The Best Forex Brokers with Instant USDT & USDC Settlements will be covered in this post. These brokers provide quicker access to cash, fewer transaction delays, and smooth trading by enabling traders to deposit, withdraw, and settle deals swiftly using stablecoins.

Knowing which brokers offer rapid stablecoin payments is essential for effective trading, whatever of experience level.

Key Point & Best Forex Brokers with Instant USDT & USDC Settlements

| Broker | Key Points |

|---|---|

| IC Markets | Known for ultra-low spreads, fast execution, and support for crypto deposits including USDT/USDC. |

| FP Markets | Offers multiple account types, competitive spreads, and reliable regulation; supports digital asset settlements. |

| Pepperstone | Popular for ECN trading, high-speed execution, and flexible crypto payment options. |

| Tickmill | Low-cost trading, strong regulatory framework, and fast account funding with crypto options. |

| Exness | Supports instant crypto deposits/withdrawals, high leverage, and diverse trading instruments. |

| Eightcap | Tight spreads, MT4/MT5 support, and growing crypto payment acceptance including stablecoins. |

| IS Prime | Institutional-grade liquidity, advanced trading platforms, and secure USDT/USDC settlements. |

| Swissquote | Strong European regulation, multi-asset support, and reliable crypto funding options. |

| Dukascopy Bank | Regulated Swiss bank, ECN execution, and integration with digital currency settlements. |

| Saxo Bank | Premium trading platform, multi-asset offering, and supports fiat-to-crypto transactions. |

1. IC Markets

IC Markets was established in 2007 and is an Australian-based Forex broker. They offer ECN trading with fast execution and super low spreads. IC Markets provides flexible trading, as they offer several account types (Standard, Raw Spread, and cTrader); thus, they support any trading level, from beginners to expert traders.

IC Markets has recently included instant USDT and USDC settlements to provide an easy and efficient way for traders to deposit and withdraw stablecoins.

The quality of IC Markets is shown in the powerful trading platforms they offer (MT4, cTrader, and MT5) in conjunction with their regulation with ASIC, CySEC, and SCB. Because of all these qualities, IC Markets is considered one of the finest brokers for Forex trading with integrated crypto.

IC Markets – Key Features

| Feature | Description |

|---|---|

| Execution Type | True ECN execution with deep liquidity |

| Spreads | Very tight raw spreads |

| Platforms | MT4, MT5, cTrader |

| Account Types | Raw Spread, Standard |

| Instruments | Forex, CFDs, Commodities, Indices |

| Liquidity | Tier‑1 provider access |

| Commissions | Low commission on raw accounts |

IC Markets Pros & Cons

Pros:

- Fast execution.

- No slippage.

- Various platforms such as MT4, MT5, and cTrader, etc.

- Good liquidity from tier-one suppliers.

- Good for volume traders

Cons:

- Commissions are charged on raw spread accounts.

- Limited educational material

- No stops can be guaranteed.

- Research tools are limited.

- Not suited for beginners.

2. FP Markets

FP Markets was launched in Phase Markets in 2005 in Australia. It provides traders with competitive trading conditions, offering tight spreads, and Standard, Raw, and Islamic account options. It also provides assistance to traders who want quick crypto settlements as the firm supports deposits and withdraws via USDT and USDC. FP Markets, in contrast to its competitors, has a competitive advantage as it has greater customer support.

The firm is partnered with top-tier regulation, ASIC, and CySEC. FP Markets also is partnered with Industry prevailing trading platforms, MT5, MT4, and Iress, which allows the firm to incorporate traditional Forex trading with modern crypto. These attributes characterize FP Markets as one of the most distinguished Forex brokers incorporating instant Stablecoin transactions.

FP Markets – Key Features

| Feature | Description |

|---|---|

| Execution | Raw & standard execution |

| Platforms | MT4, MT5 |

| Account Types | Standard, Raw |

| VPS Support | Available for EA traders |

| Education | In‑depth trader resources |

| Markets | Forex, CFDs, Commodities |

| Order Types | Market, Limit, Stop |

FP Markets Pros & Cons

Pros:

- Excellent liquidity.

