In this article, I will discuss the top the Best Ethereum Staking Platforms of today.

Staking of ETH can earn a reward for security, liquidity, and competitive returns.

This is true for both novices and experts. However, it is vital to choose an appropriate platform to ensure the safety of your assets and the maximum benefit from your staking rewards.

Key Point & Best Ethereum Staking Platforms List

| Platform | Key Point |

|---|---|

| Bybit | Leading crypto exchange offering spot and derivatives trading, advanced tools, and a secure environment for traders. |

| Lido | Decentralized staking platform that allows users to stake assets with liquidity through stETH tokens. |

| Frax | Algorithmic stablecoin protocol that offers a hybrid model combining algorithmic and collateralized mechanisms. |

| Binance | One of the largest global cryptocurrency exchanges offering trading, savings, staking, and a wide range of crypto services. |

| EigenLayer | A decentralized protocol built on Ethereum to enable data availability and cross-chain security through staking. |

| Nexo | A blockchain-based platform offering crypto-backed loans, staking, and interest-earning services. |

| Coinbase | Popular US-based crypto exchange providing a user-friendly platform for trading, buying, and selling cryptocurrencies. |

| Stafi Protocol | Decentralized staking platform that provides staking services with liquidity while maintaining security and decentralization. |

| StakeWise | A liquid staking protocol for Ethereum that allows users to stake ETH while retaining liquidity through sETH2 tokens. |

| Rocket Pool | Ethereum 2.0 staking pool offering decentralized staking services with a focus on scalability and security. |

10 Best Ethereum Staking Platforms

1. Bybit

Bybit is one of the best platforms for staking Ethereum primarily because of its features and different trading methods.

Bybit staking is a convenient and easy-to-use process where users earn rewards for minimal effort.

On Bybit, staking is offered at attractive rates, and constant liquidity is facilitated by using staking derivatives.

This makes it easy for people to trade staked tokens without losing the benefits of staking.

Staking Ethereum on this platform is beautiful. It is simple and provides ample features and functionalities for professional speakers who wish to earn the maximum return on their investment with minimum risk.

Bybit Features

- Tools for trading and staking Ethereum are well-advanced.

- High liquidity helps in easy withdrawals and trading.

- Returns for staking are competitive with very minimal charges.

2. Lido

Lido is a decentralized liquid staking protocol that enables users to stake their ETH with ETH2.0 liquidity through stETH tokens. This means that users can stake their assets while gaining access to them since stETH can be traded or utilized in various DeFi ecosystems.

Staking ETH with Lido is profitable since it is simple and has reliable security measures.

It also provides more appealing staking rewards and lower validator risks, making it an excellent alternative for all crypto enthusiasts.

Lido Features

- It enables users to stake and liquidity to speakers via stealth tokens.

- It is fully decentralized, with a lot of validators ensuring security.

- Large and small investors can make use of tailored staking facilities.

3. Frax

Frax is a novel Ethereum staking solution that integrates algorithmic mechanisms with collateral protocols.

The Frax protocol seeks to bring efficient and scalable staking with reduced volatility.

It delivers a hybrid approach towards staking and stablecoins, enabling users to stake Ethereum and other assets without compromising liquidity and risk.

Frax’s governance is decentralized, which adds a layer of transparency. In addition, the staking platform was developed to suit both long-term and short-term Ethereum investors who seek flexible and stable returns.

Frax Features

- A hybrid staking model based on algorithmic backing and collateralized backing.

- Emphasis on scalability and observable lower levels of volatility.

- Transparent staking process without any central authority.

4. Binance

Binance, one of the largest cryptocurrency exchange platforms in the world, offers an Ethereum staking service, arguably the most user-friendly way to earn rewards.

Through Binance, Ethereum holders can stake their ETH with a reasonable annual return percentage while still being on a reputable platform.

The staking functionality offered by Binance is basic and self-explanatory, with no minimum initial balance requirements.

Furthermore, a large amount of money is always available at Binance for withdrawal or trading of staked assets; therefore, any user can get access to an efficient staking platform regardless of their experience.

