While assessing prop trading firms, flexibility, funding, and assistance usually top a trader’s criteria list. In this context, FundingPips appeals to traders more than FundedNext does, mainly thanks to its unlimited evaluation periods, lower entry fees, and a community that caters to its traders.

FundingPips permits growth without anxiety through flexible trading rules, clear policies, and educational materials and resources. FundingPips is often a more rational choice for traders that appreciate a well-balanced blend of community support and future development opportunities.

What Is FundingPips?

FundingPipS is a new cutting-edge funding source that connects investors and lenders to small businesses and Startups. With automated collections and machine learning predictive models that assess and match the business profiles presented by the entrepreneur to the relevant type funding, businesses can fundraise in record time and with minimal effort.

Growing businesses can raise equity, debt and revenue-based finance. Businesses spend little effort, time and cost to build partnerships with the investors that match their profile, to support business growth making it a smart and powerful tool for the business financing needs.

What is FundedNext?

FundedNext offers traders capital for proprietary trading. After evaluation challenges, skilled traders gain access to large funded accounts. After evaluation challenges, fundedNext provides cutting-edge trading instruments, real-time analytics, and competitive profit-sharing options to help traders enhance their performance. It provides supports for MetaTrader 4 and 5.

Supported trading instruments provides traders worldwide with the opportunity to profit consistently and safely. It reduces the risk of trading and provides funded accounts to traders. It is flexible and transparent. FundedNext is rewarding trading for traders worldwide.

Here’s a clear and structured comparison table between Funding Pips and FundedNext based on the provided data:

| Feature | Funding Pips | FundedNext |

|---|---|---|

| Company Age | Established in 2022, relatively new | Established in 2022, globally active |

| Evaluation Models | Offers 1-step, 2-step, and 3-step programs | Provides 2-step and Express models |

| Profit Split | Up to 90% | Up to 95%, including during evaluation |

| Funding Limit | Up to $2,000,000 | Initial $200,000, scalable to $4 million |

| Payout Frequency | On-demand, bi-weekly | Bi-weekly |

| Trading Flexibility | Stricter rules and restrictions | More lenient, with diverse strategies |

| Platforms | Match-Trader, cTrader, TradeLocker | MT4, MT5 |

| Global Reach | Focus on UAE and select regions | Operations in 195+ countries |

| Reputation | Building reputation, some reported issues | Strong global presence and reliability |

Why is FundingPips Prop firm better Than FundedNext

FundingPips’ prop firm is regarded as superior to FundedNext due to its unlimited evaluation time, lower entry costs, and more accommodating trading circumstances. FundedNext has rigid evaluation phases, while FundingPips has designed a stress-free process centered around trader development and consistency.

Traders enjoy a caring and balanced trading environment, with generous and well-spelled instructions, limited and predictable governance, and educational materials complemented with a thriving community.

The combination of reasonable costs, adaptable systems, and features centered around the trader make it an optimal selection for prolonged trading success.

In-Depth Comparison: Funding Pips vs FundedNext

Evaluation Procedure

Funding Pips: Provides three flexible options. The One-Step allows traders to attain profit targets without going over drawdown limits. The Two-Step adds a second phase with distinct goals and limits, and the Three-Step focuses on consistency and disciplined risk control over longer periods.

FundedNext: Has a Two-Phase Evaluation Model which requires traders to attain a total of 10% in Phase 1 and 5% in Phase 2 with tightly controlled drawdown limits, and an Express Model which skips evaluation and gives instant funding to eligible traders.

Key Difference: The flexibility in evaluation frameworks offered in Utility Pips. FundedNext, on the other hand, combines a standard two-step model with an express option to get real trading as soon as possible.

Different Account Sizes and Funding

Funding Pips: Gives traders up to $2,000,000 in funding based on the evaluations, which assists in large capital especially to professionals and is one of the largest in the industry.

FundedNext: Does initially start with up to $200,000 in funding but allows escalation as the trader is consistent all the way up to $4 million.

Key Difference: Funding Pips gives larger amounts in the beginning, while FundedNext is based on the traders performance to scale over time.

Profit Splits

Funding Pips: Values trader satisfaction highly, resulting in 80%–90% profit splits, so that traders keep most of their earnings after moving past their evaluation.

