In this article, I will cover the Best Money Market Accounts With Instant Fraud Protection Alerts for Competitive Interest Rates A strive Security Features.

These accounts are optimal for individuals who prefer maintaining a low risk savings strategy whereby they earn interest on their deposits while receiving instant alerts on fraudulent activities, FDIC insurance, and easy access via online and mobile banking.

Key Point & Best Money Market Accounts With Instant Fraud Protection

| Bank | Key Point |

|---|---|

| U.S. Bank | Offers tiered interest rates with higher balances earning better APYs. |

| EverBank (TIAA Bank) | Competitive introductory APY for new customers. |

| Ally Bank | No monthly maintenance fees with check-writing and debit card access. |

| UFB Direct | Extremely high APY with no minimum deposit requirement. |

| Citizens Bank | Relationship rate bonuses for linked checking accounts. |

| Huntington Bank | Bonus rates when linked to a Huntington checking account. |

| ESSA Bank & Trust | Localized service with competitive rates for Pennsylvania residents. |

| Truist | Includes limited check-writing and debit access with tiered interest. |

| PNC Bank | Higher rates available with qualifying relationship balances. |

| Fifth Third Bank | Rate boosts with Fifth Third Relationship Checking account. |

1. U.S. Bank Elite Money Market Account

With the U.S. Bank Elite Money Market Account, customers who want secure savings with tiered interest rates will be satisfied. Having more considerable funds allows existing account holders to unlock more competitive yields, making it suitable for those with substantial funds.

This account comes with FDIC insurance alongside enhanced fraud protection via real-time alerts and U.S. Bank mobile banking security features.

Customers also enjoy online and mobile banking convenience, overdraft protection (when linked with a U.S. Bank checking account), and fund access flexibility.

Although it has a $10 monthly fee, it is waivable with a $10,000 minimum balance. Customers looking for the safety of a major U.S. bank will find added fraud protection on larger deposits useful.

U.S. Bank Features

- Extensive network of branches and ATMs

- Easy to navigate mobile application

- Offers several competitively priced credit cards

- Offers personal banking and small business banking

- Excellent support for customer services

2. EverBank Performance Money Market Account

EverBank which has now changed to TIAA Bank offers the Performance Money Market Account with one of the best welcome APYs in the industry. This account is specifically tailored for customers seeking high interest in the lower term deposits area.

It comes with no monthly maintenance fee if the account balance is $5,000, and has FDIC insurance. TIAA Bank accounts come with two-factor authentication and fraud surveillance. The account is accessible along with mobile banking, check and debit card usage.

The appealing part is still the promotional rate and along with good digital security, it is a perfect fit for consumers that look for high returns with a low risk of fraud.

EverBank (TIAA Bank) Features

- High income earning check and saving accounts

- Offers competitive prices on CD

- No monthly fees for maintaining the account

- Nationwide reimbursements of ATM fees

- Banking done mostly through the internet and mobile phones

3. Greater Bank App Kiddy Saver Money Market Account

Ally Bank’s Money Market Account is praised for being easy to use and completely fee-free. The account has a competitive APY, zero balance minimum, free checks, and a debit card.

Equally, Ally’s digital experience is impressive, with solid security controls, real-time transaction alerts, and multi-layer authentication.

The account is FDIC insured up to $250,000, making it a good choice for consumers who want easy access to their cash while being safeguarded against fraud.

The bank’s 24/7 customer support coupled with the mobile banking functionalities is useful for advanced banking customers. Overall, it is one of the best money market accounts for users seeking maintenance-free fraud protection.

4. UFB Direct’s Ultra-High Yield Checking/Savings Account

The UFB Direct account offers some of the highest yields (APY) among online banks. With no monthly fees and no minimum deposit requirements, earning interest is easy.

Customers have direct access to their funds, which can be accessed via debit card and with check-writing options. Customers have FDIC insurance coverage through UFB’s bank partner, Axos Bank.

