In this article, I will discuss the How to Convert NFTs to Fiat. You will discover how to efficiently planned the selling of your NFTs, selected the best marketplaces, and securely changed your crypto profits to fiat currency.

This guide enables anyone, whether novice or seasoned seller, to effortlessly liquidate their digital assets into cash.

What is NFTs?

NFTs, or Non-Fungible Tokens, are one-of-a-kind digital assets recorded on a blockchain and can represent ownership of something as art, music, videos, or even virtual land. Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs cannot be exchanged for one another as each one contains different data.

They use blockchain technology to ascertain their authenticity and ownership which makes them useful in the digital collectibles market. Industries have adopted NFTs for non-fungible token innovation which has allowed creators to earn money for their content by changing how they used to present it.

How to Convert NFTs to Fiat

Let’s take a closer look at selling NFTs for Ethereum using MoonPay through Trust Wallet:

Example: Selling an NFT and Cashing Out To Fiat

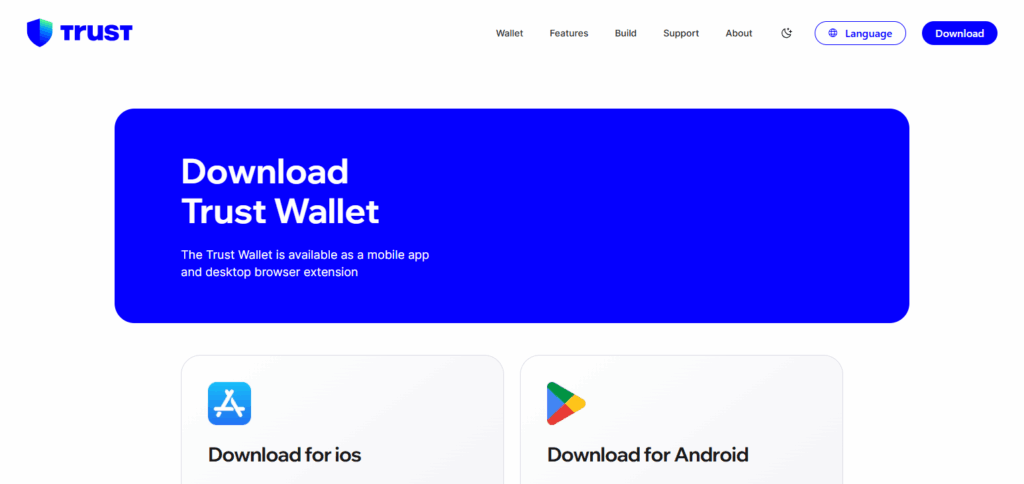

Step 1: Set Up Trust Wallet

- Download Trust Wallet and create a new wallet.

- Secure your recovery phrase to ensure access to your funds.

Step 2: Cash Out NFT To Crypto

- Link Trust Wallet to an NFT marketplace, for example, OpenSea.

- Put your NFT up for sale and price it in crypto (ETH, USDT, etc.).

- After the transaction, the crypto will be sent to your Trust Wallet.

Step 3: Cash Out Crypto to Fiat on MoonPay

- Go to Trust Wallet and open the MoonPay integration.

- Pick the crypto asset you obtained from the NFT transaction.

- Select the currency you wish to convert to (USD, EUR, INR, etc.)

- Verify the transaction details and execute the swap.

Step 4: Receive Fiat on Bank Account

- Select withdrawal method from MoonPay (bank transfer, PayPal, etc.)

- Input the amount you wish to withdraw and approve the transaction.

- Bank account will receive the withdrawal in fiat.

Other Place Where to Convert NFTs to Fiat

Rarible

Rarible is a marketplace where users can mint, buy, and sell NFTs. Unlike most NFT marketplaces, Rarible allows for direct payments in fiat currency due to its integration with MoonPay, making the conversion from crypto to fiat much simpler.

Rarible’s intuitive cross chain interface coupled with its multichain capabilities has streamlined the process of withdrawing digital assets.

