In this article, I will discuss the Most Profitable Yield Farms Right Now, focusing on the top DeFi platforms with the highest returns.

This guide aims to assist both professional investors and novice users in understanding how to crypto farm by guiding them on the optimal asset staking locations along with the risks in today’s fast paced decentralized finance world.

What is Yield Farms?

Yield farming, or yield farms as some might call them, involve lending or staking cryptocurrency assets to earn rewards such as additional tokens or interest in return. It is a practice done with the intent of earning yield in the decentralized finance world.

The platforms paying out rewards like Uniswap, Aave or PancakeSwap generate rewards via trading fees or newly minted tokens.

Yield farming enables passive income for investors, however, due to the volatility in the market, smart contract vulnerabilities and impermanent loss, the risk is usually high.

With all those risks, the strategy has still become popular in the Defi domain for people seeking to maximize the returns on their crypto assets.

Key Feature & Most Profitable Yield Farms Right Now

| Platform | Key Feature |

|---|---|

| Aave | Decentralized lending and borrowing platform allowing users to earn interest on deposits and borrow assets. |

| Yearn Finance | Yield aggregator that automates the process of finding the highest returns across DeFi protocols through its yVaults. citeturn0search4 |

| Compound | Autonomous interest rate protocol enabling users to lend and borrow cryptocurrencies with algorithmically adjusted interest rates. |

| Uniswap | Decentralized exchange utilizing an automated market maker (AMM) model to facilitate permissionless token swaps. |

| Aerodrome | (No specific information available from the provided sources.) |

| Beefy Finance | Multi-chain yield optimizer offering auto-compounding vaults to maximize returns on staked assets across various blockchain networks. citeturn0search3 |

| Kamino Finance | DeFi platform on Solana providing automated liquidity strategies, lending, borrowing, and leveraged yield farming opportunities. citeturn0search2 |

| SushiSwap | Community-driven decentralized exchange offering token swaps, yield farming, and staking options. |

| Raydium | Solana-based automated market maker (AMM) and liquidity provider for decentralized exchanges, integrating with the Serum DEX. |

1. Aerodrome

Base blockchain’s premier DEX, Aerodrome, is currently wETH/AIXBT liquidity pool yield farming has one of the highest APYs ever recorded.

The pool combines wrapped Ethereum (wETH) with the highly volatile 2025 AI agent token AIXBT. Reports suggest that due to low total TVL and high trading volume, APYs can exceed 5000%, making it a speculative darling for risk-loving farmers.

These profit prospects do come with some caveats AIXBT stock price plummeting could result in substantial permanent loss. Unlike riskier options offered by Aave, which has steadier returns,

Aerodrome provides wETH/AIXBT farming opportunities for those willing to plunge into the deepest end of the pool with little regard for their safety.

| Feature | Details |

|---|---|

| Platform Type | Decentralized liquidity pool platform |

| Technology | Built on the Base network |

| Transaction Fees | Low fees for liquidity provision |

| KYC Requirements | No KYC required for participation |

| Use Cases | High APY yield farming, liquidity provision, and token rewards |

| Governance | Community-driven through decentralized mechanisms |

| Security | Smart contract-based with cryptographic data integrity |

| Supported Assets | wETH, AIXBT, and other Base network tokens |

2. PancakeSwap

PancakeSwap is still a giant among yield farms on the Binance Smart Chain (BSC) and its CAKE-BNB is consistently considered one of the most profitable.

With APYs that fluctuate between 50% and 150%, this pool takes advantage of the BSC’s low transaction fees and high liquidity, which incentivizes cost-efficient farmers.

The CAKE token rewards further improve the returns, and the volatility of the pool creates opportunities for astute liquidity providers.

Whereas Aave provides stable lending-focused returns, PancakeSwap is known for providing aggressive raw yields, making it a go to for more risk prone farmers in 2025. Its ease of use and reliability solidify its status as a prominent yield-masher.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange and Yield Farming Platform |

| Technology | Built on Binance Smart Chain (BSC) |

| Transaction Fees | Low fees for swaps and liquidity provision |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, staking, liquidity provision, and token swaps |

| Governance | Community-driven through CAKE token holders |

| Security | Audited smart contracts and multi-layered security protocols |

| Supported Assets | CAKE, BNB, stablecoins, and other BSC tokens |

3. Uniswap V3

Uniswap V3 is the ethereum-based DEX gold standard and it cements its place as one of the most profitable yield farms for its ETH/USDT pool with active management earning around 20% to 80% APY.

