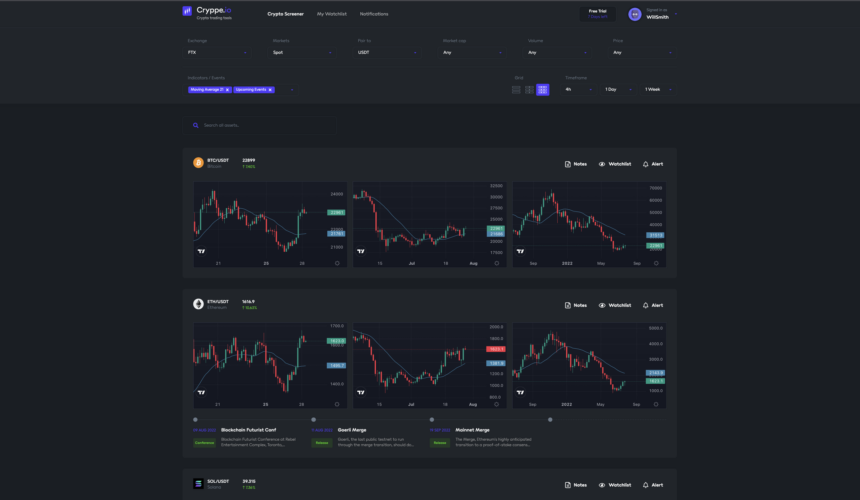

This article explains what platforms offer the possibility of buying stock tokens using cryptocurrencies. Stock tokens give cryptocurrency investors the opportunity to invest in stocks through the use of digital currencies.

There are a number of platforms offering safe and easy crypto trades, allowing users to broaden their portfolios and take advantage of new investment opportunities in the tokenized financial market.

Key Points & Best Platforms To Buy Tokenized Stocks with Crypto

| Platform | Key Point |

|---|---|

| Binance | Strong liquidity, user-friendly interface, and regulated tokenized stock offerings |

| KuCoin | Global access, supports fractional shares, and 24/7 trading availability |

| Bitpanda | European compliance, easy fiat-to-crypto conversion, and tokenized stock exposure |

| Currency.com | Licensed exchange offering tokenized stocks, indices, and commodities |

| DX.Exchange | NASDAQ-backed platform with tokenized shares tied to real stocks |

| Synthetix | Decentralized protocol for synthetic assets including tokenized equities |

| Mirror Protocol | DeFi-based platform enabling creation of synthetic tokenized stocks |

| OpenDAO | Community-driven to |

| Bitcoin.com Exchange | Secure trading with tokenized stock pairs and crypto integration |

10 Best Platforms to Buy Tokenized Stocks with Crypto

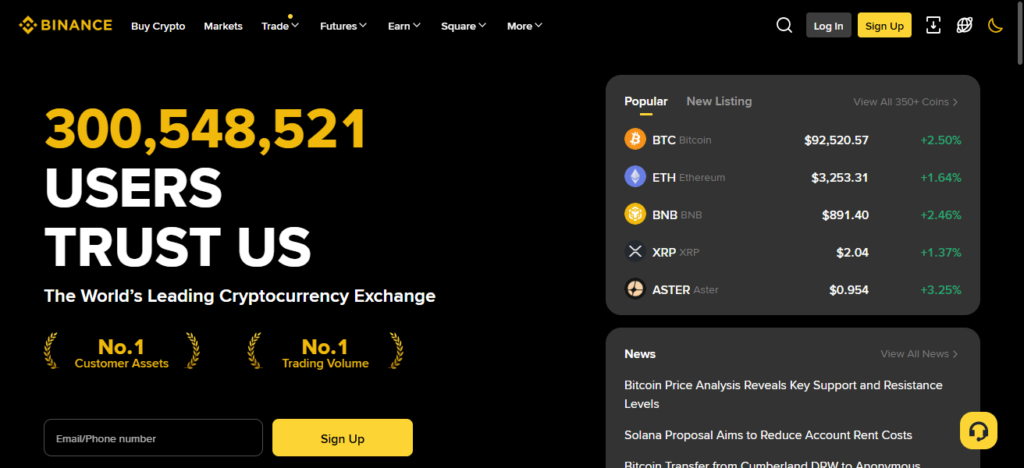

1. Binance

Most recently, Binance, the largest crypto exchange, had some limited trading of tokenized stocks that tracked a real stock’s price onchain.