- Excellent educational center for traders.

- Fast order execution.

- VPS available for automated trading.

- Good range of forex and CFDs

Cons:

- Limited for account types.

- Unreported minor withdrawal delays.

- Geographical location restrictions.

- Limited customized analytic tools

3. Pepperstone

Pepperstone is an Australian broker that was founded in 2010. It is considered an ECN broker, so clients benefit from low spreads and lightning-fast execution. They offer a wide variety of accounts, like Standard and Razor accounts.

Clients are able to deposit and withdraw funds through USDT and USDC. Pepperstone is regulated globally by ASIC, FCA, DFSA which ensures them of top tier regulation. They offer trading platforms like MT4, MT5 and cTrader which are ideal for scalpers and high-frequency traders. For these reasons, Pepperstone is among the top brokers for seamless stablecoin Forex trading.

Pepperstone – Key Features

| Feature | Description |

|---|---|

| Spreads | Competitive tight spreads |

| Platforms | MT4, MT5, cTrader |

| Social Trading | Integrated social/copy trading |

| Execution | Fast ECN execution |

| Instruments | Forex, Indices, Metals, Crypto CFDs |

| Support | 24/5 global support |

| Accounts | Razor & Standard |

Pepperstone Pros & Cons

Pros:

- Fast order execution

- Social trading

- Various accounts to choose from

- 24/5 support

Cons:

- Limited account types

- Limited customer support

- Customization for social trading is limited

- Trading analytics are limited

- The other platforms are better for other brokers.

4. Tickmill

Tickmill offers fast trade execution and low-cost spread as a Seychelles-based broker founded in 2014 and regulated by the FCA, CySEC, and FSA. They have Classic, Pro, and VIP accounts which cater to different trading styles. They have recently incorporated instant crypto deposit and withdrawal services by adding USDT and USDC.

The broker prioritizes speed, reliability, and transparency. Clients can utilize MT4 and other tools available to the broker. Tickmill has strong regulation and growing crypto services, which makes it a top Forex trading broker for clients wanting instant crypto settlements.

Tickmill – Key Features

| Feature | Description |

|---|---|

| Pricing | Low‑cost transparent pricing |

| Execution | Fast order execution |

| Platforms | MT4 |

| Accounts | Classic, Pro, VIP |

| Markets | Forex & major CFDs |

| Tools | Basic analytics |

| Fees | Low commission structure |

Tickmill Pros & Cons

Pros:

- Transparent pricing and low spreads.

- Types of accounts are easy to understand.

- Order execution with low latency is quick and simple.

- Scalpers can utilize the accounts well.

- Customer support is good.

Cons:

- Limited educational resources. 7. Not as many options as competitors.

- CFDs are limited.

- Crypto trading unavailable.

- Inactivity fees may be charged.

5. Exness

Based in Cyprus, Exness was founded in 2008 and has expanded to become a global broker for millions of users. They are known for offering a variety of account types to fit the needs of different trading styles, including high leverage and low spreads, which are enticing to professional traders.

Exness has also incorporated instant deposits and withdrawals through the crypto USDT and USDC, which allows clients to easily trade between crypto and fiat currencies. They offer MT4 and MT5 for analytics and trade execution, and are regulated by CySEC, FCA, and FSCA, ensuring safe trading. They are also one of the top bridge for instant crypto Forex trading.

Exness – Key Features

| Feature | Description |

|---|---|

| Leverage | Flexible high leverage |

| Platforms | MT4, MT5 |

| Liquidity | Deep market access |

| Minimum Deposit | Very low entry amounts |

| Instruments | Forex, Metals, Crypto |

| Execution | Fast and stable |

| Withdrawal | Quick withdrawals |

Exness Pros & Cons

Pros:

- Exceptional leverage is highly adjustable.

- Deposit and withdrawal processes are quick.

- The mobile trading experience is great.

- Minimum deposits are low.

- Overall pricing is good.

Cons:

- Prices can be impacted by high leverage.

- Volatile market spreads can widen.

- Fewer resources to learn from.

- No unique platform.

