In this article, I will discuss the How to Stake Terra Stablecoins: A Step-by-Step Guide this is one of the most popular methods of earning passive income by holding stable crypto assets.

By the end of this article, you will know how staking works, the benefits it offers, its risks, and what platforms are best to maximize your returns. As a DeFi enthusiast or a crypto investor, this guide will enable you to stake Terra stablecoins conveniently and securely.

What are stablecoins?

Stablecoins are cryptocurrencies that are pegged to a reserve asset, such as a fiat currency USD or a commodity like gold, to help them maintain a constant value.

Unlike cryptocurrencies, stablecoins do not suffer from extreme changes in price, making them ideal for payments, store of value (active that can provide future economic benefit), and remittances.

Examples of such stablecoins include USDT, USDC, and DAI have become well known by the public. In decentralized finance (DeFi), stablecoins help with trading, lending, and staking with less risk of market fluctuations. Stablecoins can be: collateralized by fiat currency, collateralized by cryptocurrency, and algorithmic.

How to Stake Terra Stablecoins

Example Staking: Using TerraUSD (UST) on Anchor Protocol

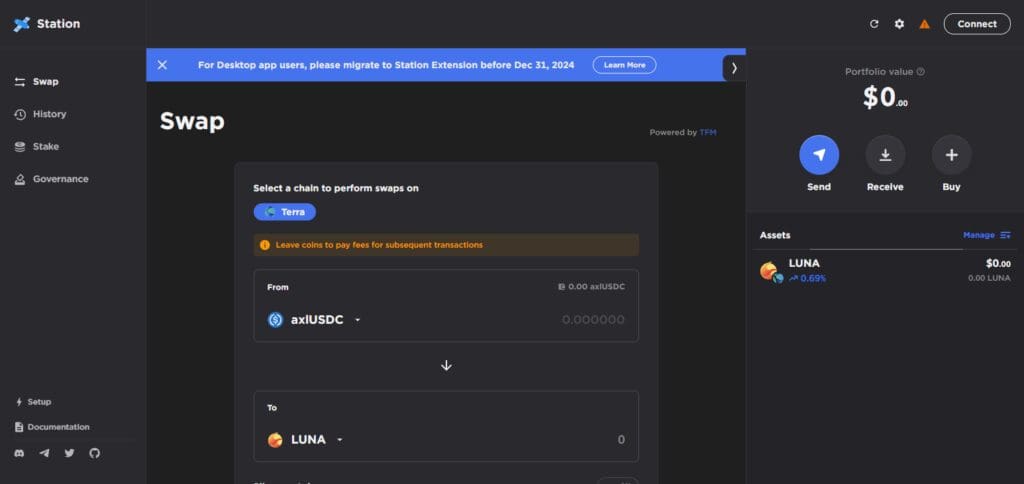

Setup your Station Wallet

Download and install the Terra Station wallet from the designated page

Create a wallet and store the generated seed phrase somewhere safe

Move TerraUSD (UST) tokens to your Terra Station wallet

Link to Anchor Protocol

Go to Anchor Protocol’s page and link your Terra Station wallet

Allow the link to permit transaction access

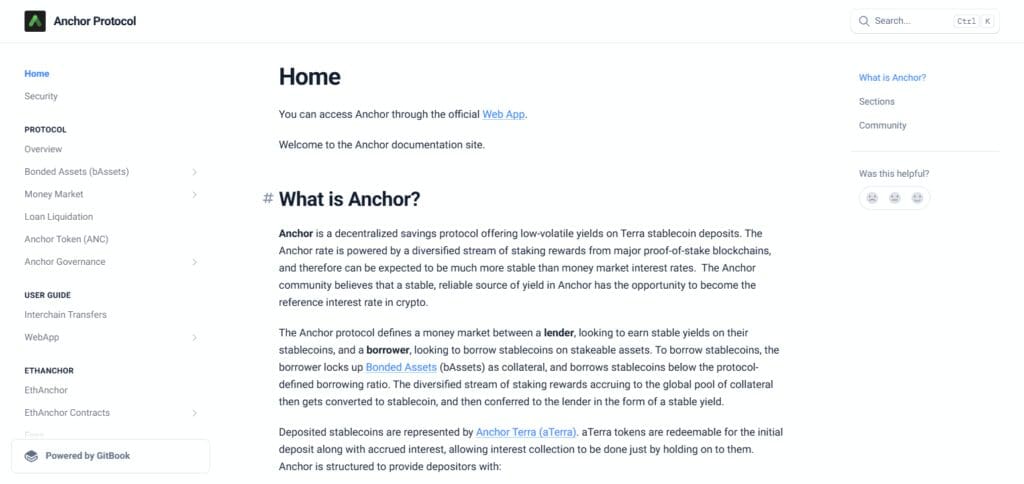

Staking Preparation: Deposit UST

In the Anchor Protocol dashboard, go to the “Earn” option

Define the UST amount you’d like to stake, then verify the action

Your set UST amount will be deposited and you will start earning rewards.