FundedNext: Provides up to 95% profit splits, along with a 15% payout right during the evaluation phase of the funding, which is a unique feature in the industry.

Key Difference: FundedNext has the unique advantage of highest payout and compensates traders during the evaluation phase, whereas Funding Pips rewards post-evaluation exceptionally well.

Payouts

Funding Pips: Grants on-demand payouts right after the trader completes their very first live trade. No other arrangement ,minimum balance, or waiting period is required. Other withdrawals are possible every two weeks.

FundedNext: Provides bi-weekly payouts, starting with first available payout 14 days after trading begins, which is a comparatively fast processing time.

Key Difference: Funding Pips is very flexible with instant withdrawal requests, while FundedNext offers a consistent bi-weekly cycle with a quick turnaround.

Trading Rules and Restrictions

Funding Pips: Enforces risk controls so traders don’t generate profits from any trades that are closed in the 10 minutes right before or after high-impact news, unless it was opened 5 hours earlier. Hedging, latency arbitrage, and certain algorithmic trading strategies are also restricted. Those accounts have a 10-lot daily cap.

FundedNext: Allows flexible news trading, swing, scalping, and EA-based strategies across most accounts, which is the opposite of the Express model, which has consistency rules.

Key Difference: FundedNext offers more trading flexibility while Funding Pips places a higher focus on managing risk, especially during major news events.

Trading Platforms and Instruments

Funding Pips: Works with Match Trader, cTrader, and Trade Locker and offers access to trading forex, indices, commodities, and cryptocurrencies.

FundedNext: Works with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) and offers a similar range of trading forex, indices, and crypto commodities alongside crypto assets.

Key Difference: Both firms provide diversified access, to various markets. Funding Pips offers modern alternative platforms, whereas FundedNext depends on the trusted MetaTrader platform.

Scaling Opportunities

Funding Pips: Offers scaling programs to recognize traders for consistent profitable positions with measured account growth.

FundedNext: Allows consistent profitable traders to scale up to $4 million, with undisclosed scaling parameters.

Key Difference: Both provide growth potential; Funding Pips has structured scaling and stability, whereas FundedNext offers a higher funding limit on potential upward scaling.

