In this article, I will discuss the How to Stake Your Bridging Aggregator LP Tokens to get boosted returns as well as improved cross-chain liquidity.

Earning passive income in DeFi is possible through staking LP tokens. I will explain the whole process of staking along with its benefits, risks, best practices, and provide insights that will help you formulate an effective strategy for optimizing your staking experience.

What is LP Tokens?

LP tokens or Liquidity Provider tokens are rewards and can be used as staking assets. LP tokens are given to users when a pair of cryptocurrency are deposited in a liquidity pool.

DEXs(like Uniswap or Sushiswap) or liquidity pools issue these tokens as proof of stake. In return of holding these tokens, users can earn additional rewards through staking or transaction fees.

Although they can be converted back to assets, trading them in the middle makes the holders vulnerable to various risks. One of the major risk involve impermanent loss where the currency in the pool changes prices.

How to Stake Your Bridging Aggregator LP Tokens

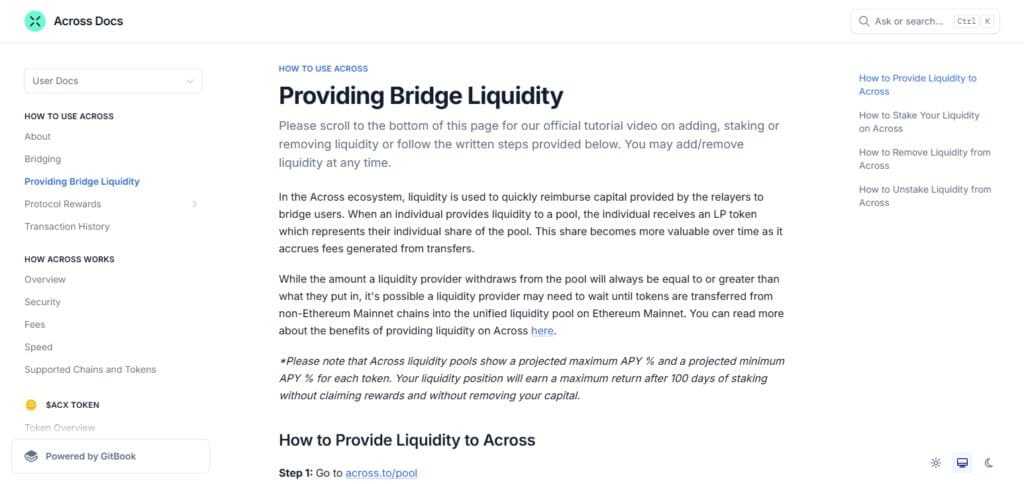

Sample: Staking Bridging Aggregator LP Tokens on Across Protocol

Provide Liquidity

Go to the Across Pool page and connect your wallet.

Choose the liquidity pool that you would want to add toand add your tokens.

After you add liquidity, you will get LP tokens that will give you a share of the pool.

Navigate to Staking

On the same platform, find LP tokens staking area for this particular platform.

Select liquidity, click on the arrow and go to the liquitity staking box.

Stake Your LP Tokens

Type the number of LP tokens you intend to stake or click ‘MAX’ on the box which allows you to stake all of them

Confirm and click ‘Stake’

Approve the transaction in your wallet.

Earn Rewards

Fees accrued from bridging transactions for instance will be added to your LP Tokens.

Go to the rewards page to monitor the progress of your rewards and also your staking position.

Unstake When Needed

Head to the unstaking area to start withdrawing the tokens you have staked, choose the value you wish and hit confirm.

Other Place Where Stake Your Bridging Aggregator LP Tokens

PancakeSwap

PancakeSwap enables users to stake their bridging aggregator LP tokens as it is one of the DEXs on the Binance Smart Chain.

PancakeSwap has quickly become a favorite in the cryptosphere for a slew of reasons: low transaction costs, rapid transaction completion, and high-yield farming are just the beginning.

CAKE token holders benefit from cross chain liquidity and now users can earn CAKE by simply LP token staking. Efficient exchange of tokens without a third-party central broker is Pepecake Pancakeswap’s most remarkable attribute: its AMM model.

Balancer

Balancer can be defined as both a DEX (decentralized exchange) and an automated portfolio manager. Users are able to stake bridging aggregator LP tokens while optimizing liquidity across multiple assets.

Unlike other types of DEXs, Balancer allows users to use various combinations of assets because Balancer supports multi-token LP pools.