Concentrated liquidity lets farmers earn even more from high volume trading pairs while on other platforms their earnings tend to be lower.

Even though gas fees on Ethereum can significantly reduce profits, Layer 2 integrations like Arbitrum lower overall expenses, improving net returns.

Relatively to Aaves safer lending yields, dynamism, trader friendly options like Uniswap guarantee their position among market activity makes them thrive, ensuring they stay relevant in 2025.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange and Yield Farming Platform |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on liquidity pool and trading volume |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, liquidity provision, and token swaps |

| Governance | Community-driven through UNI token holders |

| Security | Audited smart contracts and cryptographic data integrity |

| Supported Assets | ETH, stablecoins, and ERC-20 tokens |

4. Aave

Without a doubt, Aave is one of the most profitable yield farms at the moment, especially with its stablecoin lending pools offering decent yields of 5% to 30% APY, while more volatile asset pools exceed 50%.

Aave operates on multiple chains like Ethereum, Polygon, and Avalanche. Aave’s strengths are its massive TVL (more than $15 billion in Q1 2025) and low-risk options like USDC or DAI lending.

Unlike speculative farms such as Aerodrome, Aave focuses on stability, which makes it a good fit for conservative investors who prefer constant yields.

Its flexibility in allowing users to lend, borrow, or use leverage, and protocol-created yield guarantees, makes Aave one of the central pillars of successful DeFi strategies in 2025.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Lending and Borrowing Protocol |

| Technology | Built on Ethereum and Polygon blockchains |

| Transaction Fees | Variable fees based on network usage |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, liquidity provision, and earning interest on deposits |

| Governance | Community-driven through AAVE token holders |

| Security | Audited smart contracts and robust risk management protocols |

| Supported Assets | ETH, stablecoins, and a wide range of ERC-20 tokens |

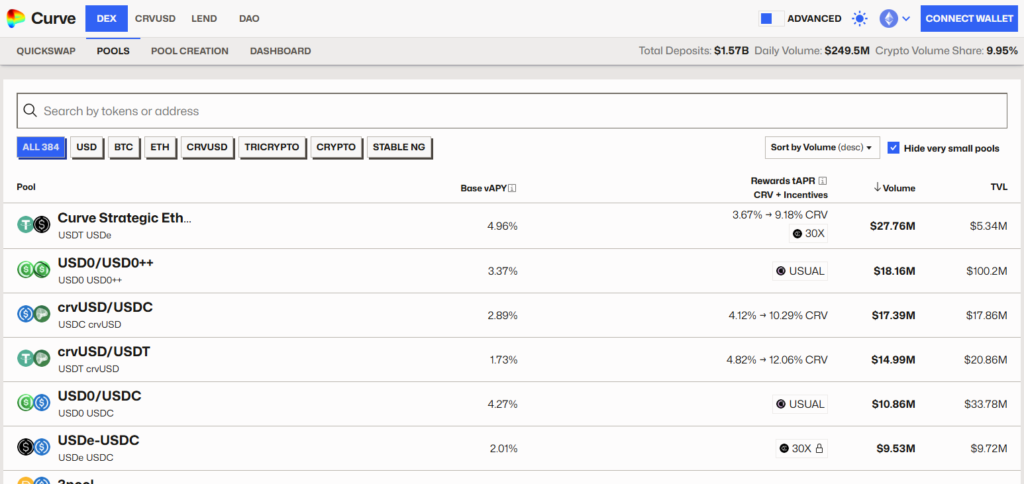

5. Curve Finance

As a premium yield farm, Curve Finance offers APYs ranging from a remarkable 5% to 25% base on its 3pool (USDT/USDC/DAI), and over 50% when enhanced with CRV staking.

Curve has mastered the art of stablecoin swaps which, in minimizing impermanent loss, makes it a safer bet than volatile pools like PancakeSwap’s CAKE-BNB.

The depth of liquidity and efficiency of Curve attract both institutional and retail farmers. Also, integrations with layer twos further reduce costs.

