In this article, I will discuss on the DeFi Protocols With Best Returns. Unlike traditional investing, DeFi offers platforms where users can earn high yields through staking, lending, yield farming, and liquidity provision.

What are the best protocols and what makes them unique? What are the different ways these protocols help investors maximize profits while managing risks in the ever-evolving DeFi ecosystem?

What is Defi Protocols?

DeFi protocols permit the execution of a myriad of financial transactions such as lending, borrowing, and staking which is otherwise possible only through the intermediation of financial institutions like banks, by replacing the intermediaries with smart contracts.

These protocols function on independent blockchains networks on DeFi networks like Ethereum, maintaining a high level of global visibility and security The use of DeFi protocols permits passive acquisition of cryptocurrencies and stable coins through liquidity pools, yield farming and staking.

The protocols are revolutionizing the entire financial system by replacing the protocols that are rigid, controlled, and geographically restricted with ones that are much easier, and provide enhanced financial Independence and returns.

How To Choose Defi Protocols With Best Returns

Here are points on how to identify DeFi protocols that offer the best returns.

Do Security Audits – Check if the protocol has undergone independent audits to mitigate chances of hacks and vulnerabilities.

Review APY/Yields – Analyze the APY and the returns provided on protocols for farming, staking, and lending.

Examine Liquidity – More liquidity guarantees stable returns and effortless entry/exit without considerable slippage.

Protocol Reputation – Use protocols with active communities, open teams, and a history of achievement.

Risk vs Reward Balance – More returns usually correspond with more risk, balance your choices with your risk appetite.

Cross-chain Compatibility – Preferred protocols with more blockchains for better freedom and opportunities.

User Experience – Simplicity in management of investments is possible with the more intuitive interfaces.

Key Point & Defi Protocols With Best Returns List

| DeFi Protocol | Key Point |

|---|---|

| Lido Finance | Leading liquid staking protocol enabling users to stake ETH and earn rewards while maintaining liquidity. |

| Aave | Decentralized lending and borrowing platform offering variable and stable interest rates. |

| Curve Finance | Specialized AMM for stablecoin trading with low slippage and deep liquidity pools. |

| Radiant Capital | Cross-chain lending protocol allowing seamless asset deposits and borrowing across multiple blockchains. |

| Yearn.Finance | Yield aggregator that automates strategies for maximizing returns on DeFi investments. |

| SushiSwap | Decentralized exchange and yield farming platform with community-driven governance. |

| Balancer | Automated portfolio manager and liquidity provider with customizable pools. |

| 1inch | DEX aggregator that sources best prices across multiple exchanges for optimized trades. |

| MakerDAO | Its unique point lies in providing stability |

| GMX | By combining derivatives trading with passive income |

1.Lido Finance

Lido Finance is recognized among the most successful DeFi protocols with great returns owing to its unique liquid staking mechanism. Lido Finance is not the same as the traditional staking process because it allows the staking of Ethereum while simultaneously permitting liquidity through stETH tokens which can be utilized in separate DeFi platforms for extra earnings.

This very unique feature allows Lido to be the most capital efficient which allows Lido to not just capture the staking rewards. Lido also manages to capture the extra rewards from the DeFi platforms. Investors can take advantage of Lido owing to its strict security audits ensuring its reputation for reliable returns.

2.Aave

Aave is one of the top DeFi protocols in terms of net annualized return on assets (NAR) because users can lend and borrow cryptocurrencies via smart contracts without intermediaries. The platform’s “flash loan” feature is unique because it allows users to borrow instantly and without any collateral.

This feature is advantageous for traders and developers needing to perform arbitrage and liquidity provisioning. Lenders receive attractive interest on the assets they deposit, while borrowers enjoy flexible rates. Aave is a robust and dependable platform because of its effective risk management, diverse asset offerings, and ample liquidity pools.

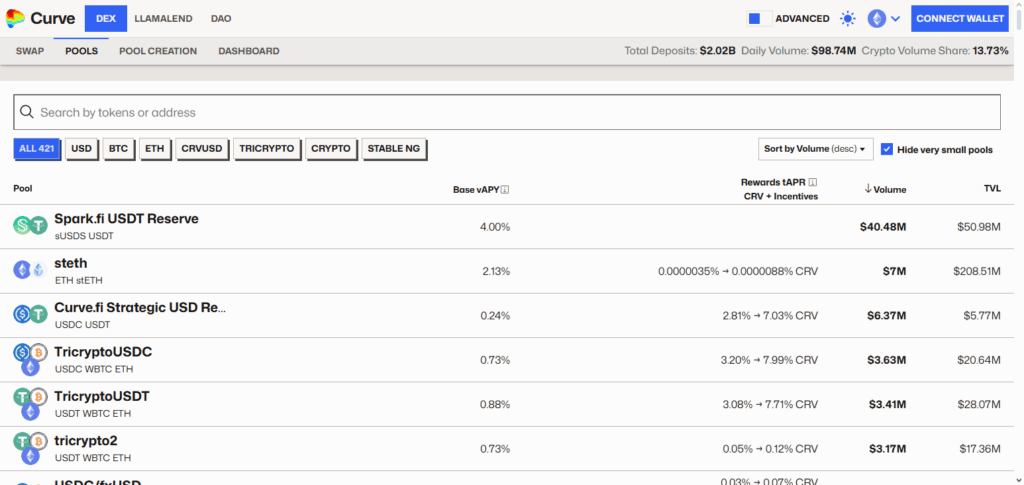

3.Curve Finance

Curve Finance is deemed as one of the DeFi protocols with the highest returns in the trading of stablecoins and pegged assets. The focal point of the Curve is the incredibly efficient Automated Market Maker (AMM) model, which aims to reduce the slippage and trading fees incurred on stable assets.

