I’ll go over the top Forex brokers that support FIX 4.4 connectivity in this post. For professional traders and institutions, FIX 4.4 is a potent protocol that makes trading quick, dependable, and automated.

Selecting a broker that supports FIX 4.4 guarantees low-latency execution, direct market access, and smooth connection with custom trading systems, assisting traders in maximizing performance and effectively implementing cutting-edge tactics.

Why It Is Forex Brokers Supporting FIX 4.4 Connectivity Matter

Low Latency Execution: Orders are completed quicker, which means less slippage.

Direct Market Access: Traders are connected to liquidity providers, which means better prices.

Automated Trading: Algorithmic and high-frequency trading are effortless with automation.

Standardized Messaging: There is consistent order and trade communication to and from the system with the industry standard FIX 4.4.

Institutional Scale: It can easily and efficiently handle high-volume trading, which is perfect for professional trading.

Key Point & Best Forex Brokers Supporting FIX 4.4 Connectivity List

| Broker | Key Points |

|---|---|

| IG | Global presence, strong regulatory compliance, wide range of CFDs & forex, advanced trading platforms, robust research tools. |

| Saxo Bank | Institutional-grade services, multi-asset trading, proprietary SaxoTraderGO platform, strong research & analytics, premium account options. |

| Pepperstone | Low spreads, fast execution, MT4/MT5 support, copy trading options, competitive fees for active traders. |

| IC Markets | True ECN execution, low-latency servers, high liquidity, multiple trading platforms, competitive spreads. |

| CMC Markets | Extensive instrument range, intuitive Next Generation platform, strong charting & technical tools, reliable customer support, regulated globally. |

| FxPro | Multiple trading platforms (MT4, MT5, cTrader), strong execution, wide range of instruments, competitive spreads, robust research. |

| OANDA | Trusted regulatory history, user-friendly platforms, API & automated trading, transparent pricing, extensive historical data access. |

| Swissquote | Swiss banking reliability, multi-asset offerings, proprietary platform, advanced security, strong regulatory oversight. |

| Dukascopy Bank | Swiss-based bank, ECN execution, proprietary JForex platform, strong liquidity, regulatory compliance with Swiss FINMA. |

| ThinkMarkets | Low spreads, fast execution, MT4/MT5 platforms, innovative ThinkTrader platform, competitive account types. |

1. IG

As a broker with an international presence and over 30 years of experience, IG is regulated by major authorities such as the FCA (UK) and ASIC (Australia) and operates in a multitude of countries, offering a substantial variety of products in CFDs, commodities, currency pairs, and indices.

Brokers as IG offers proprietary platforms, MT4 and charting software, fitting both the beginner and the professional trader. However, although IG invests a lot of resources on its platform, retail clients don’t have full access to FIX APIs. Custom-made institutional APIs may exist, but they are not as documented as other brokers.

IG Features, Pros & Cons

Features

- Global broker whose regulatory covers the range of FCA, ASIC, etc.

- Offers multiple services from FX, indices, commotites, shares.

- Uses multiple proprietary and MT4 platforms.

- Advanced charting, research, and tools.

- Multiple aids for charting and research.

Pros

- Global regulatory cover and trust.

- Offers multiple for charts and research.

- Provides customer support worldwide.

- Provides mobi and web platforms.

- Offers a wide range of services.

Cons

- Fees for some services are considered high.

- Lack of basic retial FIX 4.4 connectitvity.

- Complicated for new users.

- Fees for withdrawing are charged from some areas.

- Pricing with ECN style is limited.

2. Saxo Bank

The Danish Saxo Bank is a multi-asset brokerage and investment banking service for institutions and retail investors around the world. Danwatch, the Danish data protection watchdog, confirmed Saxo has acted on data breaches across the globe violating both GDPR and Danish data ownership laws.

Saxo has notable licenses, including the Danish FSA and the FCA in the United Kingdom. Saxo Bank offers its clients access to proprietary SaxoTraderGO and SaxoTraderPRO with advanced analytical tools and seamless integrations to world-class liquidity pools across CFDs, Forex, F&O, and equities.

Even though institutional execution tools are potent, Saxo’s retail clients are not given much information on the FIX 4.4 API, and institutional FIX connectivity is often made via custom agreements rather than in standard offerings.