The tokenized stocks were said to be real stocks backed 1:1 and allowed users trade using crypto. However, trading was abruptly halted because of regulatory complications in Germany and a few other places.

As it stands today, Binance only tokenized stocks remains focused on one trading other cryptocurrencies. The return of tokenized stocks is to be determined and is purely dependent on regulatory developments.

Regardless, the services that Binance offers and the number of users place in the position of one of the few trading platforms that can legally compliantly offer tokenized stocks.

Binance

- Provided real equity price exposure through tokenized stocks.

- Facilitated 1:1 backing with real stocks when available.

- Recently faced regulatory shutdowns in some countries.

- Retains significant number of crypto users with strong infrastructure.

- Regain tokenization of stocks when regulatory conditions permit.

2. KuCoin

KuCoin now provides tokenized stocks through expanded partnerships with xStocks, a Swiss company that offers tokenized equities backed on a one-to-one basis with real shares.

Now, clients can gain access to equities that do not require a brokerage account and can trade stablecoins or cryptocurrency in a fractional share of popular stocks

like SPYX, TSLAx, and NVDAx. KuCoin xStocks also aims to provide a global equities trading solution that is practically free of geo restrictions with 24/7 active trading.

This provides a solution for crypto investors that wish to diversify to owning real world assets through a tokenized bridge on their crypto exchanges

KuCoin

- No need for traditional broker accounts offers widespread adoption.

- Unified platform with xStocks for tokenized equities.

- Provides accessible fractional major U.S. stocks.

- Offers 24/7 trading via crypto and stable coins.

- Secured custody of underlying shares.

3. Bitpanda

Bitpanda is a tokenized stocks provider that also offers crypto and equities investing. The pan-European platform provides a streamlined service to trade equities via digital tokens, which represent shares of a company.

This equity is custodied through regulated partnerships with Bitpanda. Bitpanda integrated digital stock trading with their cryptocurrency exchange creating an active platform

for investors, particularly in crypto, to gain equity exposure for their assets. This is particularly true for those that do not want to engage with conventional brokerage platforms.

Bitpanda

- Enables tokenized stocks, traditional equities, and cryptocurrencies.

- Tokens depict real company equity owned and held by Bitpanda.

- Provides fractional exposure for retail stock ownership.

- User-friendly platform with 24/7 trading.

- Protects investors on regulation compliant European platform.

4. Currency.com

Currency.com is an innovative, tokenized securities exchange which has made it possible to trade tokenized stocks, ETFs, commodities, and other financial assets directly for cryptocurrencies.

As one of the first platforms to offer tokenized securities publicly, Currency.com allows users to convert their crypto into digital tokens that mirror the price of real-world assets,

thus allowing consumers to bypass the traditional brokerage. They are more concerned with connecting the liquidity of blockchains to the global financial markets.

They offer diverse binary tokenized products while being compliant with regulations on security tokens. This makes them perfect for crypto investors who want to access more global assets in tokenized form.

Currency.com

- Provides tokenized stocks, ETFs, commodities alongside others.

- Turning cryptocurrency into digital tokens that mirror real-world valuables.

- One of the first ever tokenized securities trading.

- Security tokens regulation compliant.

- Offers diversified investment in international markets through cryptocurrency.

- Primarily of interest to NFT and governance users. No equity exposure

5. DX.Exchange

As an early pioneer in the tokenized giveaway of equities, DX.Exchange quickly tokenized Apple and Tesla and was the first to use Nasdaq’s technology to do so.

Investors could buy stock tokens on the blockchain and use crypto to do so in what was a revolutionary proof of concept to get real equities on-chain.

Unfortunately, DX.Exchange closed its doors and its struggling case study exemplifies problems of operational challenges in the tokenized stock markets.

While the exchange is not active, its case remains how tokenized stocks have matured and how new platforms have built upon their case.

DX.Exchange

- Introduced tokenized versions of well-known stocks such as Apple and Tesla.

- Used Nasdaq technology to create blockchain-integrated stock tokens.

