In this article, we will look into the Best Linea Ecosystem Tokens that are revolutionizing DeFi, interoperability, and blockchain technology.

These tokens increase the liquidity, security and efficiency of decentralized applications.

As the ecosystem scales, these tokens continue to foster adoption while offering new revenue streams in the blockchain industry.

| Project/Token | Key Point |

|---|---|

| Axelar | Interoperability network enabling cross-chain communication for decentralized apps. |

| Edgeware | Edgeware is a scalable, sovereign and cooperatively owned smart contract platform |

| PancakeSwap | Leading decentralized exchange (DEX) on Binance Smart Chain, known for low fees. |

| Cyber | Social network for Web3, focusing on decentralized identity and content sharing. |

| SIDUS | Blockchain-based gaming ecosystem, combining NFTs, DeFi, and metaverse elements. |

| Symbiosis | Cross-chain liquidity protocol enabling seamless token swaps across blockchains. |

| WeFi | Decentralized finance platform offering lending, borrowing, and yield farming. |

| ZeroLend | Lending protocol focused on zero-interest loans and decentralized credit systems. |

| Deri Protocol | Decentralized derivatives trading platform, allowing users to trade perpetual futures. |

| Ethena USDe | Synthetic dollar protocol built on Ethereum, offering a stablecoin alternative. |

1.Axelar

Currently connected by over 50 blockchains, Axelar dapps are able to function cross-chain in a secure decentralized way.

It has developed optimal infrastructure with General Message Passing (GMP) and Axelar Virtual Machine (AVM) for superior smart contract interaction.

Because of these reasons, it’s native token AXL serves as the cornerstone of a host of p2p protocols, enabling a trustless exchange of value on the network through fee payments, staking and governance voting.

This network is essential for multi-chain applications development in the future. It aims to increase the pace of innovation across the globe, thus, is one of the foremost contenders in the revolution of modular blockchain is undoubtedly leads in the field of decentralised finance.

| Feature | Details |

|---|---|

| Project Name | Axelar |

| Category | Cross-Chain Interoperability Network |

| Key Feature | Secure cross-chain communication with General Message Passing (GMP) |

| Native Token | AXL |

| Competitive Edge | Connects 50+ blockchains, enabling seamless multi-chain dApps |

2. Edgeware

Edgeware is a scalable, sovereign and cooperatively owned smart contract platform with a large public treasury, strong governing community, and a focus on DAO deployments.

Edgeware (EDG) stands as a pioneering DAO-first smart contract platform designed to manage, fund, and build decentralized communities.

This innovative platform is a society of Edgewareand artistic thinkers dedicated to exploring new economic models, with a particular emphasis on DAO (Decentralized Autonomous Organization) deployments.

| Feature | Details |

|---|---|

| Project Name | BUSD (Binance USD) |

| Category | Stablecoin (Fiat-backed) |

| Pegged To | 1:1 with USD |

| Issuer | Binance & Paxos |

| Regulation | Approved by NYDFS (New York State Department of Financial Services) |

| Status | Minting stopped in 2023, being phased out |

| Use Cases | Trading, DeFi, payments (before phase-out) |

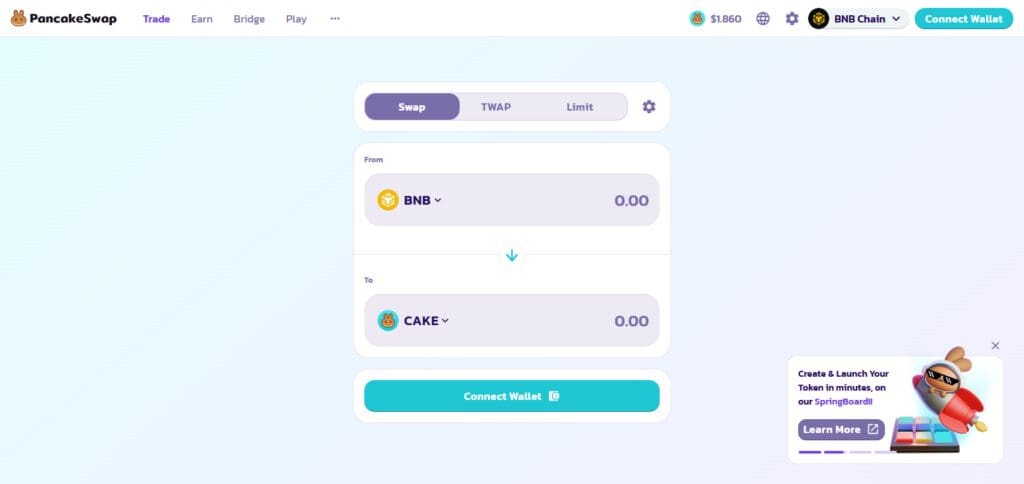

3. PancakeSwap

PancakeSwap is the fastest growing DEX on the BNB Chain offering automated market maker(AMM) trading, yield farming and staking.