- Regulatory issues may limit access by region.

6. Eightcap

Operating since 2009, Eightcap is an Australia based broker. The broker offers trading with tight spreads, and multiple account types, including Standard and Raw account types. The broker offers trading with the MT4 and MT5 trading platforms.

The broker recently added instant USDT and USDC funding to make trading easier for customers who prefer trading with crypto. Brokers should ensure their customers feel safe and secure and with Eightcap’s regulation by ASIC and VFSC, customers of the broker can be assured that their funds are safe.

The broker is seen to be an attractive trading option for retail and professional traders because of the fast execution and low fees. Due to their modern trading infrastructure and stablecoin, Eightcap is classified as one of the best Forex traders.

Eightcap – Key Features

| Feature | Description |

|---|---|

| Account Types | Standard & Raw |

| Platforms | MT4, MT5 |

| Spreads | Tight spreads on Raw accounts |

| Instruments | Forex, Commodities, Indices |

| Social Trading | Supports copy trading |

| Execution | Market execution |

| Support | Multi‑language support |

Eightcap Pros & Cons

Pros:

- Pricing is very competitive for raw accounts.

- Execution speeds are superior.

- Broad coverage for FX pairs.

- Easy for first time traders.

- Copy trading is social trading.

Cons:

- Limited advanced charting.

- Research is lacking.

- They do not have a proprietary platform.

- Crypto CFDs are covered thinly.

- Bonus offers are not available for some countries.

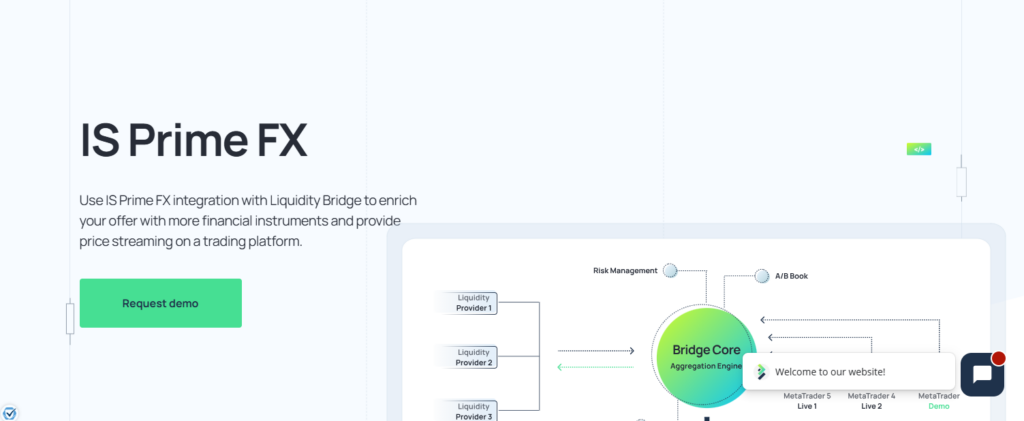

7. IS Prime

Established in 2015, IS Prime provides services to institutional and professional traders. The broker provides deep liquidity and offers services through advanced platforms. The broker provides several account types for high volume trading, including Prime and VIP accounts to encourage accounts to be created.

IS Prime is one of the brokers who offers instant USDT and USDC. With IS Prime being regulated by the FCA and other global standards, the broker provides security and trust. The brokers liquidity and secure trading offers crypto traders an ideal option for Forex trading. IS Prime is classified as one of the best brokers for stablecoin institutional trading.

IS Prime – Key Features

| Feature | Description |

|---|---|

| Target Clients | Institutional & professional |

| Liquidity | Deep multi‑bank liquidity |

| Execution | Low‑latency smart routing |

| Assets | Multi‑asset support |

| Accounts | Segmented institutional tiers |

| Risk Tools | Institutional risk management |

| Integration | Connects with prime brokers |

IS Prime Pros & Cons

Pros:

- High-volume traders benefit from professional liquidity.

- Low latency and smart routing.

- Strong execution for multi-asset coverage.

- Tools for institutional risk.

- Service levels are segmented.