Various account security features are in place such as monitoring account activity, identity verification during sign-in, and protecting the mobile app. The service is designed for users requiring high yields with convenient money access and Digitized Funds.

UFB Direct’s account is well suited for those who highly value online security and profitability due to its high-yield interest rates and advanced fraud detection systems.

UFB Direct Features

- No maintenance expenses on high yield saving accounts

- Offers Interstate banking with no service fee

- High yield saving and money market accounts

- Great mobile banking security systems

- Opening an account is simple and easy

5. Citizens Bank Personal Money Market Account

When it comes to APYs, The Citizens Bank Personal Money Market Account offers a low one, although you can earn more when it’s tied to a checking account which qualifies at Citizens Bank.

Despite lower earning potential, this account offers concrete advantages with fraud protection, and insurance through the FDIC. Customers enjoy overdraft service on their accounts as well as advanced anti-fraud measures, like biometric logins and transaction monitoring, on the mobile app.

The $10 monthly fee is waived from maintenance charges if you keep $2,500. Regional customers who value direct account access through ATMs and branch locations alongside emergency account usage will find Citizens Bank a compelling option.

Overall those with existing accounts at Citizens Bank who wish to expand their fund safekeeping options will find this account suitable.

Citizens Bank Features

- Strong presence in the northeast region

- Wide personal and business product range

- Offers variety of banking including education financing

- Digital banking services

- Services in branch as well as online

6. Huntington Bank Relationship Money Market Account

The Relationship Money Market Account of Huntington Bank incentivizes customers for account bundling by offering higher yields on interest when linked to a checking account with Huntington Bank.

It offers solid protection features that include fraud alerts and card lock access through the Huntington mobile application.

This account is FDIC insured and competes on rates with other banks in the region while having local branches to support customers which gives it a regional banking feel. Customers can avoid the \$25 monthly fee by keeping a balance of \$25,000.

Although best for those maintaining higher account balances, the Midwest and East Coast region customers tend to appreciate the account due to its fraud protection services and higher yields offered to loyal customers.

Huntington Bank Features

- 24-Hour Grace overdraft protection

- Zero cost checking

- Advanced tools for budgeting savings

- Lending and business banking solutions* Branch delivery system centered on midwestern areas

7. ESSA Bank & Trust Money Market Account

ESSA Bank & Trust’s Money Market Account has a regional focus and is tailored to the needs of residents of Pennsylvania. Multifunctional accounts also provide spending and saving flexibility as they allow limited debit card usage, check writing, and checking account features.

Though the APY differs based on the account balance, customers enjoy fraud monitoring and FDIC insured accounts. ESSA Bank is not the first name in national banking services, but for customers who value local customer support and trust, it is a reliable community bank due to its low fee structure, excellent customer service, and effective fraud safeguards.

For example, ESSA Bank’s online banking allows secure logins, transaction alerts, and access to eStatements, allowing more control over one’s finances. Accounts usually require a minimum balance of $1,000 to avoid activity-based service fees.

ESSA Bank & Trust Features

- Regional bank with a focus on the community

- Personalized attention and more local discretion

- Products relating to mortgages and home equities

- Basic checking and savings accounts

- Small business and agricultural lending offered

8. Truist One Money Market Account

For depositors who prefer accessing their funds frequently and appreciate earning interest on a gradient of tiers, the Truist One Money Market account is a go to. It also has standard check-writing privileges and access to a debit card for spending purposes.

Security is ensured through multi-factor authentication, transaction alerts, fraud monitoring, and more. This account also has the benefit of being FDIC insured and is best for individuals within the bank’s regional footprint.

The \$12 monthly fee is waived with a maintained \$1,000 balance. Truist’s robust digital banking tools and other areas of fraud protection make it a manageable account for basic savers looking to achieve some relief with low-risk savings.