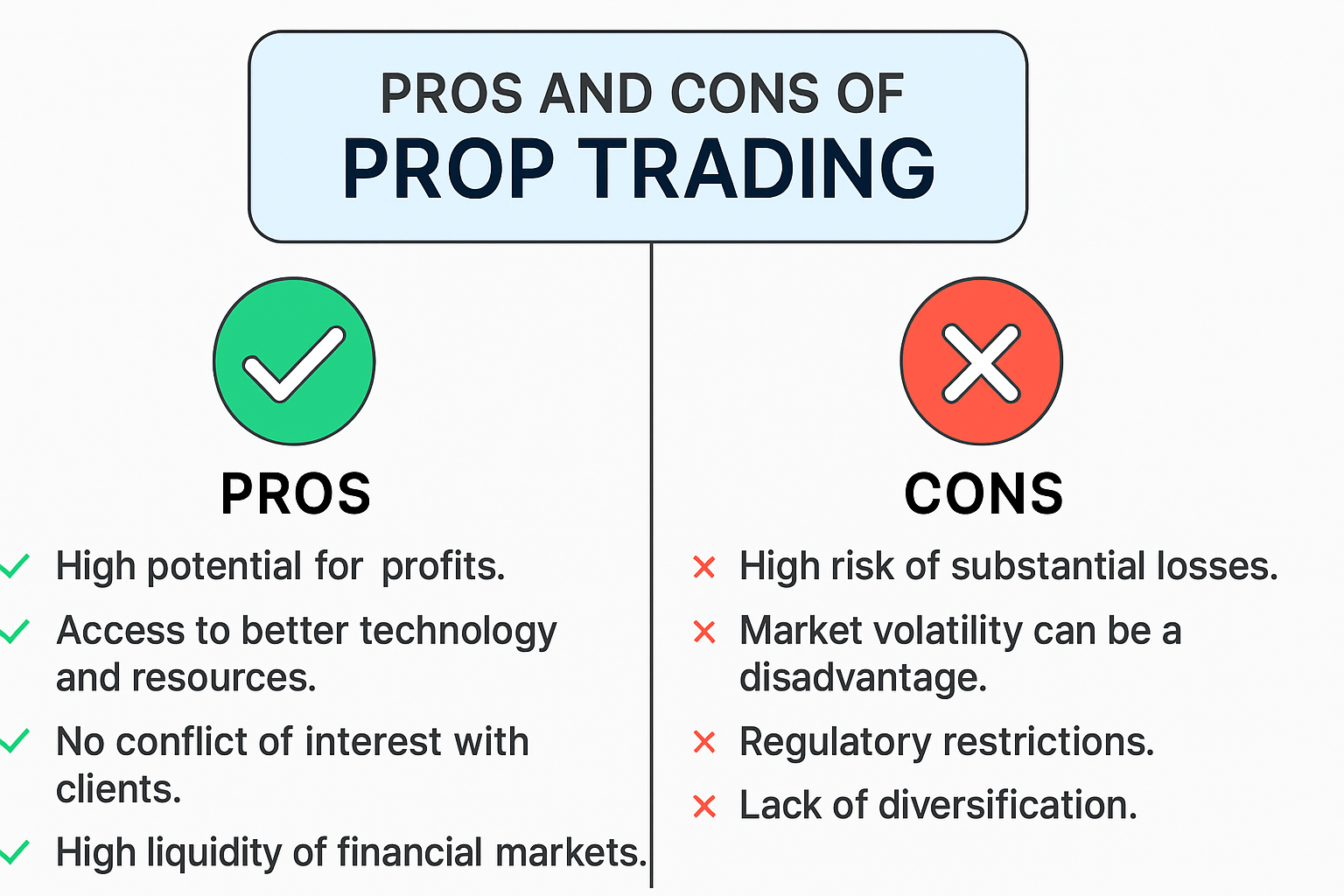

Benefits of Funding Pips

Unlimited Time for Evaluation

Traders can evaluate without the pressure of time constraints, allowing for a more relaxed, disciplined, and measured approach.

Affordable Entry Point

Funding Pips has one of the lowest, if not the lowest, entry fees in the prop trading industry, which is fantastic for beginners and those with limited budgets.

Supportive Community and Tools

Discord group, educational materials, and sophisticated compliance tools in the dashboard enhance traders’ strategy formulation while helping them remain compliant.

Trading Flexibility

News trading and weekend holds are permitted for select programs, allowing traders greater freedom in executing their strategies.

Transparent Rules

Trust is ensured by unambiguous and equitable regulations governing drawdowns, risk management, and position sizing.

Benefits of FundedNext

High Profit Splits

Traders can retain up to 95%, which rewards top traders and profit-sharing immensely.

Multiple Account Models

Models which vary by trader experience include instant funding and other customizable frameworks.

Fast Payouts

Universally praised for fast and seamless payouts, allowing traders access to their profits immediately.

CFD and Futures Trading.

Traders can trade both CFD and futures, giving them the ability to trade a variety of CFDs and futures.

Conclusion

Trading preferences determine whether Funding Pips or FundedNext is more suitable. One can appreciate flexibility in growth support, which is why Funding Pips is perfect for traders who tend to first.

Those who prefer stability in growth, especially with revenue, will surely be impressed by FundedNext’s reputation, account scalability, and quick withdrawals. Think about your trading style and determine your goals and risk exposure before selecting the appropriate prop firm.

FAQ

What are the key differences between FundingPips and FundedNext?

FundingPips offers a unique 1-step evaluation process with up to 100% profit splits and bi-weekly payouts. Traders appreciate its low spreads and fast execution.

Which firm has more favorable trading conditions?

FundingPips is known for its low spreads and fast execution, making it attractive for traders seeking optimal trading conditions. FundedNext offers competitive spreads and high leverage, appealing to traders looking for flexibility.

Which firm is better overall?

The choice between FundingPips and FundedNext depends on individual trading preferences. FundingPips offers a streamlined evaluation process and favorable trading conditions, while FundedNext provides a structured evaluation with larger account sizes. Traders should consider their specific needs and trading styles when choosing a prop firm.