Reasons Why Traders Prefer Delta Exchange for Crypto Derivatives

Over the past few years, crypto traders who are looking to hedge risk, multiply gains, or execute complex market strategies have increasingly come to use crypto derivatives as their weapon of choice. Just like traders do in traditional finance markets.

India is currently witnessing a surge in crypto adoption – especially in futures and options trading. This has led to a rising need for a crypto derivatives trading platform that is reliable, feature-rich, and also compliant with regulations. One star that perhaps shines the brightest here is Delta Exchange.

Delta Exchange has strongly positioned itself as the go-to platform for crypto derivatives trading, for both seasoned professionals and retail investors. Here are the key reasons why an increasingly large number of crypto traders, both in India and abroad, are choosing Delta Exchange to navigate the fast-paced world of digital assets.

- A Comprehensive Suite of Derivatives Products

Delta Exchange has one of the most diverse and sophisticated selections of crypto derivatives in the market. Crypto traders can choose between perpetual swaps and options with a wide variety of tokens, including Bitcoin (BTC), Ethereum (ETH), and several emerging altcoins.

With this range, Delta empowers traders to execute a variety of strategies – from straightforward hedging and directional plays to more advanced volatility or leverage-based tactics, all within a single, intuitive platform.

- INR-Centric Trading for Indian Users

Delta Exchange is also one of the best crypto derivatives trading platforms for Indian traders – it offers a localized experience with INR as the primary currency for deposits and trading.

This eliminates the tedious conversions to USDT or other stablecoins – the trading process is made effortless and transaction costs are reduced.

Indian traders benefit from simplified onboarding and the ability to track profits and losses in a familiar denomination.

- Institutional-Grade Liquidity and Execution

Liquidity is key for any offering aiming to be one of the best platforms for trading futures. Delta Exchange delivers on this front with tight bid-ask spreads and deep order books across major trading pairs.

This ensures minimal slippage even during high volatility, making it well-suited for institutional traders, high-frequency trading (HFT) firms, and retail users as well.

The experience delivered is decidedly professional-grade with its solid infrastructure and fast execution of orders.

- Advanced Trading Tools and Intuitive UI

Source | Crypto trader investing in crypto derivatives.

Delta Exchange will find favor with crypto traders with various degrees of experience – from novice to seasoned. The platform offers:

- A clean and customizable interface

- Advanced charting tools and built-in analytics providing technical and fundamental insights

- Sophisticated risk management tools – stop-loss, trailing stop, and take-profit orders – protecting capital during turbulence

- Strategy builder tools that users can experiment with and implement multi-leg options strategies with ease (missing in most exchanges)

For mobile trading, download the Delta Exchange app on Google Play or the App Store.

- Risk-Free Demo Trading Mode

One of the best features of this crypto derivatives trading platform is its demo trading mode – allowing crypto traders to use virtual funds to test out new strategies.

Being able to practice without any real risks allows users to gain confidence, fine-tune strategies, and familiarize themselves with all the features of the platform before committing actual capital.

Access the demo mode by clicking here.

- Strong Regulatory Alignment and Security Standards

Delta Exchange is one of the select few crypto derivatives trading platform in India that can boast of regulatory clarity – it is registered with the Financial Intelligence Unit (FIU) of India. This gives it excellent credibility and the trust of its users.

Delta Exchange also offers excellent security to protect user data and funds – two-factor authentication (2FA), cold wallet storage, and end-to-end encryption.

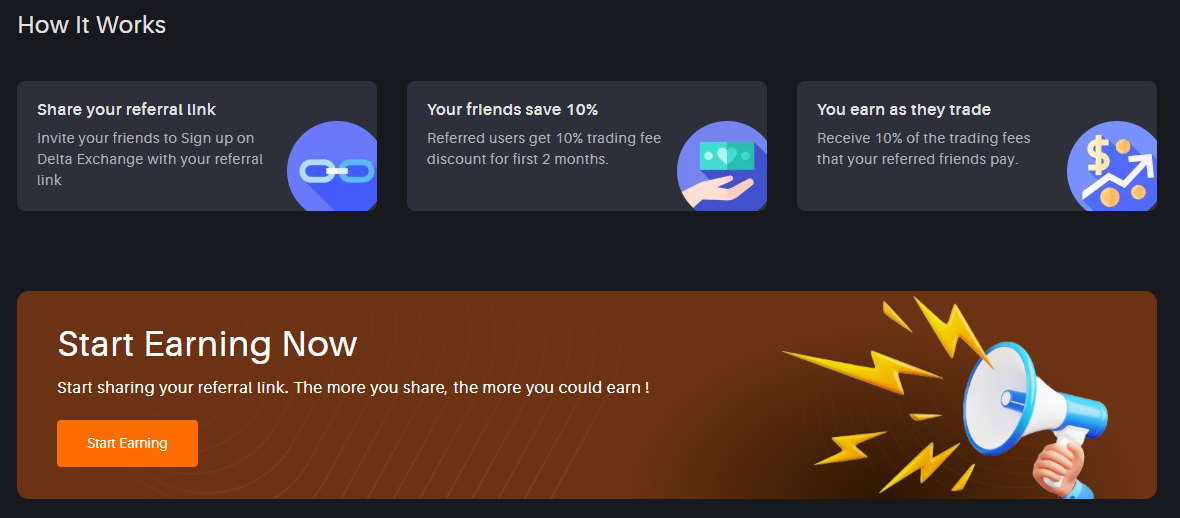

- Competitive Fees and Rewarding Ecosystem

Source | The Delta Exchange referral program.

Trading fees are notorious for eating into the profits of crypto traders, especially high-volume traders. The Delta Exchange crypto derivatives trading platform has a competitive fee structure that encourages active participation while reducing overhead.

Additionally, the platform rewards user engagement with incentives for both retail and institutional users – trading competitions, referral programs, promotional campaigns, etc.

Conclusion

As India steadily makes its presence increasingly felt in the global crypto economy, crypto exchange like Delta Exchange are helping redefine the way crypto traders interact with digital assets.

This crypto derivatives trading platform has earned the trust of its users with its robust product lineup, INR-first approach, institutional-grade infrastructure, and a highly commendable focus on compliance and user security.

For crypto traders seeking a seamless, powerful, and regulation-aligned crypto derivatives trading platform, Delta Exchange continues to be a top choice – not just in India, but globally.

Disclaimer: Cryptocurrency trading involves a high degree of risk and may not be suitable for all investors. Prices are very volatile and subject to market risks. Readers are advised to carry out their own research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in compliance with applicable Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.

FAQs

Does Delta Exchange offer options trading?

Yes, Delta Exchange does have options trading. Traders can buy/sell options contracts on cryptocurrencies like Bitcoin and Ethereum to hedge risk or speculate on price movements, similar to traditional financial markets.

What is the tax on crypto F&O trading in India?

As of May 2025, profits from crypto trading in India will be subject to a flat 30% tax under the Income Tax Act. Also, there is a 1% TDS on crypto transactions in excess of ₹50,000.

How risky are crypto options?

Crypto options are high-risk financial instruments. They can lead to massive gains or losses due to market volatility, leverage, and the complexity of options strategies, making them best suited for experienced traders.