Binance Features

- Interfaces are designed to allow even non-expert users to stake assets easily.

- Apart from Ether, other assets may be deployed in staking.

- Funds that are staked are highly secured and insured.

5.EigenLayer

EigenLayer is an innovative decentralized protocol on the Ethereum blockchain that aims to improve staking through enhanced data availability and security across chains.

As a result, Ethereum stakes do not rely solely on the Ethereum network since they can supply liquidity and submit additional stakes to other blockchains while anchoring Ethereum’s network.

Such a model allows users to receive higher yields with low-risk factors. EigenLayer is expected to deliver scalability and security, making it an attractive choice for more advanced Ethereum users interested in using a broader spectrum of staking alternatives rather than only the core Ethereum network.

EigenLayer Features

- There are cross-chain security and data availability features.

- There are additional rewards for Ethereum stakes.

- The platform aims to focus on the Ethereum ecosystem’s scalability.

6. Nexo

Nexo provides myriad features, such as crypto-backed loans and staking services, that allow users to lend against their Ethereum cryptocurrencies and earn a passive income while the asset appreciates.

Nexo qualifies as one of the most trustworthy platforms for Ethereum owners to stake their tokens and earn decent rewards while remaining safe.

The user-friendly interface offers different variations of staking, including but not limited to variable or fixed-term staking.

Another aspect of Nexo is that its services are transparent and easy to use. Thus, users can always fund and withdraw their home assets without being constrained by the locking period.

Nexo Features

- Staking comes with crypto-backed lending features.

- It is possible to earn interest on the assets that have been staked.

- Different staking periods are available for liquidity control.

7. Coinbase

Coinbase is a popular exchange platform allowing users to stake Ethereum seamlessly.

The company offers an easy educational slope for new and long-time crypto investors.

Users can stake their Ethereum on Coinbase and receive stakes effortlessly and directly into their Coinbase accounts.

The platform offers liquidity and security, making it one of the most used platforms for staking tasks.

With reasonable fees and great rewards, Coinbase is a good option for people who want to stake Ethereum in an easy and safe environment.

Coinbase Features

- It is easy to stake Ethereum because there is no minimum required amount.

- It’s a trusted platform because it is compliant with regulatory requirements.

- Rewards from staking are sent to the account without delay.

8. Stafi Protocol

The Stafi Protocol is another platform that can stake assets for all who possess Ethereum without sacrificing liquidity for its staked tokens.

It allows users to use DeFi staking with much security since their staked tokens can still get involved in DeFi applications.

Stafi’s model effectively restructures the staking process, removing the usual challenges associated with Developing ETH tokens and then staking Them. Users can stake their ETH and still have access to their funds.

This, therefore, makes Stafi the best option for people who want high returns and easy liquidity.

Stafi Protocol Features

- Advanced staking with active liquidity solutions and decentralization.

- Allow staking for several cryptos, mostly staking Ethereum and ERC20 tokens.

- Prioritizes users’ safety from validator selection and active monitoring of the validator.