Users are paid BAL rewards and trading fees for providing liquidity and its smart rebalancing mechanism helps minimize impermanent loss which is what makes it stand out in liquidity management.

Managing Your Staked LP Tokens

Check Your Staking Activities

- Periodically verifies the harvested rewards, staked LP token balance, and APY for maximum profitability.

- Monitor your holdings in real-time using TVL portfolio tracking DeBank, Zapper, and Zerion.

Claim or Reinvest Rewards

- Choose between claiming and diversifying or compounding (re-staking for exponential growth).

- Do not forget about gas fees while claiming rewards, especially on costly networks like Ethereum.

Follow Protocol Governance Updates

- Follow any reward step changes, staking policy changes, or liquidity migration plans.

- Actively participate in Discord, Telegram, or Twitter to join official community forums for protocol announcements.

Manage Risk and Exit Strategy

- Monitor Impermanent Loss: Keep tabs on the value of your LP tokens relative to individually held assets.

- Pay Attention to Unstaking Requirements: Certain pools enforce lock-up periods or have penalties for early withdrawal.

- Diversify Holdings: Alleviates the risk from concentrated exposure in one pool or protocol.

Security Best Practices

- Use Hardware Wallets: Store LP tokens with Ledger or Trezor for better security.

- Avoid Suspicious Links: Always interact with staking platforms vetted and approved as trusted.

- Revoke Permissions: Using effective token approval tools like Revoke.cash, manage and revoke excess token approval permissions.

Risks and Best Practices

Risks

Impermanent Loss – Your LP tokens will be worth less if the value of the tokens in the liquidity pool change significantly relative to them just being held, rather than withdrawn.

Smart Contract Vulnerabilities – There is potential for significant fund loss due to bugs or exploits in the staking or liquidity pool contracts or other relevant contracts.

Bridge Security Risks – These bridging aggregators use cross-chain protocols which are some of the most commonly targeted mechanisms for hacking.

Slashing or Penalties – Certain protocols may set a prerequisite for a defined period from which LP tokens may be withdrawn without incurring penalties.

Liquidity Risks – LP tokens which are staked may have low market liquidity, therefore, exit without slippage may not be possible.

Regulatory Uncertainty – DeFi staking regulations will differ per region and may affect potential revenue or access.

Best Practices

Choose Reputable Platforms – Utilize bridging aggregators that have been securely reviewed for their use-track record.

Monitor Smart Contract Audits – Ensure that LP staking and other relative contracts have undergone audits and assessments by independent security assessors.

Diversify Staking Strategies – Split liquidity provision tokens across different protocols and drip-feed them to different pools instead of concentrating them in one.

Understand Reward Mechanics – Assess how rewards are earned and if their distribution is feasible.

Security News of Bridges – Keep up with any changes in the security incident or upgrade phase of the bridging protocol.

Multi-Signature or Hardware Wallets – Limit exposure to risk by adequately protecting your funds with wallets that have multi-signature or hardware features.

Pros & Cons

Pros

Earn Passive Income – Winning in business without working is possible by generating income through interest, fees, or governance tokens for staking LP tokens.

Robust Liquidity Rewards – Staking rewards from liquidity pools and transaction fees profit liquidity providers.

Facilitates Cross-Chain Liquidity – Bridging aggregators strengthen cross blockchain liquidity because they offer bridges.

Opportunities for Compounding – A few platforms provide auto-compounding tools to further increase profits.

Cons

Impermanent Loss – Reduces profits when paired asset prices’ oscillation causes fluctuations.

Smart Contract Risks – By staking on risks, funds may get lost due to exploits on throne of weak platforms.

Lock-Up Periods – Ceiling on withdrawing staked tokens ultra curtails liquidity.

Network Fees – Higher network congestion translates to higher gas fees for staking and unstaking transactions.

Conclusion

In summation, the process of Staking and bridging aggregator LP tokens helps in earning passive income while also supporting cross-chain liquidity.

The proper procedure needs to be followed: select a safe site, stake your tokens correctly, and manage your assets.

This allows for maximum profitability with minimal risks. Imbalance withdrawal gaps, loss of geopolitical power, smart contract threats, and containment bounds need to be kept in mind at all times.

Using best practice methodology guarantees safety when monitoring your financial inputs, resulting in a profitable staking outcome. Enjoy the staking!