With a daily trading volume of more than $500 million, it serves as one of the most utilized platforms in the Defi sector. The CAKE token is employed for governance, staking, and liquidity mining.

Pancakeswaps DeFi users has tremendously benefitted from its low transaction fees and high speed trading.

The platform became more competitive against Ethereum-based DEXs like Uniswap with the introduction of PancakeSwap v3 where the trading fees were decreased and capital efficiency was improved through better liquidity provisioning and increased rewards for liquidity providers.

| Feature | Details |

|---|---|

| Project Name | PancakeSwap |

| Category | Decentralized Exchange (DEX) |

| Blockchain | BNB Chain (Supports multi-chain) |

| Key Feature | AMM-based trading, staking, and yield farming |

| Native Token | CAKE |

| Competitive Edge | Low fees, high-speed transactions, and deep liquidity |

4.Cyber

Cyber is a new project under development focusing on AI infused decentralized social networks and digital identity management in Web3. The hybrid nature of Cyber offers complete control along with sophisticated privacy and security to users.

It aims to build a self sovereign identity (SSI) framework where users have the ability to own and govern their identities over a hostname.

Data security is guaranteed by the use of decentralized storage facilities and zero knowledge proofs (ZKPs).

With Web3 social finance (SocialFi) and decentralized identity (DID) industries poised for a staggering expansion in the next few years, Cyber is at the forefront with having an innovative strategy that is unique to other competitors.

| Feature | Details |

|---|---|

| Project Name | Cyber |

| Category | Decentralized Social Network & Web3 Identity |

| Key Feature | AI-driven self-sovereign identity (SSI) & privacy-focused social platform |

| Native Token | CYBER |

| Competitive Edge | Combines AI & blockchain for decentralized identity management |

5. SIDUS

SIDUS is an play-to-earn (P2E) metaverse gaming platform that integrates blockchain technology with top notch gaming.

SIDUS is built on the Ethereum network, and offers a space-themed MMORPG where players earn rewards from NFT-powered battles, trading, and exploration.

The ecosystem also comprises of SIDUS Heroes, a gaming univerese which has NFT avatars, land ownership, and DeFi features. SIDUS has its own game currency called SIDUS token, which can be used for purchasing items, staking, or voting within the game.

As a leading blockchain gaming ecosystem powered by AI-driven gaming mechanics and DeFi features, SIDUS is expanding its player community alongside forming strategic partnerships with major Web3 gaming projects.

| Feature | Details |

|---|---|

| Project Name | SIDUS |

| Category | Blockchain Gaming & Metaverse |

| Key Feature | Play-to-Earn (P2E) MMORPG with NFT integration |

| Native Token | SIDUS |

| Competitive Edge | Combines gaming, DeFi, and NFTs in a futuristic metaverse |

6. Symbiosis

Symbiosis is a cross-chain liquidity protocol that allows users to swap digital assets freely between blockchains. It eliminates the necessity for multiple bridges with a more efficient one-click solution for cross-chain asset transfer.

Its ecosystem is powered by SIS tokens, which provides governance, staking, and transaction fee payment options.

Apart from SIDUS, Symbiosis offers services to Ethereum, BNB Chain, Polygon, Avalanche, and many other blockchains, ensuring liquidity transfer across major ecosystems is obtainable without any issue.

As adoption towards DeFi and GameFi increases, Symbiosis has become an essential component for cross-chain functionality by offering low slippage swaps and single-sided liquidity provisioning. This makes it one of the top multi-chain liquidity aggregators in the market.

| Feature | Details |

|---|---|

| Project Name | Symbiosis |

| Category | Cross-Chain Liquidity & Swap Protocol |

| Key Feature | One-click cross-chain swaps with deep liquidity aggregation |

| Native Token | SIS |

| Competitive Edge | Eliminates the need for multiple bridges, ensuring fast & low-slippage swaps |

7. WeFi

WeFi is built as a decentralized lending and borrowing protocol specifically designed for WeFi on DeFi with the aim of maximizing capital efficiency.