Keep Track and Reward Withdraw

You can check your rewards balance regularly on the Anchor Protocol dashboard.

Rewards can be withdrawn and UST can be unstaked anytime.

Other Place Where Stake Terra Stablecoins

Binance

Binance has a simple platform for staking Terra stablecoins, which enables users to earn passive income on investment.

Their competitive yield remains unmatched by many others. Its strong point is the friendly interface with flexible staking that can be used by both novice and seasoned investors.

Binance’s additional sponsored security features combined with zero-lock flexible stake makes funds available for withdrawal at anytime. For many, this is the select option for staking Terra stablecoins with lower liquidity risks.

Guarda Wallet

Guarda Wallet solution makes it easy to stake Terra stablecoins directly from the non-custodial multi-currency wallet which offers full control of private keys to users.

It’s built-in staking feature makes it possible for users to stake without the aid of third party platforms.

Other than instant reward monitoring, Guarda also provides flexible options for users who want to un-stake, which gives peace of mind to users who want security and convenience at the same time while earning passive income from their Terra stablecoin holdings.

Tips for Maximizing Staking Rewards

Pick Trusted Validators

Grow your staking yield as a validator by picking ones with a good track record, low commission rates, and high uptime.

Spread Staking

Stake your stablecoins with several validators to lessen risk exposure and improve reward reliability.

Reinvest Profits: Focus on reinvesting profit earned and benefits will multiply after some time.

Stay Updated on Terra News: Keep an eye on any new updates or governance proposals on the Terra network as well as how the validators are performing so you can choose appropriate staking strategies.

Lower Expenses: Select platforms with lower transaction and withdrawal fees so more of your money is profit in the end.

Risks and Considerations

Slashing: You can lose some of your staked assets because of the penalties (slashing) Terra network penalized validators for their misconduct.

Vulnerabilities of Smart Contracts: Your funds are left at risk because smart contracts, that staking platforms depend, have bugs or security issues.

Depegging Stablecoins: Due to market volatility, the value of assets can lower and your staking returns would be affected because Terra stablecoins could lose their peg.

Risks of Liquidity: Your assets are limited because withdrawing staked assets can have waiting times or fees.

Performance of Validators: You can be in a situation where you are exposed to higher risk and getting lower rewards due to poor performing validators.

Pros & Cons

Pros:

Predictable Earning: Get predictable returns that are more impressive than non-stable cryptocurrency staking.

Farming Returns: Making money by just holding paid stablecoins is impossible – unless you stake them.

Reduced Market Volatility: Stablecoins reduce exposure to variations in the financial market, due to stable value.

Accessing DeFi And Other Services: DeFi platforms allow for more flexible staking and often provide better interest rates.

Network Participation: Help the Terra blockchain achieve greater levels of security and stability.

Cons:

Risk of De Pegging: Stablecoins backed by Terra have a chance of losing their peg value.

Losable Funds due to Platform failure: Funds that are stored in a staking platform may get lost if some security concerns arise.

Validator Fraud Losses: Expenses that come from poorly performing validators are shared amongst all users which can create a negative balance.

Token Liquidity Restrictions: When a user stakes their stablecoins, they may be subject to a notorious “lockup period.”

Rewards on Stablecoin staking are lower: Using stablecoins for staking always come with lower yields than for volatile assets.

Conclusion

In summary, staking Terra stablecoins is an easy and low risk passive income stream that supports the Terra network.

The stable value and predictable returns make it ideal for DeFi enthusiasts. As with all investments, potential depegging, slashing, and liquidity risks must be considered.

Reliable validators can be selected and diversifying stakes will increase rewards. Without a doubt, staking Terra stablecoins is a suitable approach for stable, sustainable earnings in crypto.