This model is advantageous not only to the traders, but to the liquidity providers as well, who earn consistent, low-risk returns. Curve achieves these stable returns for liquidity providers, which makes the platform one of the most popular among investors with low-risk appetites.

4.Radiant Capital

Among DeFi protocols, Radiant Capital boasts some of the highest returns available. This can be attributed to the company’s introducing the first cross-chain lending and borrowing solution. Unlike many protocols that are confined to a specific blockchain, Radiant enables users to deposit collateral on one blockchain and borrow against that collateral on multiple networks.

This kind of seamless technology interoperability significantly optimizes capital and improves cross-chain earning capabilities. Its novel cross-ecosystem liquidity distribution model rewards users with multiplier returns, making it one of the premier downstream liquidity super- AVL Distribution users cross- blockchainystem users.

5.Yearn.Finance

Yearn. Finance is called one of the DeFi protocols with the highest returns because it automates the complex process of yield optimization. Its distinct feature is the use of “vaults,” in which users deposit crypto and Yearn’s smart contracts automatically reposition capital among various strategies in search of profit maximization.

This system is automated which saves time and minimizes the risk of manual error as well as sustains yield farming results. Thanks to the aggregation of liquidity and developed strategies, Yearn. Finance offers better efficiency and returns than if the investments were managed separately.

6.SushiSwap

SushiSwap remains one of the best DeFi protocols with high returns thanks to the combination of yield farming with the distinct DEX functionality of liquidity providing and receiving numerous rewards.

Apart from token swaps, SushiSwap is one of the exclusive platforms that includes the BentoBox and Kashi lending, let alone the community ownership and governance of the protocol. This holistic model will permit the user to engage and maximize returns from lending, trading, and farming for the first time in one platform.

7.Balancer

The reputation of Balancer as one of the DeFi protocols with the highest yields earnings stems from its transformative approach to liquidity provision with its customizable pools. It allows users to design liquidity pools with an arbitrary number of tokens and various weightings, functioning as self-balancing portfolios.

Balancer’s flexible mechanisms grant liquidity providers the unique ability to achieve targeted asset allocation investment strategies, optimizing yield and portfolio control. Balancer seamlessly integrates automated portfolio management with trade execution, providing portfolio investors with an attractive solution for generating sustainable, diversified returns.

8.1inch

1inch is considered one of the Defi protocols that offer the highest yield because of its advanced DEX aggregator that optimally secures trades. 1inch’s unique feature is its capability to slice single transactions into dozens of DEXes to ensure the best price and slippage to every trader.

This not just lowers the cost for traders ensures the highest possible profit. 1inch makes certain that every user secures the highest value and that is why the returns are also competitive and Defi ecosystem.

9.MakerDAO

MakerDAO is a prominent DeFi protocol with competitive returns because it allows users to create the DAI stablecoin by depositing crypto assets as collateral, hence, forming a DeFi lending system.

Its unique selling proposition is offering stability via an over collateralized system, while users earn interest through the DAI Savings Rate. Such lending and stablecoin generation guarantees stable and reliable returns, and as a result, is an appealing option for certificate investors with a low-risk income strategy in the DeFi world.

10.GMX

GMX is one of the prominent DeFi protocols with best returns offering decentralized perpetual trading with low fees and high capital efficiency. Its unique point is the usage of multi-asset liquidity pools that support both spot and leverage trading, thus allowing liquidity providers to earn trading fees with minimal risk.

GMX’s unique combination of derivatives with passive income provides users with maximized returns. Users earn GMX tokens through smart contracts and GMX’s fortified security protocols ensuring the safety of investments. This provides users with a reliable source of passive income through DeFi.

Pros & Cons

Pros

- High Earning Potential – APYs available through staking, lending, and yield farming, remain attractive.

- Decentralization – Users maintain full control of their assets with no intermediaries.

- Liquidity Options – Numerous protocols offer the ability to withdraw liquidity, stake liquid, or both.

- Transparency – Transactions remain open and verifiable due to smart contracts and blockchain records.

- Diverse Strategies – Earning opportunities including lending, farming, and governance rewards offer versatile strategies.

Cons

- Smart Contract Risks – Losing funds due to vulnerabilities or hacks is always a possibility.

- High Volatility – Returns are subject to the crypto market and its movements.

- Complexity – For novices, some protocols are complicated and are hard to comprehend.

- Regulatory Uncertainty – Future compliance may impact operation of the protocols.

- Impermanent Loss – The value liquidity providers face may be less than the value of assets held.

Conclusion

In summary, the most profitable DeFi protocols are pioneering the financial landscape by providing stakers, lenders, and liquidity and yield farmers with innovative income maximization strategies.

Lido Finance, Aave, Curve, Radiant Capital, Yearn.Finance, SushiSwap, Balancer, and 1inch are examples of protocols each possessing individual competitive advantages that enhance efficiency and income.

Though there are risks posed by smart contracts and volatile markets, thorough research and planning allows investors to secure high yield rewards more continuously. DeFi protocols grant users decentralized, transparent, and high yield financial opportunities.

FAQ

Are DeFi protocols safe to use?

Many undergo audits, but risks remain due to smart contract bugs, hacks, and market volatility. Always research before investing.

Which DeFi protocols give the best returns?

Popular choices include Lido Finance, Aave, Curve Finance, Yearn.Finance, SushiSwap, Balancer, Radiant Capital, and 1inch.

Do I need technical knowledge to use DeFi protocols?

Some platforms are beginner-friendly, while others require understanding of wallets, gas fees, and yield strategies. Start simple, then scale.