Saxo Bank Features, Pros & Cons

Features

- Denmark based broker and bank with multi services.

- Offers multiple platforms like SaxoTraderGO and PRO.

- Provides analytics along with Deep Liquidity.

- Offers access for both Institutional & retail.

- Good analytics and research.

Pros

- Offers premium multi-assets.

- Provides tools and analytics.

- Provides global coverage for research.

- Offers multiple products apart from FX.

- Provides tools for effective risk management.

Cons

- Increased fees and BITs for lower class treasurs.

- Not ideal for those who retail are inactive.

- Fees are complicated.

- EZ 4 4 access is custom in most cases.

- New traders are offered limited promotions.

3. Pepperstone

Pepperstone is a well-known ECN Forex broker with a favorable reputation due to its competitive pricing, and low spreads. It also offers execution across multiple trading platforms including MetaTrader 4, MetaTrader 5, and cTrader.

It is also regulated by the ASIC, FCA, and CySEC, and therefore has strong oversight. With the low spreads and strong oversight, it is a good broker for active traders and algorithmic strategies. FIX API is available, but it is targeted towards high-volume professionals and institutional traders rather than retail clients. In addition, to access the FIX API, clients must meet certain volume requirements.

Pepperstone Features, Pros & Cons

Features

- Low spread prices using ECN style

- Supporting MT4/MT5 & cTrader

- Quick trade execution

- Social & copy trading services

- VPS support for automated trading

Pros

- Execution quality and spread pricing are exceptional.

- cTrader and other great platforms are available.

- Excellent for automated trading/algorithmic trading.

- Minimal latency thanks to VPS support.

- Customer support is fantastic.

Cons

- Institutional volume traders usually receive FIX connectivity.

- They have proprietary research that is minimal.

- No stock trading (they only offer CFDs).

- Certain instruments incur overnight fees.

- MT4 has a limit to advanced order types.

4. IC Markets

Ultra low spreads, high multiple platform support (MT4, MT5, cTrader), and deep liquidity are all aspects of Australian ECN broker IC markets. This attracts scalpers, EA developers and high frequency traders.

Although brokers don’t promise or advertise public FIX 4.4 access for clients, in order to service professional trading accounts, at higher volumes, and institutional clients, they can arrange integrations through third-party ECNs and institutional APIs, including FIX via partners.

IC Markets Features, Pros & Cons

Features

- Execution using true ECN

- cTrader and MT4/MT5

- Ultra-low spreads

- High liquidity

- VPS

Pros

- High liquidity and ultra-low spreads are available.

- Algorithmic trading operates with low latency.

- Several platforms are supported.

- Excellent account type flexibility.

- Good partnering with APIs.

Cons

- Institutional accounts usually receive limited FIX 4.4.

- No platforms that are proprietary.

- Customer support is sometimes inconsistent.

- Only available are CFD products.

- Costs for overnight and rollover are applicable.

5. CMC Markets

For over 20 years, CMC Markets has been a FCA-regulated UK financial broker, and offers its clients an in-house built trading platform called Next Generation. The trading software has a variety of useful trading and market analysis features including charting tools, risk management features, and offers around 300 currency pairs and CFDs for trading.

The CMC differentiates from other brokers by focusing on retail and providing in-platform tools for market analysis rather than providing APIs for customers to connect to. The public documents don’t mention retail accounts having access to FIX 4.4, however, in some cases, for institutional clients and technology bespoke partnerships, CMC Markets may offer access in conjunction with their professional services.

CMC Markets Features, Pros & Cons

Features

- UK broker with FCA regulation

- Next-Generation platform

- Advanced analytics and technical tools

- Big selection CFD & FX

- Tools for risk management

Pros

- Charting and platform UX are great.2. Industry grading tools for risk management.

- Extensive product offering.

- Strong educational resources.

- Operated in several regulated jurisdictions.

Cons

- Retail access lacking API FIX.

- More expensive non-trading fees.

- Complicated pricing.

- cTrader and other 3rd party integrations missing.

- Sometimes there is slippage in cases of high volatility.

6. FxPro

FxPro is a global financial broker with a multitude of licenses from other jurisdictions. The broker offers their clients a variety of platforms to trade on including MetaTrader 4, MetaTrader 5, cTrader, and their proprietary platform called FxPro Edge.

