In this article, I will discuss the How to Borrow Against Your Crypto. This is a great way to get liquidity without having to sell your digital assets. You can quickly access funds while still owning your cryptocurrency.

Together, we will review the steps to take, the benefits of this process, and the associated risks to ensure you are well informed when borrowing against your crypto.

What is Borrow Against?

“Borrowing against” means to use your assets such as cryptocurrencies as collateral for a loan. Instead of selling your crypto, you can use it as collateral to be lent cash or some other form of funding.

Usually, the sum you are entitled to receive is a certain proportion of the value of the asset which is termed as loan-to-value (LTV) ratio. If the loan is not repaid, the collateral can be sold off by the lender in order to obtain the required amount.

How to Borrow Against Your Crypto

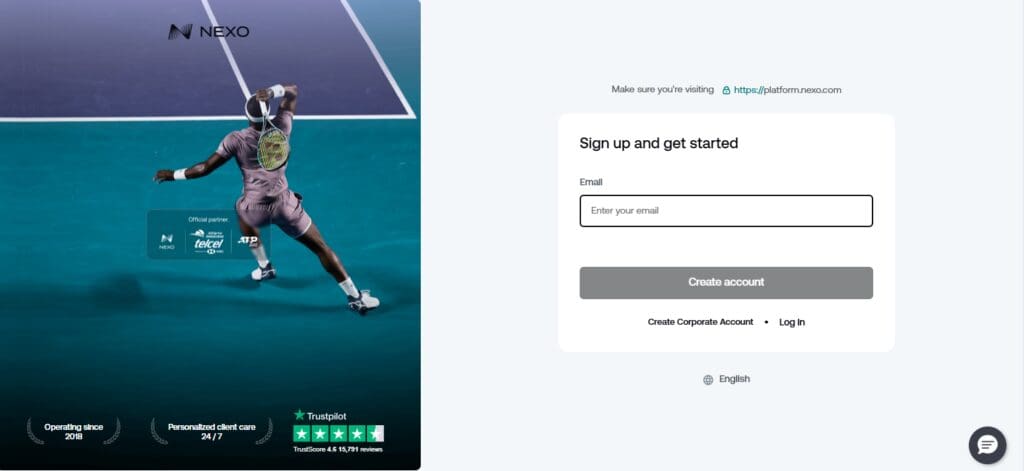

Here’s a step-by-step guide to borrowing against your crypto using Nexo as an example:

Create an Account

Head over to Nexo and set up an account.

Go through KYC (Know Your Customer) verification to stay compliant with the law.

Deposit Collateral

Send your cryptocurrency (Bitcoin, Ethereum, or stablecoins) to your Nexo wallet.

Your borrowing potential will be determined by your deposited collateral’s value, as well as the Loan-to-Value (LTV) ratio.

Choose Loan Terms

Pick your desired loan amount alongside the currency you want it in (USD, EUR, or stablecoins like USDT).

Check the interest rates and repayment periods or terms offered by Nexo.

Approve the Loan

Accept the loan terms and authorize the transaction.

Nexo will automatically transfer the loan amount to your Nexo account or linked bank account or wallet, instantly.

Repay the Loan

Loans can be paid in flexible installments or all at once, based on your current financial state.

Both cryptocurrencies and fiat currencies can be used to repay the loan.

Withdraw collateral

After you have paid the loan off completely, your collateral will be frozen no more and will be able to be withdrawn.

Risks of Borrowing Against Crypto

Risk of liquidation

This refers to losing all your cryptoassets in a situation where you are no longer able to pay back your loan and the lender liquidates your crypto to recover the loan. If, for instance, the price of your collateral crypto declines below a certain amount, this is also a risk.

Volatility

The value placed on cryptocurrency changes every second, so monitoring collateral throughout the process is necessary because poor timing could lead to a margin call or complete liquidation case.

Security risk

There’s a risk of hacking, fraud, or platform failures which can lead to loss of funds when stored with third parties.

Changeable interest rates

Certain platforms allow for interest rates that vary with time which increases the amount required to repay the loan over time.

Pressure around repayment

The punishment for not paying on time is losing the ability to access your collateral and the crypto assets you have placed with the lender, incurring additional fees.

Best Practices for Borrowing Against Your Crypto

Some tips on using your cryptocurrencies as collateral for a loan are as follows:

Keep Your LTV Ratio Low: In order to decrease the chances of liquidation, try to borrow the least amount of money while staying below the maximum LTV ratio that the platform provides. The lower the LTV is set, the better position you will be in to handle market fluctuations.

Keep An Eye On The Market: Monitor the overall crypto market regularly. Big price movements can lead to margin calls, so actively managing the market can help in reducing risks.

Lending Platforms Reputation: Use platforms that have established names as well as strong security features, well-defined terms, and positive customer ratings as your first choice in selection.

Read The Loan Agreement: Know every detail regarding the loan from interest rates, duration of the repayment, to any additional charges there may be. Be sure to agree with the terms before proceeding.

Use Different Types Of Collateral: If possible, use more than one type of cryptocurrency as collateral to reduce chances of risk. Do not overextend yourself by securing multiple loans with different assets all at once.

Set A Plan To Pay Back The Loan: Be certain that you possess the ability to pay back the loan within the specified time limit set out in your plan. Set sufficient funds or certain assets to fulfill the repayment while maintaining the assets to avoid liquidation.

Use Crypto-Backed Loans for Short-Term Needs: Do not resort to using a crypto back loan for long term financing. The dependance on liquid funds can fluctuate and such loans are best suited for short term use.

Pros & Cons

| Pros | Cons |

|---|---|

| Access Liquidity Without Selling: Unlock funds without having to liquidate your crypto assets. | Risk of Liquidation: If the value of your collateral falls, the lender may liquidate it to cover the loan. |

| Retain Ownership of Crypto: Continue to hold your cryptocurrency and benefit from any potential price appreciation. | Cryptocurrency Volatility: Market fluctuations can impact the value of your collateral and the loan terms. |

| Faster Access to Funds: Borrowing against crypto can be quicker than traditional loans or selling assets. | Interest Rate Fluctuations: Some platforms offer variable interest rates, increasing repayment costs over time. |

| Flexible Use of Funds: Can be used for various purposes, such as personal expenses, investments, or business. | Security Risks: Storing crypto with a third-party lender carries potential security risks, including hacks or fraud. |

| No Credit Checks: Typically, there’s no need for credit score evaluation, making it accessible to those with poor credit histories. | Debt Accumulation: If not managed properly, borrowing against crypto could lead to accumulating debt, especially if the loan terms are unclear. |

Conclusion

In your conclusion, crypto borrowing can be a great option for people looking to access some liquidity without having to sell their assets. Unlocking funds against your cryptocurrency can help you cater for personal needs or even investment.

Selling your crypto always comes with risks like volatility and liquidation which is why it is better to practice greater precaution by always protecting your collateral. Using a trusted platform, having a low loan to value (LTV) ratio, and a set repayment plan will always enable you to borrow crypto in a safe manner whilst also being effective.