I’ll go over how cryptocurrency businesses handle banking relationships in this post, including the difficulties they have with conventional banks, the tactics they employ to foster trust, and the alternative banking options they embrace.

To understand how digital asset companies maintain seamless operations while adhering to regulations and obtaining trustworthy financial services, one must comprehend these processes.

Understanding the Banking Challenges for Crypto Companies

Obtaining banking partnerships is especially difficult for crypto companies due to the number of challenges they must face. More traditional banking institutions tend to view crypto businesses as more high-risk clients, often due to the rapid declines in values of digital assets, as well as fraud, and possible lack of regulation to protect customers.

Many institutions, especially overseas, tend to lack partnerships due to the rigid regulations of KYC and AML and the large amounts of reporting that must be done to comply with those regulations. Banks also face challenges when working with crypto companies that conduct business in multiple countries, as different countries have varying regulations when it comes to the transporting and trading of digital assets.

For all of the reasons listed above and more, companies in the crypto industry are often forced to close accounts, and are left with limited banking options. Overall, the lack of clear regulations along with the scope of bank policies and varying degrees of perceived risk allocate Institutional banking for crypto companies to be very limited.

How Crypto Companies Navigate Banking Relationships

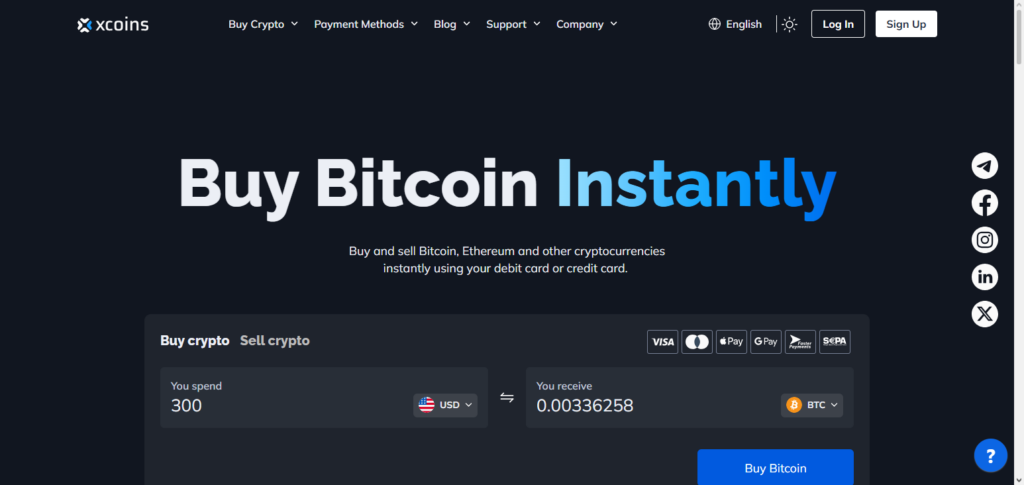

Example: Navigating Banking Relationships by Crypto Exchange “XCoin”

Step 1: Banking Requirements

- XCoin is a mid-sized cryptocurrency exchange that needs banking services for fiat payments including deposits and withdrawals, payroll, and other operational costs.

- Banking services are needed for specific currencies and countries.

Step 2: Research and Identify Crypto-Friendly Banks

- Searches for banks that have collaborated with fintech and crypto companies in the past.

- Studies a bank’s compliance, transaction fees, and willingness to transact cryptocurrencies.

Step 3: Develop a Strong Compliance Framework

- Builds strong KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

- Construct documents to demonstrate transparency and compliance.

Step 4: Engage Banks with Transparency

- Outlines business model, compliance model, and risk control model to potential banking partners.

- For trust building, offers to share regular audits and proof of reserve reports.

Step 5: Engage with Fintech or Payment Processors as Intermediaries if Necessary

- In areas where banks have cold feet, XCoin collabs with fintech companies that are crypto-friendly.

- This offers substitute or roundabout banking services such as fiat withdrawal and deposits.

Step 6: Maintain Communication and Ongoing Reporting

- Sends reports, summary of transactions, and audits to the bank.

- Updates the bank on the changes in the regulation and the business process.

