In this article I will discuss the How to Stake Kava Token and elaborate on the steps involved in staking. When you stake KAVA, you earn rewards as you help secure and govern the network. I will take you through the critical steps, which include selecting a validator and efficiently managing your staked tokens.

What is Kava Token ?

Kava Token (KAVA) serves as the native cryptocurrency of the Kava blockchain, a Decentralized Finance (DeFi) platform on the Cosmos ecosystem. KAVA performs both functions of a governance token as well as collateral in the ecosystem.

KAVA holders can vote on protocol changes, system governance, and network security through staking. Kava allows users to have cross-chain financial services – lending, borrowing, issuing stablecoins, all in one place, all while maintaining low transactions costs and great scalability for decentralized applications.

How to Stake Kava Token

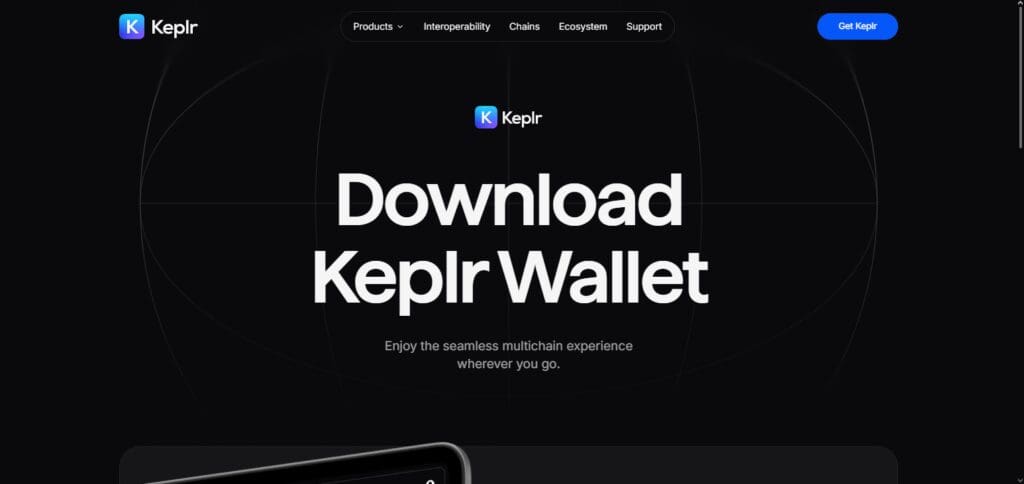

Now, lets take a look at how to stake Kava tokens with Keplr Wallet and an example of a staking platform:

Download Keplr Wallet

Download the Keplr browser extension from the official website.

Create or Import a Wallet

Utilize the Keplr extension to either create a new wallet or import an existing wallet using your mnemonic phrase.

Select Kava Network

Select the Kava Network from the dropdown menu at the top.

Stake Tokens:

- Click the “Stake” button on the main wallet dashboard

- Type the name of the validator you wish to stake with (for example, StakeFish) in the Search box: “Search Validator”.

- Hover over the validator and click the arrow next to their name to view how much Kava you have.

- Click “Delegate”, a box will pop up asking how many tokens you wish to stake. Enter the amount you wish to stake, make sure to leave 0.01 Kava for future uses.

- To confirm the transaction click “Delegate” once more and approve the transaction.

TakeApp: A Take Platform Example

TakeApp is an ecommerce take platform that simplifies the construction of ecommerce websites and WhatsApp integrations for merchants. It enables merchants to develop third-party integrations, thus providing flexible custom workflows and automation of online business processes.

Features:

Order Management: Enables creation and retrieval of orders to facilitate efficient order processing and tracking.

Inventory Management: Ability to modify and manage product inventories to ensure real-time stock updates.

API Integration: Enables interaction with core features of the platform through its TakeApp API.

Why Stake Kava Token?

Here are the advantages of staking Kava Token (KAVA):

Staking Rewards

Users that helped stake the network’s security receive KAVA token rewards.

Blockchain Security

While staking, you contribute to the decentralization and security of the Kava blockchain.

Voting Rights

Stakers have the ability to vote on upgrades and other significant protocol decisions for the advancement of the platform.

Working Income

Staking does provide the option for passive income which increases your KAVA tokens over time.

Increase Holdings

Having KAVA tokens staked increases its value and utility long term. Aided by the success of the network.

Risks of Staking Kava

Risk Factors for Staking Kava Token (KAVA):

Slashing Risk

Even validators get slashed for malice or miss with their downtime, this could affect the tokens which are staked too.

Lock Up Period

People looking to sell or transfer tokens will be disappointed to find that the staked ones are locked up for a duration of time.

Validator Risk

If one decides to delegate to a bad validator or one who doesn’t perform well, the rewards might be low or in the negative.

Market Volatility

The KAVA tokens value is highly volatile and so could the assets which are staked.

Network Vulnerabilities

There are bugs and security issues with the network which open it up to losing assets for people who stake.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn Rewards: Receive KAVA token rewards for staking. | Slashing Risk: Validators can be penalized for malicious behavior or downtime. |

| Governance Participation: Influence protocol upgrades and decisions. | Lock-up Period: Tokens may be locked, limiting liquidity and access. |

| Network Security: Contribute to the blockchain’s decentralization and security. | Validator Risk: Risk of choosing an unreliable validator. |

| Passive Income: Generate passive income from staking rewards. | Market Volatility: Token value may fluctuate, affecting staked assets. |

| Long-Term Growth Potential: Support the network’s growth and value. | Technical Complexity: Staking requires understanding of the process and network. |

Conclusion

In summary, active participators earn incentives from the Kava Token Network (KAVA) by staking Kava Token(KAVA) within the protocols, which aids them in earning passive income, voting on vital protocol matters, and assisting in securing the Kava blockchain.

At the same time, risks such as slashing, lock-up boundaries, and market unpredictability exist. Taking these factors into consideration, Kava blockchain’s risks can be decreased through the careful selection of a dependable validator alongside comprehending the staking procedure. Earning rewards comes along with supporting the network, which makes staking KAVA tokens a reasonable long-term plan for passive Kava advocates.