The broker also has a wide variety of financial instruments for trading and competitive execution including FX, metals, energies, and indices. FxPro also specializes in retail and professional trading by providing them with a wide flexible choice of platform.

Even though FxPro allows intricate algorithmic trading as well as the use of third-party platforms, *particular FIX 4.4 API access is not widely available to retail traders; dependent upon account tier and trading activity, professional and institutional clients might have on-request access to FIX connectivity.

FxPro Features, Pros & Cons

Features

- Multiple platforms: MT4, MT5, cTrader, FxPro Edge

- Great execution

- Broad range of assets

- EA tools & VPS

- Good customer support

Pros

- Flexibility in platform selection.

- Execution and liquidity are reliable.

- Good offering for CFD & Forex traders.

- Good educational resources.

- Regulated in several jurisdictions.

Cons

- FIX 4.4 is usually only available upon request.

- Sometimes wider variable spreads.

- Advanced proprietary analytics are unavailable.

- Pricing is not the most competitive.

- Social trading is lacking.

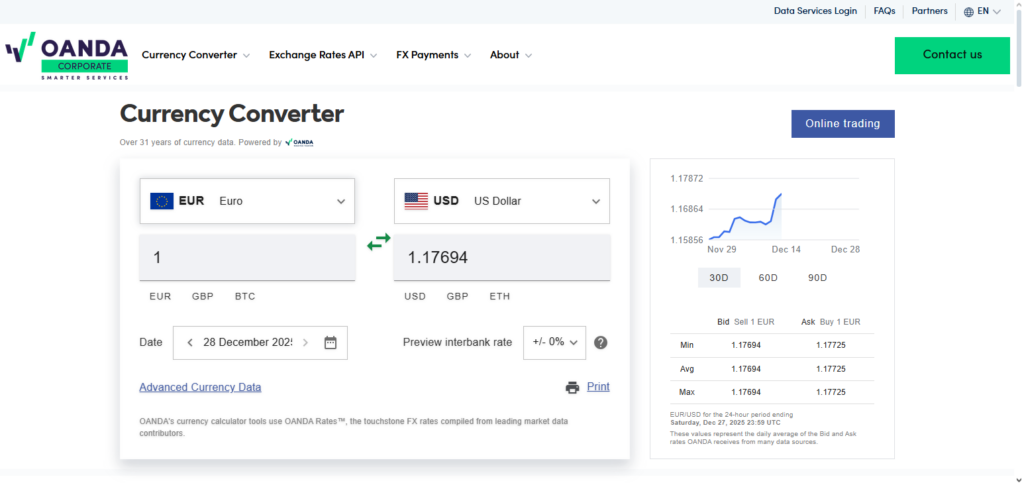

7. OANDA

OANDA is one of the brokers and liquidity providers with supervision by the CFTC and the FCA, presenting open and honest pricing, solid API support (REST and FIX), and great historical data custody. As per reputable sources in the industry,

OANDA does offer a FIX API alongside the REST-based options allowing clients to perform automated trading and direct order execution using the FIX protocol once appropriately configured for the client to be a professional trader. For clients that are not professional traders, they may need to liaise with support or sales to understand the conditions to qualify for access and guidance for the setup.

OANDA Features, Pros & Cons

Features

- MT4 support

- Global regulation

- Strong historical data

- REST & FIX APIs

- Pricing with transparency

Pros

- Straightforward pricing.

- Available for professional traders, FIX 4.4 API.

- Good API (with REST & FIX).

- Good reporting.

- Responsive support.

Cons

- Compared to peers, the product offering is limited.

- Not great for high-frequency trading.

- Spreads widen in low liquidity

- cTrader not offered.

- Some competitors offer better charting.

8. Swissquote

Swissquote is a Group, which is also a bank in Switzerland that is regulated by FINMA and provides a decent range of offerings in forex, stocks, ETFs and derivatives also having a solid institutional grade infrastructure.

Swissquote assists traders looking for direct electronic connectivity, and it specifically provides clients with FIX APIs in compliance with the requested level of regulation and direct market access, which is appropriate for sophisticated automated trading systems and algorithms, while still ensuring compliance with the regulation.

Swissquote Features, Pros & Cons

Pros

- Swiss banking & brokerage

- Multi-asset trading

- Regulation & security by FINMA

- Strong security & regulation

- Comprehensive tools

- FIX 4.4 API

Pros

- Access to FIX 4.4 for advanced traders.