Cons:

- Retail beginners not catered for.

- Service and minimums are higher.

- Pricing is less transparent.

- Limited resources for learning.

- Promotion is less and marketing is limited.

8. Swissquote

Founded in 1996 in Switzerland, Swissquote is a premium, fully regulated multi-asset broker. With account types like Classic, Premium, and Prime, Swissquote caters to both retail and professional traders. The brokerage also offers instant USDT and USDC settlements, unlocking fast funding and withdrawal options for crypto users.

Swissquote is fully compliant and regulated by FINMA and provides strong security measures to users. They offer robust and feature-rich trading platforms (web, mobile, and MT4) and advanced charting and trading tools. Swissquote has a long-standing reputation for trust and innovation, and is one of the best Forex brokers to offer stablecoin integration.

Swissquote – Key Features

| Feature | Description |

|---|---|

| Regulatory | Strong banking regulation |

| Instruments | Forex, Stocks, ETFs, Crypto |

| Platforms | Proprietary & MT support |

| Research | Advanced research tools |

| Wealth Services | Integrated banking/trading |

| Security | High compliance & protection |

| Education | Market insights & analysis |

Swissquote Pros & Cons

Pros:

- Strong regulation is very credible.

- Banking and trading services are integrated.

- Research and analyst insights are excellent.

- High multi-assets (stocks, FX, and crypto) services are available.

- Top-notch client services.

Cons:

- Fees are higher than pure brokers.

- High frequency scalpers are not ideal.

- The platform can be difficult for beginners to navigate.

- The platform has less coverage for crypto than specialized exchanges.

- Different account types come with different minimums.

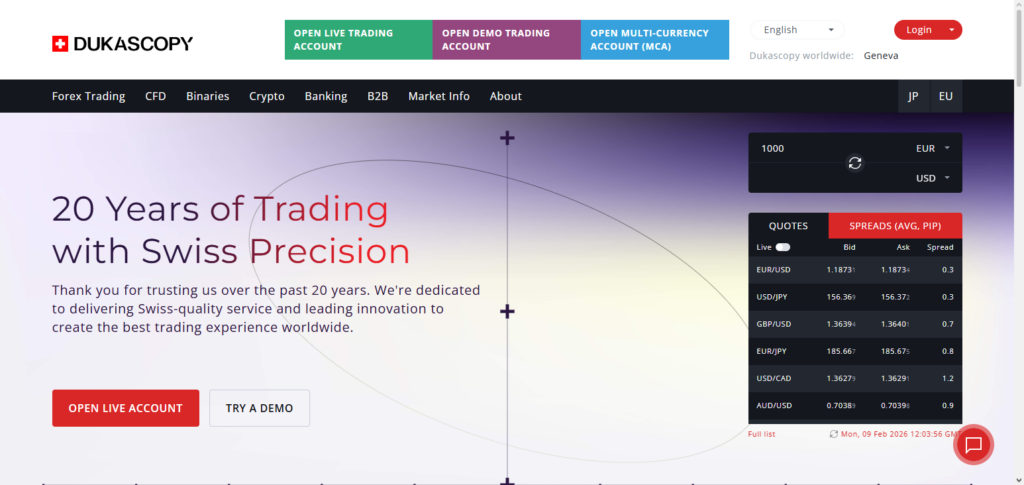

9. Dukascopy Bank

Dukascopy Bank started its operations in 2004 in Switzerland. It is a Swiss- regulated bank and Forex broker, offering ECN trading. The account types are Live, Demo, and Professional accounts that offer bespoke solutions to traders.

Dukascopy also provides instant USDT and USDC deposits and withdrawals, and as a result, there is a fusion of traditional Forex trading and crypto trading. The bank is under the regulation of FINMA, which guarantees security and transparency.

The trading facilities include JForex and MT4, which support advanced trading strategies and also automated trading. Dukascopy Bank provides strong compliance and that is why it is ranked among the best brokers for crypto-integrated Forex trading.