Unlike the lending focus, Curve captures value through a niche in stablecoin trading, reducing risk and maintaining profitability in the current DeFi landscape.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange and Liquidity Pool Platform |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Low fees optimized for stablecoin trading |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, stablecoin swaps, and liquidity provision |

| Governance | Community-driven through CRV token holders |

| Security | Audited smart contracts and cryptographic data integrity |

| Supported Assets | Stablecoins (USDC, DAI, USDT) and wrapped assets (wBTC, wETH) |

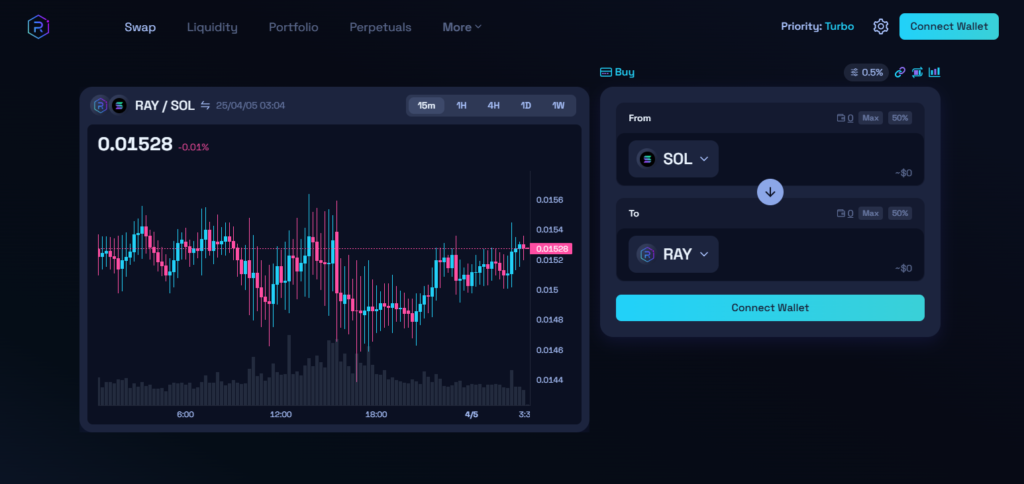

6. Raydium

Raydium is a DEX based on Solana and is one of the most profitable yield farms with its RAY/SOL pool. It is backed by APYs that range from 30% to 120%.

The anticipated growth of Solana’s ecosystem in 2025, coupled with its rapid and low-cost transactions, contributes to trading volume.

An added bonus is the extra yield from RAY token rewards, lending appeal to farmers looking to profit from Solana’s expected momentum.

While Aave provides more stability, Raydium caters to the more aggressive traders, allowing them to leverage the volatility of the multi-chain yield farming market.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Exchange and Automated Market Maker (AMM) |

| Technology | Built on Solana blockchain |

| Transaction Fees | Extremely low fees due to Solana’s high-speed network |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, liquidity provision, and token swaps |

| Governance | Community-driven through RAY token holders |

| Security | Audited smart contracts and cryptographic data integrity |

| Supported Assets | RAY, SOL, USDC, and other Solana-based tokens |

7. Yearn Finance

Yearn Finance ranked as one of the best yield farms because of its vaults that yield 40% APY for stablecoins, and 50%+ for risker assets such as ETH.

It automates profitability through cross protocol strategizing, simplifying farming while targeting the best opportunities.

It is streamlined Aave with better upsides Innovations allow its vaults, such as yvUSDC or yvETH, to maintain returns regardless of market conditions.

The combination of automation and high yields maintained Yearn in the top three choices for farmers seeking stable profits through out 2025.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Yield Optimization Protocol |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on network usage |

| KYC Requirements | No KYC required for participation |

| Use Cases | Automated yield farming, vault strategies, and stablecoin aggregation |