- Multi-asset options outside of FX.

- Strong institutional services.

- Advanced data & platforms.

- Banking credibility & safety.

Cons

- Compared to pure FX brokers, higher costs.

- More costly pricing tiers.

- Only retail FX is not ideal.

- Onboarding might take longer.

- Response time from support is inconsistent.

9. Dukascopy Bank

Dukascopy Bank is a Swiss broker and banking institution that is well known for his liquidity and electronic trading services for professionals.

It *offers FIX 4.4 compliance, Voice API, which enables clients to receive, process, and programmatically manage orders and positions in real time with high and low latency throughput. This feature makes Dukascopy especially attractive to sophisticated algorithmic traders and institutional clients who demand direct access to the FX market.

Dukascopy Bank Features, Pros & Cons

Pros

- Swiss bank & liquidity provider

- JForex eco system tailored for algorithmic trading

- VPS offerings

- ECN pricing & deep liquidity

- FIX 4.4 API

Pros

- Authentic support for FIX 4.4

- Profound focus on algorithmic trading

- Abundant liquidity in market

- Trust secured from banking license

- Advanced platform and automations

Cons

- Learning the platform is difficult.

- Less recognized in the market compared to larger brokers.

- Price structure might be complicated.

- Non-FX offerings are limited.

- Smaller clientele.

10. ThinkMarkets

ThinkMarkets (ThinkForex) is a global broker who is regulated by the FCA and the ASIC and is a global broker who offers MetaTrader 4 and MetaTrader 5 and its own ThinkTrader platform with competitive spreads and quality of execution.

While ThinkMarkets offers automated trading with the use of the MT4/MT5 and has a flexible infrastructure, support for public FIX 4.4 is not documented for most retail clients, and institutional or bespoke FIX solutions are available for larger or professional accounts by request.

ThinkMarkets Features, Pros & Cons

Features

- MT4/MT5 & ThinkTrader

- Competitive spreads

- Educational resources

- VPS support

- Strong mobile platform

Pros

- Pricing & platform competitiveness.

- Intuitive ThinkTrader platform.

- Excellent for retail algorithms & EAs.

- Reliable customer support.

- ThinkMarkets regulation is comprehensive (FCA, ASIC).

Cons

- FIX 4.4 support is often custom, not standard.

- Lacking more sophisticated institutional resources.

- CFD-centric, no direct stock access in some jurisdictions.

- Spreads widen during major news events.

- Small broker compared to legacy big research firms.

Conclusion

FIX 4.4 connection is crucial for institutions and professional traders looking for direct, low-latency market access. By offering dependable FIX API solutions that facilitate algorithmic trading, automatic order execution, and smooth interaction with custom trading systems, brokers like Dukascopy Bank, Swissquote, and OANDA stand out.

While platforms like IG, Saxo Bank, and CMC Markets may offer customized FIX solutions upon request, other brokers like IC Markets and Pepperstone mainly provide FIX access for high-volume or institutional clients. Selecting a broker that supports FIX 4.4 is essential for advanced forex trading methods since it guarantees speed, accuracy, and control.

FAQ

What is FIX 4.4 Connectivity?

FIX (Financial Information eXchange) 4.4 is an industry‑standard electronic messaging protocol used for real‑time exchange of trade information between financial institutions, brokers, and trading systems. FIX 4.4 enables fast execution, standardized messaging, and reliable integration for algorithmic trading, automated strategies, and institutional workflows.

Why Choose a Forex Broker with FIX 4.4 Support?

Brokers supporting FIX 4.4 offer direct market connectivity, low latency, customizable order routing, and ability to integrate custom trading systems and execution algorithms. This makes them ideal for high‑frequency traders, hedge funds, institutional clients, and serious algorithmic traders.

Do Retail Traders Have Access to FIX API?

FIX connectivity is often reserved for institutional or professional accounts with high volume and minimum criteria. Some brokers require approval based on trading volume, account size, or professional status before granting FIX 4.4 access.

Can FIX 4.4 Support Automated Trading?

Yes — FIX 4.4 is widely used to support algorithmic and automated trading strategies because it provides structured messaging for orders, executions, fills, market data, and position updates.