In this article, I will cover the Best Personal Finance Apps that can assist you in managing your money well. From budgeting to investments and even credit, these apps can help with every aspect of financial planning.

I will cover the best apps for expense tracking and wealth growth that simplify the process of finance management.

Key Point & Best Personal Finance Apps List

| App Name | Key Feature |

|---|---|

| Money View | Personal loans, expense tracking, budgeting |

| CRED | Credit card bill payments, rewards, credit score tracking |

| INDmoney | Investment tracking, wealth management, US stock investments |

| Walnut | Expense manager, bill reminders, budget insights |

| Paytm Money | Mutual funds, stock trading, NPS investments |

| ET Money | Mutual funds, insurance, loans, tax planning |

| Buddy Loan | Instant personal loan aggregator platform |

| Fyle | AI-powered expense management for businesses |

| Groww | Stock trading, mutual funds, digital gold, US stocks |

| Goodbudget | Envelope-based budgeting, personal finance management |

1.Money View

Money View offers some of the best personal finance tools with its intuitive budgeting feature, intelligent expense tracking, and quick personal loans. Its advanced AI technologies assist users in managing finances with efficient insights, alongside loan options and credit score monitoring.

Unlike other apps, Money View’s loan automation processes provide instant approvals with little paperwork, making it perfect for promises in financial planning and emergency funds.

| Feature | Details |

|---|---|

| App Type | Budgeting, Expense Tracking & Loans |

| Unique Feature | AI-driven financial insights & credit score monitoring |

| KYC Requirement | Minimal (Basic details for budgeting, PAN for loans) |

| Loan Facility | Instant personal loans with quick approval |

| Expense Tracking | Automated SMS-based expense categorization |

| Budgeting Tools | Smart budget creation & bill reminders |

| Best For | Managing expenses, tracking credit score, quick loans |

2.CRED

CRED targets personal finance management uniquely by incentivizing users with rewards primarily for timely credit card bill payments. CRED’s distinguishing feature is its exclusive reward system, which gives cashback, discounts, and premium deals for responsible financial expenditures.

Moreover, CRED also offers users free credit score tracking, expense analytics, and AI financial advisers. CRED’s gamification of finance provides an engaging and efficient approach to managing debt and personal finances.

| Feature | Details |

|---|---|

| App Type | Credit Card Bill Payments & Rewards |

| Unique Feature | Rewards for on-time credit card payments |

| KYC Requirement | Minimal (Mobile number & credit card details) |

| Credit Score Check | Free & real-time credit score updates |

| Rewards & Cashback | Exclusive deals, discounts, and perks |

| Expense Insights | Smart spending analysis & reminders |

| Best For | Managing credit card payments & improving credit score |

3.INDmoney

INDmoney is a comprehensive personal finance app the integrates wealth management, investment tracking, and planning into a single. The app features AI driven advisory which ensures smooth facilitation of investments into Indian and US stocks, mutually fond, and fixed deposits.

The app boasts of zero commission on US stock investments alongside automated watching of the users portfolio. With bespoke insights and tools for tax optimization, it makes wealth creation simple while offering a multifaceted approach to growth and management.

| Feature | Details |

|---|---|

| App Type | Wealth Management & Investment Tracking |

| Unique Feature | AI-driven investment advisory |

| KYC Requirement | Minimal (Basic details for tracking, PAN for investments) |

| Investment Options | Indian & US stocks, mutual funds, FDs |

| Zero-Commission | No brokerage on US stock investments |

| Expense Tracking | Automated portfolio & net worth tracking |

| Best For | Wealth building, investment tracking, financial planning |

4.Walnut

Walnut is one of the best personal finance apps with features like automatic expense tracking and budgeting. Its exceptional feature is in tracking SMS transaction data to spendings without requiring user input.