| Governance | Community-driven through YFI token holders |

| Security | Audited smart contracts and robust risk management protocols |

| Supported Assets | ETH, stablecoins, and a wide range of ERC-20 tokens |

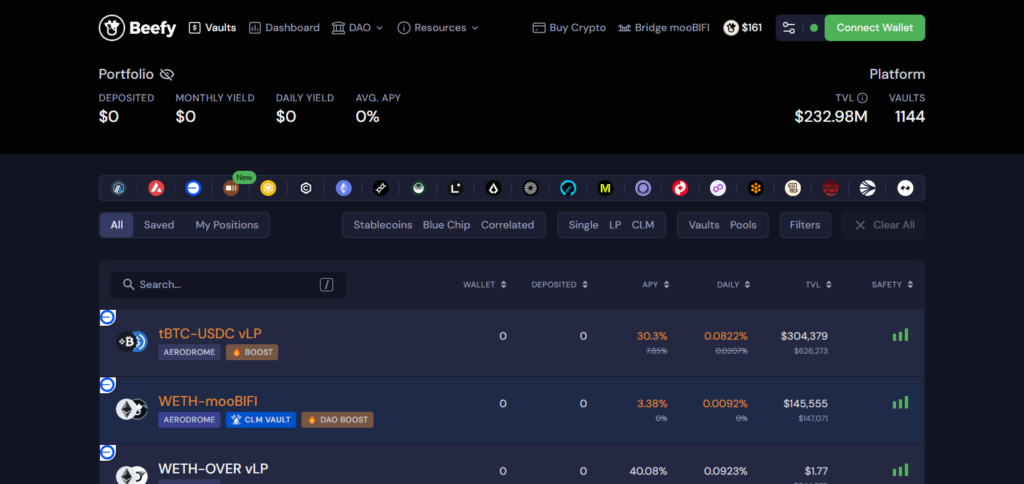

8. Beefy Finance

On the chains that Beefy Finance manages, it amplifies yields and currently boasts the most profitable APYs of 30% – 100% with the Sonic $S/USDC strategy on Solana.

Concentrated liquidity is the backbone of profit in Sonic, a Solana DEX, which is further amplified through Beefy’s automation and compounding.

The strategy surpasses Aave’s stablecoin yield range, and the efficiency of Solana alongside $S token rewards enhances its appeal.

With the current state of the market, it’s a robust option for farmers looking to step away from Ethereum.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Yield Optimization Platform |

| Technology | Multi-chain support across Binance Smart Chain, Ethereum, Polygon, and more |

| Transaction Fees | Low fees for auto-compounding strategies |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, staking, liquidity provision, and auto-compounding rewards |

| Governance | Community-driven through BIFI token holders |

| Security | Audited smart contracts and robust risk management protocols |

| Supported Assets | BIFI, stablecoins, and a wide range of tokens across supported chains |

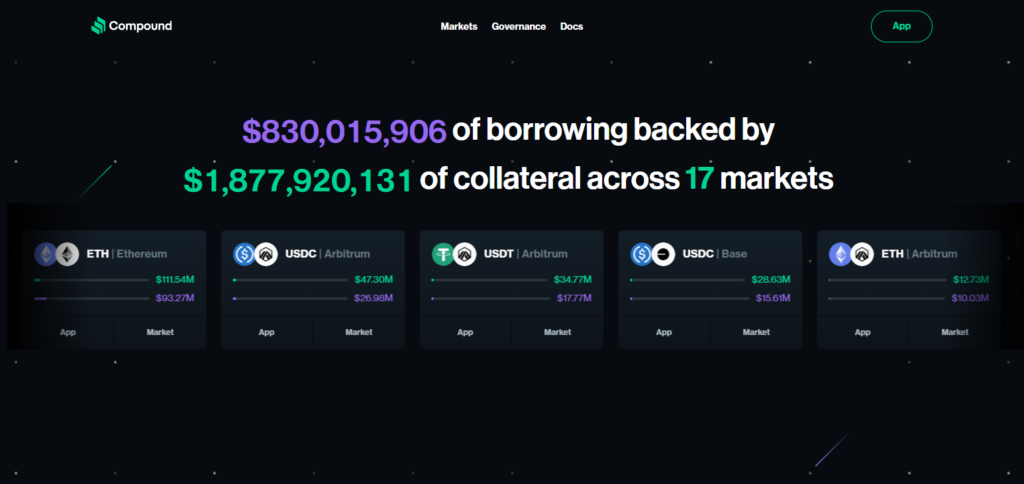

9. Compound

With an APY of 5% to 20% on stablecoin lending and over 30% in COMP rewards, Compound remains one of the most profitable yield farms.