With WeFi, users no longer have to compete against platforms as It supports risk-collateralized interest rate and multi-collateral options which are much more friendly towards yield strategies.

Loans on this platform are made more secure with the integration of AI risk assessment which reduces the liquidation risk.

WeFi also has its token which serves the purpose of governance, liquidity mining, and staking.

WeFi aims to become a leading DeFi credit market with cross-chain compatibility in competition with Aave and Compound by providing new financial products.

| Feature | Details |

|---|---|

| Project Name | WeFi |

| Category | Decentralized Lending & Borrowing Protocol |

| Key Feature | AI-powered risk assessment & multi-collateral lending |

| Native Token | WEFI |

| Competitive Edge | Enhances capital efficiency with AI-driven lending strategies |

8. ZeroLend

ZeroLend allows a new paradigm of non-custodial lending with a focus on simplified lending and borrowing with strong security features.

Operating on Ethereum and Layer 2 solutions, ZeroLend allows users to borrow and lend with little fees and good capital efficiency.

The platform utilizes liquid staking to enhance yields in farming while retaining liquidity.

Governance, staking, and rewards are all executed through the ZLEND token. ZeroLend is more advanced than other DeFi services due to the addition of multi-collateral borrowing.

| Feature | Details |

|---|---|

| Project Name | ZeroLend |

| Category | Decentralized Lending Protocol |

| Key Feature | Non-custodial lending with efficient capital utilization |

| Native Token | ZLEND |

| Competitive Edge | Integrates liquid staking & multi-collateral borrowing for optimized DeFi lending |

9. Deri Protocol

Deri Protocol is a decentralized derivatives trading platform that allows users to trade futures, options, and perpetual contracts. This is done fully on-chain without the need for centralized trading platforms.

Real time price feeds, decentralized settlement, and on-chain risk management are some of the features that Deri provides.

Used for governance and liquidity incentives, the DERI token is also traded and utilized to pay platform fees. Ethereans are attracted to Deri Protocol because of its flexible margin system paired with real-time risk assessment.

On top of being one of the few platforms providing hedging tools within DeFi, Deri Protocol also positions itself in opposition to the centralized derivative exchange giants by fully complying to the principles of transparency and self custody.

| Feature | Details |

|---|---|

| Project Name | Deri Protocol |

| Category | Decentralized Derivatives Trading |

| Key Feature | On-chain perpetual contracts & risk management |

| Native Token | DERI |

| Competitive Edge | Transparent, DeFi-native hedging tools |

10. Ethena USDe

Ethena USDe plays an influential role in the Linea ecosystem as a synthetic stablecoin.

It has its value guaranteed with collateral based on Ethereum guaranteeing its decentralized stability without traditional fiat sponsorship.

In contrast to the USDT and USDC stablecoin ethnos, Ethena USDe utilizes DeFi-native systems which takes the stablecoin resistant to censorship and regulatory attacks.

The token is built for trading, on-chain payments, and DeFi lending, increasing liquidity on the Linea network.

As DeFi applications continue to grow, Ethena USDe is positioned to become a primary stable asset alongside dominant forces such as DAI and LUSD.

| Feature | Details |

|---|---|

| Project Name | Ethena USDe |

| Category | Synthetic Stablecoin |

| Blockchain | Linea Ecosystem, Ethereum |

| Backing Mechanism | Backed by Ethereum-based collateral |

| Use Cases | On-chain payments, trading, DeFi lending |

| Key Advantage | Censorship-resistant, avoids reliance on fiat reserves |

| Competitors | DAI, LUSD, crvUSD |

| Growth Potential | Increasing adoption in DeFi & stablecoin markets |

Conclusion

The incorporation of Ethena USDe as a synthetic stablecoin enhances the Linea ecosystem that is rapidly advancing.

A strong candidate to capture this space is Ethena USDe which provides non-custodial, censorship resistant assets.

This is usefull for migrating from traditional stable assets. Other tokens in the Linea ecosystem include ZeroLend for lending, Symbiosis for cross-chain liquidity and Deri Protocol for decentralized trading of derivatives.

As more projects on Linea are developed, these tokens will be crucial in changing the landscape of DeFi and blockchain implementations.