Truist Features

- Merged from BB\&T and SunTrust merger

- Offers personal and business banking

- Competitive mortgage and loan rates

- Advanced digital banking tools

- Serves the entire country with concentration on the Southern U.S.

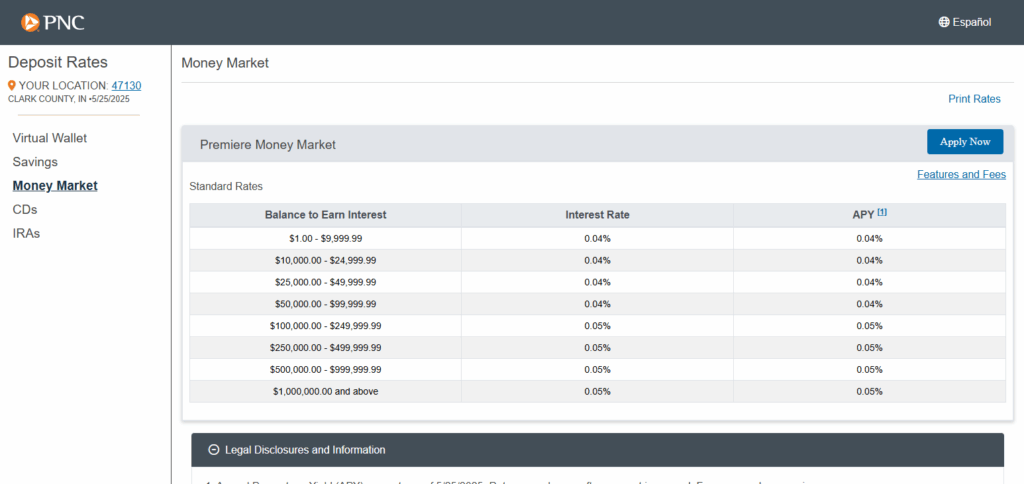

9. PNC Bank Premiere Money Market Account

The PNC Bank Premiere Money Market Account is optimized for customers with PNC checking accounts that enjoy better interest rates through relationship pricing. It allows check writing and debit card transactions, and it also offers proactive fraud prevention through account alerts, card locks, and monitoring through the PNC mobile app.

There is additional protection with FDIC insurance the account offers. The account has a monthly service charge of $12 which can be avoided by maintaining a balance of $5000.

This account is equipped with solid fraud prevention and full-service banking options that are helpful for those already entrenched in the PNC ecosystem. As such, users looking to securely grow savings while benefitting from comprehensive digital safeguards will find this account to be ideal.

PNC Bank Features

- Offers Virtual Wallet with budgeting tools

- Strong presence in multiple states

- Credit card and various lending products

- Business and merchant banking

- Accessible mobile and online platforms

10. Fifth Third Bank Money Market Account Summary

Fifth Third Bank Money Market Account provides additional features for account holders who already have a Relationship Checking account by increasing interest rates and waiving fees for maintaining required monthly balances.

The account permits writing of checks and a limited number of debit card transactions, and enhances security by using alerts, encryption, and automated systems to detect fraud. Identity theft protection tools and mobile banking safeguards are also available.

The account does not incur a fee of $5 per month as long as the balance held within the account is greater than $500.

This account is best suited for traditional bank customers who are more concerned about the security of their personal information and banking details but would like to maximize returns within a regional bank. The account balance is insured by the FDIC.

Fifth Third Bank Features

- Offers Early Pay direct deposit.

- Wide ATM and branch access

- Provides financial education and planning tools

- Business and commercial banking offered

- Digital tools like alerts and mobile check deposit

Conclusion

To summarize, the money market accounts provided by Ally, UFB Direct, EverBank, and Huntington have some of the best features including instant fraud protection.

They offer advanced security measures alongside competitive interest rates. These banks send instant notifications, offer FDIC insurance, and provide full online access which is beneficial for those who wish to maximize their money.

Their comprehensive security guarantees complete safety at all times while granting the user easy access to their funds.