Walnut also offers bill reminders, shared expense trackers, and ATM finders. Walnut helps users take full control of their finances effortlessly, provides insightful trends in cash flow and savings, and helps makes budgeting so simple and intuitive.

| Feature | Details |

|---|---|

| App Type | Expense Tracking & Budgeting |

| Unique Feature | Automatic SMS-based expense categorization |

| KYC Requirement | Minimal (No bank linking required) |

| Expense Insights | Smart analytics & monthly spending trends |

| Bill Reminders | Alerts for upcoming payments |

| ATM Locator | Finds nearby ATMs with cash availability |

| Best For | Tracking expenses, setting budgets, bill reminders |

5.Paytm Money

Paytm Money is a top app for managing personal finances, allowing users to invest in stocks, mutual funds, digital gold, and NPS with ease. Its deep integration with the Paytm ecosystem ensures seamless fund transfers as well as inexpensive investing.

Users, both new and experienced, can build wealth because of the primary market insights provided by the app, advanced stock trading tools, and zero-commission direct mutual funds. The optimally designed application interface makes financial growth easy and simple.

| Feature | Details |

|---|---|

| App Type | Investment & Wealth Management |

| Unique Feature | Low-cost stock & mutual fund investments |

| KYC Requirement | Minimal (Basic KYC for mutual funds, PAN for stock trading) |

| Investment Options | Stocks, mutual funds, NPS, digital gold |

| Zero-Commission | Direct mutual funds with no brokerage |

| Stock Trading | Advanced tools for trading & market insights |

| Best For | Affordable investing, long-term wealth creation |

6.ET Money

ET Money is one of the best personal finance apps because it allows the users to invest, track expenses, and plan taxes. One of the best features is AI-powered Smart Recommendations, which guides users in selecting the best mutual funds with respect to risk tolerance and financial goals.

The app also provides direct mutual funds, instant loans, insurance, and automated expense tracking without any commissions. ET Money, an integrated financial solution, concentrates on maximizing the user’s returns and tax savings.

| Feature | Details |

|---|---|

| App Type | Investment, Expense Tracking & Tax Planning |

| Unique Feature | AI-powered Smart Recommendations for investments |

| KYC Requirement | Minimal (Basic KYC for mutual funds, PAN for tax planning) |

| Investment Options | Mutual funds, stocks, insurance, FDs |

| Zero-Commission | Direct mutual funds with no hidden fees |

| Tax Planning | Automated tax-saving investment suggestions |

| Best For | Smart investing, tax optimization, financial growth |

7.Buddy Loan

Buddy Loan is a premier loan app that appeals due to its aggregated loan features. It is popularly known for its AI powered loan matching feature that gives users the best offers from various lenders based on their credit score.

Buddy Loan makes personal borrowing very flexible as there is little paperwork needed for approval. With no waiting period and various repayment plans to choose from, users can have money for their different needs as fast as possible.