Step 7: Diversify Banking Relationships

- Keeps relationships with different banks to mitigate the risk of having an account closed.

- Guarantees business continuity in the event that one of the banking partners is too restrictive.

Step 8: Track Changes in Regulation

- Scans the landscape for changes in regulations regarding the business of crypto in all places of operation.

- Earns and maintains the trust of the bank by updating the measures of compliance.

Role of Regulatory Compliance in Banking Relationships

Banks Trusts You

- Regulatory frameworks & compliance when it comes to KYC & AML evidences that the company operates responsibly.

You Don’t Break the Law

- Compliance provides the company with legal protection in case international/ local regulations change.

You Get More Services

- Financiering is way easier to come by from the banks when you are compliant.

Reports are Clear

- There is little to no risk for the banks when partnerships are long term even due to complicated currency structures.

Less Operational Risk

- Compliant crypto companies are less exposed to the risk of account closures, sudden banking barriers or fines/losing entire banking systems.

Stakeholders Reputation

- More confidence to partner with the company from banks due to the reliability you gain from your compliance.

Alternative Banking and Payment Solutions

Fintech Platforms and Payment Processors

- Companies such as PayPal, Wise, or Stripe work as intermediaries, meaning crypto companies can handle payments in fiat currency without having to rely on traditional banks.

Crypto-Friendly Banks

- A small number of banks are able to work with crypto companies and offer accounts and services based on the operation of digital assets and their compliance to flexible internal policies.

Stablecoins as a Banking Alternative

- Holding value in USDT, USDC, or BUSD allows companies the on-chain management of transactions in equivalents to fiat currency, and decreases the need to use traditional banking systems.

Correspondent Banking for Cross-Border Transactions

- Through correspondent banks with a global outreach, crypto companies are able to transfer funds in a elastic manner, even in places with restricted access to direct banking.

Embedded Finance Solutions

- The use of fintech APIs and digital wallets allows crypto companies to add features that enable their clients to make deposits, withdrawals, and payments even if the crypto company does not have a traditional banking relationship.

Partnerships with Neobanks

- Neobanks or digital-only banks, tend to have fewer restrictions than traditional banks when providing services to crypto companies. They assist with payroll, invoicing, and treasury management.

Accounts with Multiple Banks and Banking Aggregators

- Employing several banking partners or providers that integrate accounts guarantees flexibility should one banking connection become limited.

Challenges Crypto Companies Face with Banks

Regulatory Uncertainty

Banks prefer not to work with crypto companies due to the risk of compliance with uncertain or changing regulations.

Reputational Risk

Cryptocurrency companies are often the target of fraud, scams, and money laundering and banks fear that if they partner with crypto companies, they may be perceived to be complicit in those illegal activities.

Operational Restrictions

Banks may impose restrictions on the crypto businesses they work with in terms of payments, wire transfers, and other services.

De-risking Trends

To mitigate perceived financial risk, some banks are simply opting to cut crypto-related businesses from their portfolio.

High Compliance Costs

Due to the banks’ KYC/AML auditing and reporting requirements, compliance may become exceedingly costly for crypto-related businesses.

International Banking Barriers

The banking regulation in some jurisdictions is too vague or too stringent and makes cross-border transactions exceedingly complex.

Account Closures and Frozen Funds

Due to shifting policies or lack of parameters, the perceived risk of a client may result in banks closing the accounts of crypto companies and freezing their transactions.

Risk Management in Banking Relationships

Monitoring the Health of Banks: Keep an eye on the stability and policies of partner banks in order to manage and forecast risks.

Updates of Regulatory Compliance: Managing trust with banks requires adherence to regulatory compliance at the local and intemnational levels.

Multiplexing Banking Relationships: Have several partner banks in order to eliminate the risk of reliance on one institution.

Open Communication with Banks: For banks to trust you, divulge business policies, transactions, and risk mitigation plans.

Developing a Contingency Plan: Have plans for when accounts get suddenly closed, funds get frozen, or payments get disrupted.

KYC/AML Procedures: Strengthening KYC and AML protocols helps eliminate perceived risks.

