-Chain Compatibility: Can accommodate other blockchain networks to enable varied trading.

- User-Friendly Dashboard: An easy-to-use interface for managing and navigating the liquidity positions and rewards provided.

12. Sushi

Sushi is a broad defi facility that integrates as a multi-chain Dex.

Some of the products include token exchange, asset staking, and yield farming, among others, giving users wishing to manage their crypto portfolio a wide choice of options.

Sushi’s decentralized network enables governance, which allows democracy within their ecosystem.

The platform’s ongoing development and novel features, such as unique liquidity pools and lending protocols, further add to its allure.

Invigorated by enhancing user experience and offering features useful for both traders and investors, Sushi is still at the forefront of the Defi market.

Sushi Features

Multi-Chain Support—For greater ease of access, this feature is Available on numerous blockchains, such as Ethereum, Binance Smart Chain, and Avalanche.

SushiSwap Liquidity Pools – Allows users to make and join liquidity pools of different tokens.

Yield Farming – Facilitates earning of rewards by placing liquidity provider’s tokens in the various farming pools.

Limit Orders – Allows users to determine prices for transactions that are executed.

SushiBar Staking – Rewards users for staking their SUSHI tokens by rewarding them with more SUSHI.

13. dYdX

dYdX is a decentralized exchange focusing on highly sophisticated perpetual contracts and margin trading.

It is aimed at professional traders interested in trading on margin and using sophisticated trading techniques.

With the platforms’ sophisticated tools and analytic functions, users can control their investment portfolios well and take advantage of opportunities in the relevant market.

DYdX provides experienced traders with the right tools that promote decentralization and allow advanced trading functionalities, making it an attractive place for talented traders looking for a competitive advantage.

As dYdX moves forward with its expansion plans, the ecosystem is set to become one of the most engaging platforms for efficient advanced crypto trading.

DYdX Features

- Perpetual Contracts: Features include perpetual contracts for various cryptos, which provide advanced trading options.

- Layer 2 Scaling: Employs Layer 2 technology for quick transactions and low gas fees on Ethereum.

- Margin Trading: Allows users to trade on margin, which enhances the possible investment returns.

- Advanced Charting Tools: Give professional traders access to their own analytical and graphic tools.

- Order Types: It allows a wide range of trading strategies, as it accepts different order types, such as market, limit, and stop orders.

- Non-Custodial Wallet: This allows users to keep full control of their funds without the obligation to deposit them on the exchange.

14. Yield Yak

Yield Yak is a yield optimizer on an avalanche network that liberalizes optimizations for its users using different protocols.

By yield farming, Yield Yak automatically allows users to passively earn rewards without monitoring constantly.

The platform gives its clients techniques that reinvest yields for optimised returns in the long run.

Low-level technicalities associated with yield optimization are combined with adequate visibility. Yield Yak targets both professional and inexperienced investors who want to diversify into cryptocurrency.

Yield Yak is becoming increasingly valuable as DeFi expansion continues to maximize asset returns.

Yield Yak Features

- Yield Optimization: automatically detects and compounds the most lucrative yield farming opportunities using numerous protocols.

- Single-sided staking offers the user the option to stake a single asset, which minimizes the chances of impermanent loss.

- Cross-Platform Integration: Integrates with various blockchains and DeFi protocols to enhance accessibility.

- User-Friendly Dashboard: Intuitive and clean user interface for simple navigation and management of farmers’ strategies.

- Customizable Strategies: Users are welcome to design their own yield farming strategies based on their specific risk and objective parameters.

- Community-Based Governance: Focuses on how users can influence protocol governance through voting using their tokens.

How Do Decentralized Exchanges Work?

A few smart contracts—computer programs that automatically execute transactions once both parties meet certain conditions—have been written in code to facilitate these exchanges.

This is done through a blockchain, eliminating the requirement for trust and any other central authority.

As a result, these transactions are conducted directly between users’ wallets; third-party involvement is unnecessary.

It is important to note that intelligent contracts help realize this decentralization.

Advantages of Using a Decentralized Exchange.

Security

Enhanced security is one of the significant benefits of decentralized exchanges (DEXs).

This means that even if there is a hack, users cannot lose assets because they were not transferred to the exchange.

Decentralized cryptocurrency exchanges are more secure than centralized ones.

Anonymity and Privacy

Decentralized exchanges provide higher levels of anonymity as transactions do not need personal details or KYC (Know Your Customer) processes.

This privacy aspect suits those who would like their financial operations and names concealed, and it matches the philosophy behind the decentralized cryptocurrency exchange.

Control Over Funds

Decentralized exchange users remain in complete control of their funds, which contrasts sharply with centralized models where exchanges have authority over user assets.

As the saying goes, “Not your keys, not your coins. ” This phrase highlights the independence users enjoy in managing their resources on Bitcoin or other cryptocurrencies’ decentralized exchange platforms.

Reduced Risk of Market Manipulation

In comparison, centralized platforms can be easily manipulated for market purposes and unfair trade.

On the contrary, every transaction made on decentralized exchanges is recorded on a public ledger, reducing manipulation possibilities since blockchain technology is immutable and transparent.

Conclusion

To summarize, DEXs are game changers as they offer users increased control, security, and flexibility when trading crypto.

DEXs are gaining popularity with users who want to trade crypto assets in a manner that offers them better features, such as automated market-making on Uniswap, Sushiwap, and dYdX, advanced trading options, and even community governance.

As the DeFi sphere grows and matures, these exchanges are destined to drive the future of finance more efficiently than it is now.

Users are invited to seek a DEX that fits their requirements, as it would make the financial system much more decentralized and user-friendly.