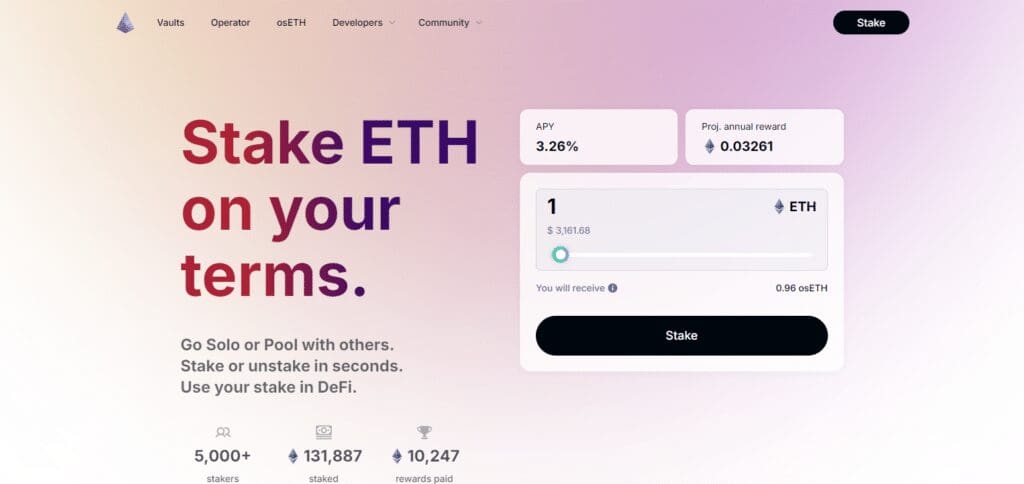

9.StakeWise

StakeWise is a young project that makes it easy and pleasant to stake ETH while retaining liquidity via sETH2 tokens.

This token type allows holding staked ETH, which can be swapped or used in DeFi protocols.

StakeWise expands its portfolio by allowing users to participate in staking and providing liquidity, which means higher rewards for its users.

Its decentralised environment ensures safety and control over customers’ money.

StakeWise is an excellent option for Ethereum investors who aim for high profits and the ability to use their staked assets however they wish.

StakeWise Features

- This includes liquid staking and yield farm on one platform.

- The minimum amount for staking that is accessible.

- Supports reinvestment of staking rewards for higher profits.

10. Rocket Pool

Rocket Pool is an Ethereum staking pool offering secure and scalable staking.

Unlike traditional centralized platforms where users stake their Ethereum in centrally located ETH375756973, which compromises network security.

Here, users can stake Ethereum in a decentralised way and still receive reasonable rewards in return.

Staking can be entered with as low as 16 ETH, which also helps earn rewards with a minimal structure.

A large share of staked assets are earned from Rocket Pool’s design. Rocket Pools are also suited for those who value decentralization and scalability in their staking approach.

Rocket Pool Features

- Community-governed, decentralized Ethereum staking where a node is a validator.

- Deposit 16 of ETH to stake or more.

- Provides solid decentralisation and security over the network.

How To Choose Best Ethereum Staking Platforms

Security

Ensure that the platform implements strong measures such as two-step verification (2SV), encryption, and other methods that have been successful in protecting users’ funds in the past.

Liquidity

When selecting a strategy for professional trading, you may want to include liquid strategies that offer liquidity solutions or marketing that allows you to unfreeze your features if necessary.

Fees: Please verify if staking fees and other additional costs exist. Fewer fees will eventually ensure better rewards.

Rewards Rate

Assess the sites’ capability to reward you on an annual basis and more. While striving for higher rewards may be attractive, one should ensure that the risks are within reasonable proportions.

User Experience

Look for a platform that is quite simple and offers easy staking. It’s important to find clear, step-by-step instructions and simple controls.

Reputation

Choose platforms with strong followership and good reviews. Such platforms are much less likely to engage in risky fraud behavior.

Decentralization

Look for platforms that emphasize decentralization. These are more secure and will not be overly controlled by regulation.

Minimum Deposit

While some platforms will not allow you to make an ETH stake lower than the set minimum, others do not impose such restrictions. Pick a provider that allows you to stake the amount that suits your goals and movements.

Additional Features

Consider whether the platform has scope for more services, such as liquidity staking, reward compounding, and other DeFi platform integrations, to enhance the staking experience.

Support and Customer Service

Ensure the necessary support is available to handle problems or concerns as quickly as possible.

Conclusion

Finally, it can be concluded that the choice of the best staking platform depends on the parameters of security, liquidity, fees, rewards or user experience in general.

In this regard, Lido, Binance or Rocket Pool score high on security, liquidity, and rewards – the significant determinants of the staking decision.

Such a choice is made because it is essential to focus on the goals behind staking, which could range from getting maximum returns, maintaining some degree of flexibility, or fostering the cause of decentralization.

The right platform selection and understanding of the key factors would allow for a simple and rewarding Ethereum staking experience.