Fintech and Crypto-Native Solutions: Instead of using traditional banking methods, try using a payment processor, stablecoin, or crypto-friendly bank.

Case Studies / Industry Examples

Coinbase: Understanding the importance of maintaining strong compliance for seamless fiat transactions, Coinbase established partnerships with several banks in the U.S. and abroad.

Binance: Utilizes a payment and banking partner network to manage both operational liquidity and global deposits and withdrawals.

Kraken: Focused on transparency and KYC/AML compliance, Kraken developed partnerships with other banks and crypto-friendly fintech companies.

BitPay: Minimizes reliance on traditional banking systems by utilizing a combination of banking and payment processors that streamline crypto payment solutions for merchants.

Gemini: To ensure seamless operational continuity for fiat and cryptocurrency transactions, Gemini established strong compliance and available feedback loops with their banking partners.

RippleRipple: has successfully navigated the complex intersection of international banking and cross-border payments by partnering with global financial institutions and managing correspondent regulatory relations.

Smaller Crypto Startups: Have utilized small banking partners, fintech solutions, and neobank systems to manage the risk of banking partner account closures.

Future of Banking Relationships for Crypto Companies

The relationships that crypto companies will be able to form with banks is extremely positive due to the banks, along with the regulators, adapting to the digital assets. Within the next year, almost all banks will be able to adjust their services to provide more crypto-friendly services.

Banks will also be able to partner with embedded finance companies, stablecoins, digital banking, and fintech with blockchain to maintain the safety of crypto and crypto-related transactions. Optimistic frameworks and clarity in regulations will provide banks the confidence to work with crypto companies.

Innovation will give banks more operational channels and increased flexibility both with and without the integration of crypto. These will all assist in eliminating the trust deficit in the crypto world along with the world of crypto companies. We will be able to see the merging of the crypto and digital worlds. This will give us the crypto friendly financial system that has been so desperately needed.

Pros & Cons

| Aspect | Pros | Cons |

|---|---|---|

| Partnering with Crypto-Friendly Banks | Easier account opening, better support, tailored services | Limited availability, often smaller banks with less reach |

| Diversifying Banking Partners | Reduces risk of disruption, ensures backup options | More administrative work, higher management costs |

| Robust Compliance (KYC/AML) | Builds trust with banks, reduces account closures | Expensive to implement and maintain |

| Transparent Communication with Banks | Improves relationships, banks understand business model | Time-consuming, may require legal oversight |

| Using Fintech & Crypto Payment Solutions | Provides alternative liquidity, fast transactions | May incur fees, less regulatory protection than traditional banks |

| Contingency Planning | Prepares company for sudden banking issues | Requires constant monitoring and updates |

| Global Banking Partnerships | Enables cross-border operations, access to international liquidity | Complex regulatory compliance across jurisdictions |

Conclusion

For cryptocurrency companies, managing banking relationships is still one of the most difficult tasks, but it is not insurmountable.

Crypto companies may ensure dependable access to financial services by emphasizing regulatory compliance, upholding openness, and implementing alternative banking alternatives.

Diversifying banking partners and utilizing fintech advances guarantees operational continuity, but establishing trust with banks through audits, KYC/AML processes, and transparent reporting is crucial.

Businesses that actively manage compliance and cultivate solid partnerships will be best positioned to prosper in both traditional and digital financial ecosystems as the regulatory environment changes and more banks become crypto-friendly.

FAQ

Why do crypto companies face challenges with banks?

Crypto companies are often seen as high-risk due to regulatory uncertainties, potential fraud, and the volatility of digital assets. Many traditional banks hesitate to offer services without strict compliance measures.

How do crypto companies build trust with banks?

They maintain robust KYC/AML compliance, conduct regular audits, provide proof-of-reserves, and maintain transparent reporting to demonstrate responsible and low-risk operations.

Can crypto companies operate without traditional banks?

Yes, through alternative solutions like fintech platforms, payment processors, stablecoins, digital wallets, and crypto-friendly neobanks, companies can manage most financial operations.

How important is regulatory compliance for banking relationships?

Regulatory compliance is crucial. Adhering to local and international laws reduces legal risks, reassures banks, ensures access to financial services, and strengthens credibility with investors and customers.