Dukascopy Bank – Key Features

| Feature | Description |

|---|---|

| Execution | ECN via SWFX marketplace |

| Platform | JForex with automation |

| Regulation | Swiss regulated bank |

| Assets | Forex, CFDs, Fixed income |

| Liquidity | Deep LP access |

| Tools | Advanced analytics |

| Fees | Transparent pricing |

Dukascopy Bank Pros & Cons

Pros:

- ECN execution is very transparent.

- JForex platform is great for advanced automation.

- Swiss regulation is very strong.

- ECN liquidity is available from the Swiss FX marketplace.

- Good coverage for FX and CFDs.

Cons:

- The platform can be difficult to master.

- There may be an inactivity fee.

- Pricing is higher than some ECN brokers.

- Not many promotions available.

- Support is not available 24/7.

10. Saxo Bank

Saxo Bank, an internationally renowned premium broker that offers multi-asset trading, was established in Denmark in 1992. Classic, Platinum, and VIP account types are available, each with services designed specifically for institutional and retail traders.

Fast and safe cryptocurrency funding is made possible by Saxo Bank’s support for rapid USDT and USDC payments. A secure trading environment is ensured by its regulation by FSA Denmark and other agencies.

SaxoTraderGO and SaxoTraderPRO are two platforms that provide sophisticated charting and analytics. Saxo Bank is among the top Forex brokers for stablecoin-friendly trading because of its extensive history, first-rate service, and cryptocurrency integration.

Saxo Bank – Key Features

| Feature | Description |

|---|---|

| Platforms | SaxoTraderGO & PRO |

| Assets | Forex, Stocks, Bonds, ETFs |

| Research | World‑class analytics |

| Regulation | Multi‑jurisdiction regulated |

| Wealth Tools | Portfolio & advisory tools |

| Institutional | Services for pros & institutions |

| Fees | Premium pricing |

Saxo Bank Pros & Cons

Pros:

- Exceptional research and analytics.

- Stocks, bonds, FX, and ETFs included.

- Strong regulation in various jurisdictions.

- Great unique trading platform.

- Great wealth & portfolio management.

Cons:

- Fees and minimums are higher.

- Not suited for traders seeking ultra-low-cost options.

- The platform may be overwhelming for beginners.

- There are not many retail client promotions.

- The crypto coverage is still growing.

Conclusion

Brokers that offer quick USDT and USDC settlements are the perfect option for traders who want to combine the ease of stablecoins with the speed of Forex trading.

Reliability, strict regulation, and cutting-edge trading platforms make IC Markets, FP Markets, Pepperstone, Tickmill, Exness, Eightcap, IS Prime, Swissquote, Dukascopy Bank, and Saxo Bank stand out among the best options.

These brokers make trading easier and more effective by providing safe crypto integration, a variety of account types, and quick deposits and withdrawals. Selecting one of these brokers guarantees a smooth, cutting-edge trading experience with flexibility for stablecoins.

FAQ

What are USDT and USDC settlements in Forex trading?

USDT (Tether) and USDC (USD Coin) are stablecoins pegged to the US Dollar. Brokers offering instant settlements allow traders to deposit or withdraw funds quickly in these digital currencies, reducing delays compared to traditional banking methods.

Which Forex brokers support instant USDT and USDC deposits?

Top brokers include IC Markets, FP Markets, Pepperstone, Tickmill, Exness, Eightcap, IS Prime, Swissquote, Dukascopy Bank, and Saxo Bank. They enable near-instant funding and withdrawals using stablecoins.

Are instant USDT/USDC settlements safe?

Yes, as long as the broker is regulated (ASIC, FCA, CySEC, FINMA, etc.) and uses secure blockchain transactions. Stablecoins provide transparency and minimal volatility compared to other cryptocurrencies.

Can beginners use brokers with USDT/USDC support?

Absolutely. Brokers like IC Markets, FP Markets, and Pepperstone offer user-friendly platforms and demo accounts, making it easy for new traders to deposit and trade with stablecoins.

What are the benefits of using USDT/USDC in Forex trading?

Benefits include faster deposits and withdrawals, lower transaction fees, stable value pegged to USD, and seamless integration with global trading accounts, making it easier to manage funds efficiently.