Along with Aave, it thrives on reliability, with a TVL about to reflect Aave’s growth in 2025. Farmers can provide USDT and other assets, or borrow against collateral for leveraged gains, allowing flexibility.

Compared to the speculative highs of Aerodrome, Compounds offers lower but more consistent returns.

Its defended reputation makes it a cornerstone for conservative DeFi participants looking to lower their risk.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Lending and Borrowing Protocol |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on network usage |

| KYC Requirements | No KYC required for participation |

| Use Cases | Yield farming, earning interest on deposits, and liquidity provision |

| Governance | Community-driven through COMP token holders |

| Security | Audited smart contracts and robust risk management protocols |

| Supported Assets | ETH, stablecoins, and a wide range of ERC-20 tokens |

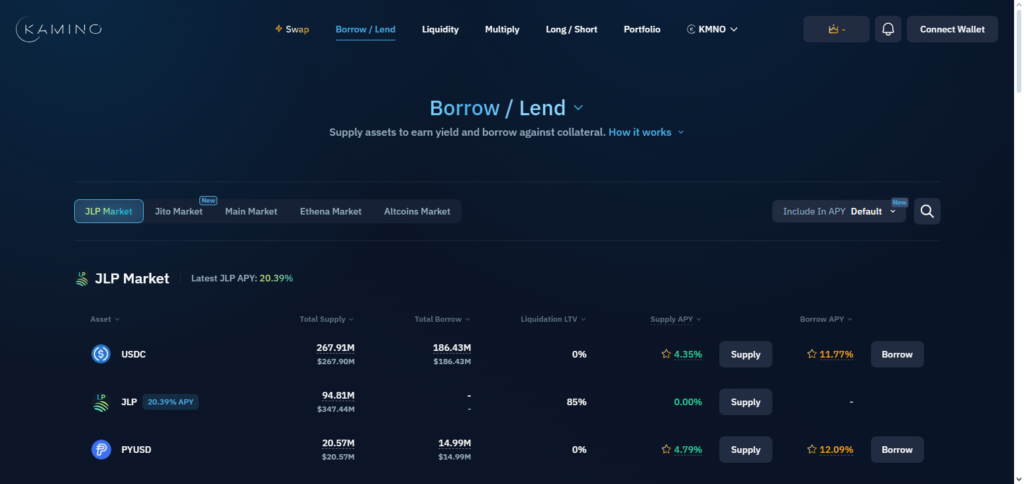

10. Kamino Finance

Known for its delta-neutral strategies, Kamino Finance uses stablecoins to yield 10% to 40% APY and rounds out the list as the top yield farm on Solana.

By hedging positions such as USDC/USDT pairs, Kamino reduces volatility risk and attracts farmers looking for Aave-like stability with a Solana twist.

Focus on automation and low fees augments net profits for Kamino making it more competitive in 2025.

While some deem it less flashy, its consistency finds low-risk returns that help defend its title as the most profitable farm for cautious investors today.

| Feature | Details |

|---|---|

| Platform Type | Decentralized Yield Farming and Lending Protocol |

| Technology | Built on Solana blockchain |

| Transaction Fees | Low fees for liquidity provision and leveraged farming |

| KYC Requirements | Minimal KYC required for accessing certain features |

| Use Cases | Yield farming, leveraged liquidity provision, and passive income strategies |

| Governance | Community-driven through decentralized mechanisms |

| Security | Audited smart contracts and cryptographic data integrity |

| Supported Assets | SOL, USDC, JitoSOL, and other Solana-based tokens |

Conclusion

To sum up, the yield farms that are currently most profitable seem to involve a mixture of high yielding systems as well as reliable returns on investment over time from Aave, Yearn Finance, Compound, Uniswap, Aerodrome, Beefy, Kamino Finance, SushiSwap, and Raydium.

Newer platforms, such as Aerodrome and Beefy, do have very high APYs, but these often come with higher risks. On the other hand, older protocols like Aave and Compound pay outon more stable, balaned cashflow with lower returns.

For yield farmers, the ideal choice is almost always one that provides the the optimal amount of risk and reward. One way to maximize profits while also minimizing exposure is by staying informed, using multi-faceted approaches, and keeping an eye on market conditions in the highly fluid DeFi environment.