This article will discuss Venus Crypto – the DeFi platform that is changing the world of lending and borrowing through the use of the Binance Smart Chain.

With the advantage of having quick and cheap transactions, synthetic stablecoins, and community driven governance through the XVS token, Venus Crypto is a unique one amongst its fellow competitors.

Let’s take a look at its major features, benefits, and future impact on the DeFi space.

What Is Venus?

Venus is an algorithmic money market and synthetic stablecoin protocol launched exclusively on Binance Smart Chain (BSC).

The protocol introduces a simple-to-use crypto asset lending and borrowing solution to the decentralized finance (DeFi) ecosystem, enabling users to directly borrow against collateral at high speed while losing less to transaction fees. In addition, Venus allows users to mint VAI stablecoins on-demand within seconds by posting at least 200% collateral to the Venus smart contract.

VAI tokens are synthetic BEP-20 token assets that are pegged to the value of one U.S. dollar (USD), whereas XVS tokens are also BEP-20-based, but are instead used for governance of the Venus protocol, and can be used to vote on adjustments—including adding new collateral types, changing parameters and organizing product improvements.

| Metric | Value |

|---|---|

| Price | $7.77 |

| Market Cap | $128.17M |

| Volume (24h) | $4.63M |

| Fully Diluted Value (FDV) | $232.95M |

| Vol/Mkt Cap (24h) | 3.68% |

| Total Value Locked (TVL) | $1.88B |

| Market Cap/TVL | 0.06772 |

| Total Supply | 30M XVS |

| Max Supply | — |

| Circulating Supply | 16.5M XVS |

Venus Price Live Data

Venus Prime rewards loyalty with superior rewards

With Venus Prime, dedicated users obtain boosted rewards when they lend and borrow on Venus while staking in the governance vault.

Challenge our code and be rewarded

We encourage all to challenge code and search for vulnerabilities. Read about our bug bounty rewards, and please submit any bug you identify.

Protection prioritized

Maintaining a fallback pool to keep us all safe in the case of outlier events.

Safety Before all

Transact with confidence, knowing Venus places nothing before the security of your assets

Decentralized

Access an immutable money market directly on-chain.

BEP-20/ERC-20

All Venus Protocol assets are bound by the BEP-20 and ERC-20 standards.

Omnichain

Built on EVM-compatible chains for fast, secure, and low cost transactions.

Tokenomics

The Venus Protocol tokenomics have been reevaluated to optimize income distribution and cater to the protocol’s present and future needs. Version 4.0 of the Venus Protocol revenue distribution model addresses the need and optimizes the allocation between rewards and treasury reserves.

XVS Vault Base Rewards

The XVS Staking Vault is an integral component of the Venus ecosystem. It enables governance voting participation and is a prerequisite for Venus Prime eligibility. To incentivize XVS staking, additional rewards will be offered in the form of Base Rewards (previously referred to as Legacy Rewards).

These rewards will be transferred every six months from the XVS Distributor to the XVS Vault Store, where they will be emitted at a rate of 441 XVS per day.

Revenue Distribution from Protocol Reserves

Protocol reserves are mainly composed of accumulated borrow fees. The model for revenue allocation from these reserves divides income into three main segments:

- Treasury Reserve (60%): The treasury reserve is used to fund community-driven initiatives and essential protocol expenses for its ongoing operations.

- XVS Vault Rewards (20%): This allocation is designated for the buyback of XVS, which is then distributed via vault rewards.

- Venus Prime Token Program (20%): Used to boost select market APYs with organic rewards for users that qualify.

Allocation for Additional Revenue Streams

Other revenue streams include liquidation penalties and potential income generated from future product releases. The revenue distribution for these streams is as follows:

- Treasury Reserves (80%)

- XVS Vault Rewards (20%)

The methodology behind these adjustments includes an assessment of the existing tokenomics, past changes, their impact on the ecosystem, and analysis of market dynamics and trends.

Who Are the Founders of Venus (XVS)?

The development of the Venus project is being undertaken by the Swipe project team. The main goal of Venus is to achieve decentralization through community-governance. There are no pre-mines for the team, developers or founders, giving XVS holders total control over the path the Venus Protocol takes.

Venus Features

Decentralised Lending

Venus permits users to lend and borrow different types of cryptocurrencies in a decentralised environment via smart contracts that serve as a means of transparency and efficiency.

XVS Token Utility

Using the XVS token, holders are allowed to partake in governance and staking that both earn rewards and make decisions on the protocol.

Revenue Distribution

Venus employs a systematic revenue distribution model where some aspects of the revenue are dedicated to community projects, expenses of the protocol, and rewarding stakers.

High-Speed Transactions

As a product of Binc, Venus has fast and low cost transactions which are more efficient for the users.

Synthetic Stablecoins

Users can create their desired amount of stablecoin VAI after offering collateral which serves as a self-regulated crypto asset during market turbulence.

Community Governance

The protocol is managed by the holders of XVS tokens ensuring there is no single entity to dominate the decision-making process with no unspent founder tokens.

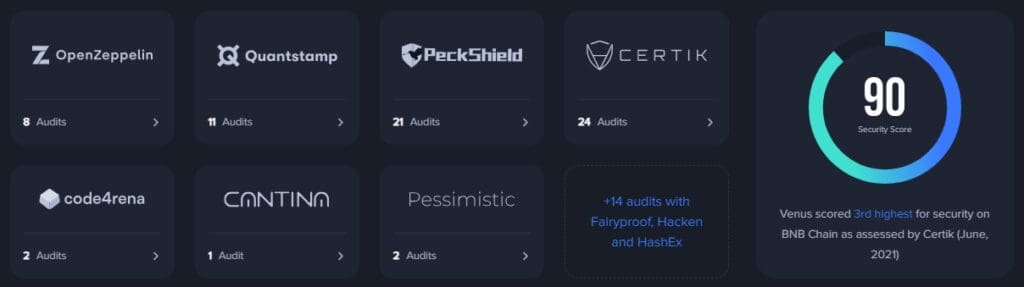

Security

Venus focuses on security by conducting multiple audits and maintaining a high security score on the Binc Smart Chain.

Where Can You Buy Venus (XVS)?

As of November 2020, Venus is available to trade on a single exchange platform: Binance. It is listed against Tether (USDT), Bitcoin (BTC), Binance Coin (BNB) and Binance USD (BUSD). There are currently no direct fiat on-ramps to purchase Venus. To buy Bitcoin and other cryptocurrencies with your credit or debit card.

Venus Crypto Alternatives

Aave: It gives users the opportunity to borrow and lend funds at fixed or floating interest rates, thus creating more financial opportunities.

Compound: A lending platform, which enables the borrowing and lending of listed tokens including DAI, ETH, and WBTC with ease.

Silo Finance: It builds permissionless and risk – isolated lending markets for better safeguarding and control.

Cream Finance: Token holders have the ability to stake their tokens and borrow against it rather instantly, attaining liquidity and yield simultaneously.

Conclusion

To summarize, Venus stands out as one of the top decentralized finance (DeFi) platforms within the cryptocurrency ecosystem with an exceptionally built infrastructure for lending, borrowing, and minting stablecoins.

It offers user-friendly services, swift transactions on the Binance Smart Chain, and XVS token facilitates community governance, bringing security and efficiency to digital asset management.

With the introduction of synthetic stablecoins along with revenue distribution, there is more to DeFi making it more useful and popular these days, which helps bolster its adoption. Venus does continue to grow and develop, this is particularly valuable for users wanting financial solutions in a decentralized world.