| Feature | Details |

|---|---|

| App Type | Personal Loan Aggregator |

| Unique Feature | AI-powered loan matching with multiple lenders |

| KYC Requirement | Minimal (Basic details, PAN for loan approval) |

| Loan Amount | Up to ₹15 lakhs (varies by lender) |

| Approval Speed | Instant eligibility check & quick disbursal |

| Repayment Options | Flexible EMIs & tenure choices |

| Best For | Quick personal loans, emergency funding |

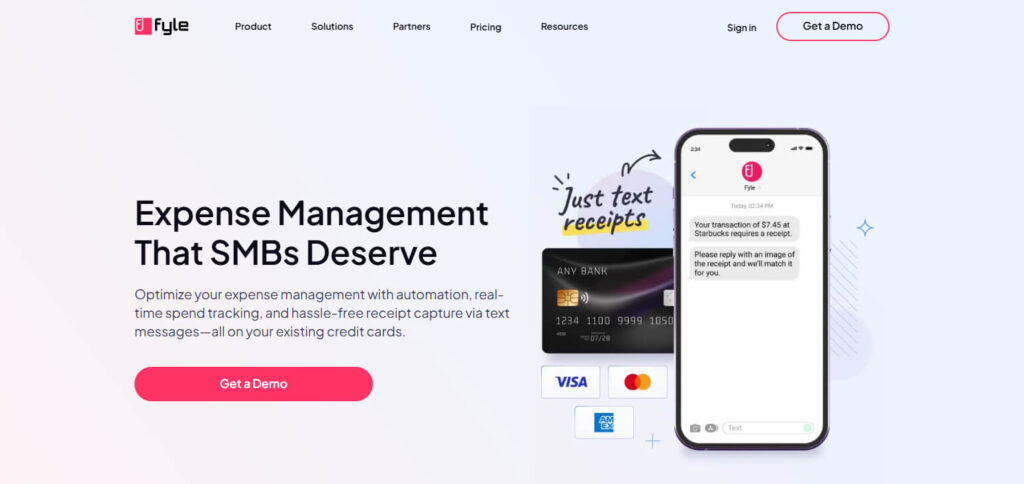

8.Fyle

Fyle is a leading personal finance application that utilizes AI for expense management, making it perfect for companies and professionals. One of its distinct features is its ability to track expenses in real-time with automated receipt scanning and direct corporate card integration.

Fyle eliminates the need for manually handling reimbursements, policy violations, and financial reporting efforts. With easy integration of accounting software, it enhances expense management for individuals and businesses, guaranteeing accuracy and efficiency in financial tracking.

| Feature | Details |

|---|---|

| App Type | AI-Powered Expense Management |

| Unique Feature | Automated receipt scanning & expense tracking |

| KYC Requirement | Minimal (Basic details, no bank linking required) |

| Integration | Works with corporate cards & accounting software |

| Expense Approval | Real-time policy compliance & approvals |

| Automation | Auto-categorization & reimbursement tracking |

| Best For | Business expense tracking, employee reimbursements |

9.Groww

The Groww mobile app has simplified the investment process for beginners interested in the stock, mutual fund, and even digital gold markets. Groww’s easily approachable app interface that is free from jargon enables modern investors to understand and utilize its features without any challenges.

Opened in 2017, the California based Groww aims to improve the investment experience by enabling fee-less direct mutual fund and real-time stock market purchases, along with US stock investments. With its pioneering KYC and document-free processes, it helps members make smarter financial decisions and increase their wealth easily.

| Feature | Details |

|---|---|

| App Type | Investment & Stock Trading |

| Unique Feature | Simple, user-friendly investment platform |

| KYC Requirement | Minimal (Basic KYC for mutual funds, PAN for stock trading) |

| Investment Options | Stocks, mutual funds, US stocks, digital gold |

| Zero-Commission | Direct mutual funds with no brokerage |

| Stock Trading | Real-time market data & advanced tools |

| Best For | Beginner-friendly investing, wealth creation |

10.Goodbudget

Goodbudget is among the best apps on finance because it helps with envelope budgeting which makes reserving money easier. It’s most distinguishing feature is its ability to share budgets in real time, making it easier for families and partners to manage their expenses.

Goodbudget is different from automated trackers in that it encourages mindful spending since users must enter their expenses manually. It improves control over finances and encourages better discipline through cloud synchronization, advanced reports, and helps them budget collaboratively, which is best for long term money management.

| Feature | Details |

|---|---|

| App Type | Budgeting & Expense Management |

| Unique Feature | Envelope budgeting system |

| KYC Requirement | Minimal (No bank linking required) |

| Budget Sharing | Yes, real-time syncing for families/partners |

| Automation | Manual expense entry for mindful spending |

| Cloud Sync | Available across multiple devices |

| Best For | Personal budgeting, financial discipline |

Conclusion

To sum it up, the top personal finance apps have varying specializations, whether it is for budgeting, tracking expenses, investing, or acquiring loans. Money View, Walnut, and Goodbudget do really well in budgeting while CRED and INDmoney focus on credit management and wealth creation.

Paytm Money, ET Money, and Groww take the hassles out of investing while Buddy Loan and Fyle do that for loans and expense tracking. The appropriate app choice is based on personal financial objectives and this will result in better control of finances and optimal growth.