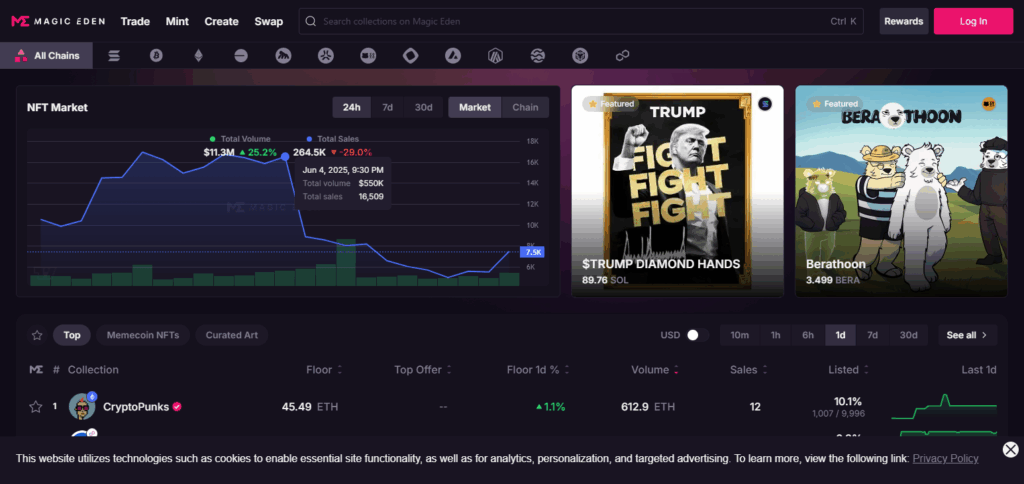

Magic Eden

Magic Eden holds its own as one of the top NFT market places and is widely known for operating within the Solana ecosystem. They have simplified the process of NFT-to-fiat The integrated payment options permit users to buy and sell NFTs using credit or debit payments.

Because of this, sellers can earn fiat directly without having to go through complex crypto swaps. Because of Magic Eden’s focus on ease and accessibility, they hold a preference for users aiming to efficiently convert NFT sales into traditional currency.

Coinbase

As a reputable workplace in the crypto industry, Coinbase serves as a significant gateway for users to turn their crypto and NFTs into fiat currency. They conveniently enable the transfer of cryptocurrency to ETFs and even provide support for the transfer of Ethereum. Users receive theirs in fiat, Coinbase offers USD, EUR and GBP.

Coinbase also differs in fulfilling regulations, having no issues with compliance, providing tutorials on the platform and letting their users withdraw funds to a bank account makes Coinbase stand out as having the fastest and easiest offline exchange.

Use NFT Marketplaces That Offer Direct Fiat Payout

Recently, some NFT marketplaces like Rarible, Nifty Gateway, and Zora allow users to convert NFTs to cash directly using credit cards or bank transfers. This lets users bypass the arduous task of going through crypto exchanges, making the process easier than ever.

These platforms work with payment processors to ensure that NFT creators are paid in real-world currency. With this direct NFT-to-fiat payment technique, users need to perform fewer conversions which is especially beneficial for those who are not tech-savvy.

Legal and Tax Considerations

Capital Gains Tax

A capital gains tax is applicable whenever an NFT is sold and a profit made in line with the selling price vis-à-vis the purchasing price.

Income Reporting

From the majority of the places globally, inclusively, all the NFTs are reported, meaning the money made on the NFT sells for deficit is considered income.

Record Keeping

For instances such as wallets, transactions, and exchange rates, a separate allocation of all information pertaining in payments should be maintained.

Regulations Vary By Country

Different jurisdictions have different regulations—It’s best to speak to a tax specialist for guidance about your jurisdiction.

Use Tax Software

Services for tax calculation related to NFTs are easily available at CoinTracker or TokenTax.

Tips for Safe and Efficient Conversion

Use Trusted Platforms: Only transact NFTs on exchanges or marketplaces that have a proven history of reliability and several security protocols.

Enable Two-Factor Authentication (2FA): Access to your wallets and accounts will be restricted to only you when 2FA is activated.

Verify Buyer Identity: Ensure that the user does not impersonate the real buyer to avoid scams during selling.

Be Aware of Fees: Familiarize yourself with the transaction and withdrawal fees associated with the platform to prevent dealing with hidden reductions.

Keep Transaction Records: For legal and tax examinations, keeping records of NFT sales and conversions along with the pays received is mandatory.

Risk & Considerations

Volatility

The expected earnings during conversion might be impacted because NFT prices can change drastically.

Con Artists

Always guarantee NFT transactions, as the presence of fake buyers or phishing links, as well as counterfeit NFTs, are large sources of risk.

Fee Structure

There are platforms that offer NFT sales or crypto-to-fiat conversion, but they charge high and obscure fees for their services.

Legislation Absence

Laws regarding NFTs are still being developed, and vague policies can pose potential risks concerning tax or legal matters.

Illiquid Market

Not all NFTs have steady demand; therefore, the time taken to convert to fiat currency can differ according to interest and demand in the market.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy access to real-world money | Market volatility can reduce profits |

| Direct fiat payout reduces extra steps | Potentially high platform and conversion fees |

| User-friendly platforms simplify the process | Risk of scams and fraudulent buyers |

| Enables broader adoption beyond crypto users | Legal and tax regulations can be complex |

| Secure transactions on reputable marketplaces | NFT liquidity can be low, delaying sales |

Conclusion

In summary the step of turning NFTs into fiat currency is now more convenient due to streamlined marketplaces and payment systems.

By comprehending how an NFT appraisal works, selecting a reputable marketplace, and executing safe payment withdrawal procedures, users can seamlessly convert their digital assets into cash.

Sellers should remain vigilant against fraudulent schemes as well as be informed on the relevant laws and taxation policies. If approached correctly, changing NFTs to fiat will be easy and beneficial towards both NFT creators and collectors alike.