- Enabled trading between crypto and stock tokens.

- Closed down due to operational issues.

- An early example of integrating equity securities with blockchain technology

6. Synthetix

Synthetix is a cross-chain to Ethereum protocol in DeFi that allows the creation of synthetic assets they call ‘Synths’, which are able to mirror the price of real-world assets.

In contrast to equity-backed tokenized stocks, Synthetix, supports, what are called synthetic stocks, where one holds no underlying assets

But rather gains exposure to their price by using oracle feeds to determine price movements and holds a collateralized position.

This provides a way for users to experience stock price changes without any permission, KYC, or custodial entities.

Of course, one does not receive any shareholder or other equity rights with stock, however, these smart contracts may be more risky than tokenized stocks directly issued by a central authority.

Synthetix

- A decentralized finance protocol that provides synthetic assets (“Synths”).

- Synths track real-world assets, such as stock values.

- Offers fully decentralized and unrestricted trading, no KYC needed.

- These assets are not backed by real equity; they only give price exposure.

- There are risks associated with smart contracts and collateral.

7. Mirror Protocol

This platform also provides what are called mAssets. These are synthetic assets that track the price of stocks, but do not provide the underlying assets that are typically required for one to own in order to receive shareholder rights or dividends.

Instead, one mints a token which tracks the price of equities like Apple or Tesla, using over-collateralized positions in cryptocurrency.

Even though there are no real stocks in Mirror Protocol, there are shareholder rights and dividends, and collateral and stablecoin systemic risks to the platform.

The original incarnation of Mirror on Terra, collapsed, but the concept behind the platform provides, and continues to provide, inspiration to other projects that offer synthetic equities in the DeFi space, particularly in a tokenized stock environment.

Mirror Protocol

- Created synthetic assets (mAssets) that track stock prices.

- Over-collateralized crypto is required when minting the tokens.

- No dividends are paid, and no rights of a shareholder are granted.

- Provided decentralized and unrestricted access to equity markets.

- Notable DeFi concept, albeit influenced by the collapse of the Terra ecosystem.

8. OpenDAO

OpenDAO operates within the tokenized stock environment, however, their focus has primarily centered around NFTs, particularly with community governance and NFT reward tokens.

OpenDAO has many token utility models and ecosystem building. However, they do not have a mainstream tokenized stock trading service comparable to centralized exchanges or significant tokenization services.

Customers seeking stock exposure do not come to OpenDAO, whose ecosystem revolves around NFTs and governance. Instead, they use platforms provided with real-world assets.

OpenDAO

- Community governance and NFT-based rewards.

- Mainly focused on stock tokenization.

- Investigates various token utility models in building ecosystems.

- No mainstream trading of stock tokens.

- Predominately focuses on NFT and governance, and not on equity exposure.

9. Bitcoin.com Exchange

Bitcoin.com Exchange has crypto trading and limited asset tokenization, including trading certain tokenized real-world assets, such as equities, for Bitcoin and stablecoins.

They claim to facilitate equitable access to financially tokenized trading instruments seamless to Bitcoin and stablecoins.

While not as well-known as others, such as KuCoin or specialized tokenized stock exchanges, Bitcoin.com Exchange creates more opportunities for crypto holders to diversified stock portfolios.

Bitcoin.com Exchange Offerings

- Offers cryptocurrency trading and certain tokenized asset services.t.

- Offers the trading of tokenized equities.

- Instant exchange of Bitcoin, stablecoins, and stock tokens.

- Wallets integrated to facilitate access.

- More general than platforms focusing on tokenized stocks, but adds to options for crypto-to-stock trading.

FAQ

What are tokenized stocks?

Tokenized stocks are digital tokens representing real-world company shares, tradable using cryptocurrencies.

Can I buy fractional shares with crypto?

Yes, many platforms allow fractional ownership of tokenized stocks.

Which platform is safest for tokenized stocks?

Regulated exchanges like Bitpanda, KuCoin, and Currency.com are considered safe.

Do tokenized stocks pay dividends?

Some centrally issued tokens do, but synthetic DeFi stocks usually do not.

Are tokenized stocks legal?

Legal status depends on local regulations and platform compliance.