I will discuss the How to Stake Tokens on PancakeSwap, which is a widely-used and decentralized exchange on the Binance Smart Chain.

You will know how to connect your wallet, pick staking pools, and receive rewards. Regardless of whether you are a newcomer to DeFi or an individual who is trying to optimize their crypto profits, this guide will assist you in staking easily and efficiently.

What is staking token ?

Token staking refers to the locking of crypto assets in a blockchain ecosystem for transaction fee validation and receiving rewards.

It earns emphasis in PoS and DPoS systems. Users can stake their crypto tokens to earn extra tokens on every withdrawal, allowing them to have additional benefis from the network’s security and functionality.

Passive earning opportunities through staking are common within DeFi platforms, making it especially appealing for novel cryptocurrency investors.

How to Stake Tokens on PancakeSwap

Staking tokens on PancakeSwap is an easy approach and in this example, I walk you through the basic steps on how to stake CAKE tokens on PancakeSwap.

Example: Staking CAKE Tokens on PancakeSwap

Setup Your Wallet

Get a crypto wallet like MetaMask or Trust Wallet.

Within the settings, remember to add Binance Smart Chain (BSC) so you can change to the correct network.

Get CAKE Tokens

Purchase CAKE tokens from an exchange such as Binance (it’s the native token of PancakeSwap).

Move these tokens to their respective wallets.

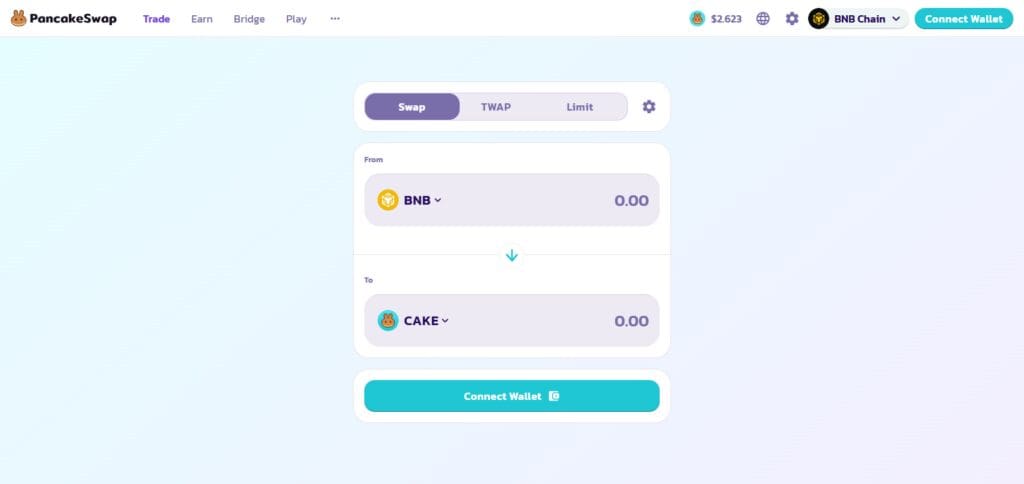

Check Out Pancakeswap

Go to the Pancakeswap site and on the upper right side of the page, click on ‘connect wallet’ to connect your wallet.

Go To Syrup Pools

On the PancakeSwap, click on the Earn tab and from the dropdown select Syrup Pools.

Pick the pool you want to stake your CAKE tokens at (there could be flexible or locked staking options).

Stake Your CAKE Tokens

Choose your desired Syrup Pool and click on Stake.

Type in the amount of CAKE tokens you wish to stake.

Using your wallet, approve the transaction.

Claim Your Rewards:

With your CAKE tokens staked, you can begin to earn rewards.

Oftentimes, rewards can be harvested and either reinvested or taken out after a certain period of time.

Unstake Tokens (Optional)

Go back to the Syrup Pool and click on “Unstake” to withdraw your staked tokens. After that, give approval for the transaction in your wallet.

Risks and Considerations

Impermanent Loss: Tokens experience price changes which may lead to loss while providing liquidity as opposed to simply holding the tokens.

Smart Contract Vulnerabilities: Security issues can arise from DeFi platforms such as PancakeSwap as they depend on smart contracts, which are subject to bugs and other problems.

Token Volatility: The value of your rewards and staked tokens can be impacted due to increased prices of crypto and their volatility.

Gas Fees and Slippage: Slippage as well as transaction fees can cut down your profits, particularly if the network is busy.

Platform Risks: Anonymous platforms do not provide any customer assistance which means you are not protected from issues that may occur.

Tips for Maximizing Rewards

Select Pools With Defer and Bigger Risks

Go for pools that have a greater annual percentage rate (APR) for more profits, taking their risks into account.

Reinvest Profits

Withdraw and reinvest your profits frequently to take advantage of compounding and increase overall returns.

Pay Attention To Token Prices

Staked tokens and reward prices should be watched closely in order to maximize profit when selling or reinvesting.

Consolidate Your Staking

Spread your crypto deposits over several pools with the intent of increasing revenue while minimizing risk.

Lower Gas Fees

Claim rewards or stake tokens during times of less network activity to pay less transaction fees.

Pros & Cons

| Pros | Cons |

|---|---|

| High APR Rewards: Earn attractive returns through staking pools. | Impermanent Loss: Liquidity providers risk losses due to token price fluctuations. |

| Low Transaction Fees: Built on Binance Smart Chain (BSC), offering cheaper fees than Ethereum. | Smart Contract Risks: Potential vulnerabilities or bugs in the contract. |

| Passive Income: Earn CAKE and other tokens without active trading. | Token Volatility: Rewards and staked tokens may lose value. |

| Flexible Staking Options: Choose between Syrup Pools and Farms. | Slippage and Fees: Transaction fees and slippage can reduce profits. |

| Easy-to-Use Interface: User-friendly platform suitable for beginners. | DeFi Platform Risks: No direct customer support or recourse for issues. |

Conclusion

In summary, staking tokens on PancakeSwap remains among the efficient ways to passively earn revenue in in the DeFi world. Its low fees and user-friendly interface, as well as current APRs, makes it an attractive option for those within the crypto space.

Still, it is essential to understand the risks involved, such as impermanent loss, token price volatility, and smart contract hacking. Maximizing returns is possible through diversification of staking, compounding of rewards, and market monitoring. As always, be sure to conduct market research before allocating your tokens into staking pools.