This article will cover the Best Banks For Multiple Currency Accounts in terms of their suitability for global transactions.

Regardless if you’re a constant traveler, an entrepreneur, or a forex trader, multi-currency accounts are an efficient way to hold, send, and receive different currencies.

I will also mention which multi-currency accounts from banks have the best prices for exchanging money, small service charges, and easy foreign country transfers.

Key Feature & Best Banks For Multiple Currency Accounts

| Bank | Key Feature |

|---|---|

| HSBC (UK, Global) | Holds 19+ currencies with seamless global transfers. |

| Citibank (US, Global) | Supports 12+ currencies with no fees within the Citi network. |

| Standard Chartered (UK, Global) | Offers 10+ currencies with free currency conversion. |

| Barclays (UK, Global) | Provides access to 30+ currencies with no monthly fees. |

| Revolut (UK, Europe, Global) | Supports 30+ currencies with fee-free exchange up to a limit. |

| Wise (UK, Global) | Holds 50+ currencies with real exchange rates and low fees. |

| DBS (Singapore, Asia, Global) | Multi-currency account with 12+ currencies and fee-free transfers. |

| UOB (Singapore, Asia, Global) | Holds 10+ currencies, ideal for businesses in Asia. |

| OCBC (Singapore, Asia, Global) | Multi-currency savings with 8+ currencies and no minimum balance. |

| Bank of America (US, Global) | Business-focused multi-currency account with forex hedging. |

1. HSBC (UK, Global)

HSBC supports 19+ currencies on their multi-currency account, making it perfect for business travelers, overseas workers, and global citizens.

Clients can have, send, and receive numerous currencies at real-time exchange rates with effortless global transfers and transactions.

Holders of HSBC Premier accounts enjoy no charge for global money transfers between HSBC accounts. The bank issues multi-currency debit cards for easy purchases in different countries.

With their vast international footprint, HSBC facilitates easy banking in many regions. Customers can also protect themselves from currency risks, making it a great for people who frequently transact internationally or invest in foreign currencies.

HSBC (UK, Global) Features

- Multi-currency acounts are available in over 19 currencies.

- Globally, clients can access their funds with easy transfer capabilities.

- Premier account holders incur no charges for transfers.

2. Citibank (US, Global)

Citibank complements their multi-currency account with the ability to operate 12+ currencies within their global network.

Associated clients can transfer between Citibank accounts free of charge and is a great choice for expatriates and international businesses.

Their account supports conversion of foreign currencies into the base currency at greatly favorable exchange rates.

Access to currency balances is offered in real-time through Citibank’s online and mobile banking, making it convenient to manage money from anywhere around the world.

Businesses with foreign suppliers or freelancers needing payments in varying currencies will find Citibank’s structured forex solutions ideal.

Given its international presence, Citibank is one of the most sought after banks for those looking for conveniently located banking services.

Citibank (United States, Global) Features

- Accounts available for both personal and business transactions.

- Permits holding 12 different currencies simultaneously.

- Within the Citi network, there are no charges for currency conversion.

3. Standard Chartered (UK, Global)

Standard Chartered facilitates individuals and companies involved in international trade with the option of holding multi-currency accounts with over 10 currencies.

The bank provides free conversion of currency balances between various accounts, thus minimizing the cost of foreign exchange conversion.

International payments can be done easily through the bank’s global network. The bank provides a multi-currency spending debit card for cost effective ease of use.

Moreover, the account is designed for global investors as well as expatriates who wish to effectively manage numerous currency balances.

Standard Chartered’s established presence in Asia, Africa, and the Middle East further strengthens its position as a banking partner.

Standard Chartered (United Kingdom, Global) Features

- Over 10 currencies supported.

- No charges for transforming one currency into another amongst account balances.

- Widely available in several Asian and African countries.

4. Barclays (UK, Global)

International businesses and frequent travelers will appreciate the multi-currency accounts in over 30 currencies that Barclays has on offer.

The account permits the maintenance and transfer of foreign currencies without need for constant conversions, reducing forex fees.

Furthermore, Barclays provides competitive payment rates and low fees for international payments. For customers who want to hedge against currency risk, Barclays has dedicated forex management services.

They allow easy follow-up of the currency balance and transaction executions through simple online banking integration.

Adding to this is the firm position that Barclays holds in Europe and other major financial centers, which make it the go to for people that deal with different currencies on a frequent basis.

Barclays (United Kingdom, Global) Features

- Foreign currency account holders can transact in more than 30 currencies.

- No monthly service fee.

- Reasonable and better than average exchange rates.

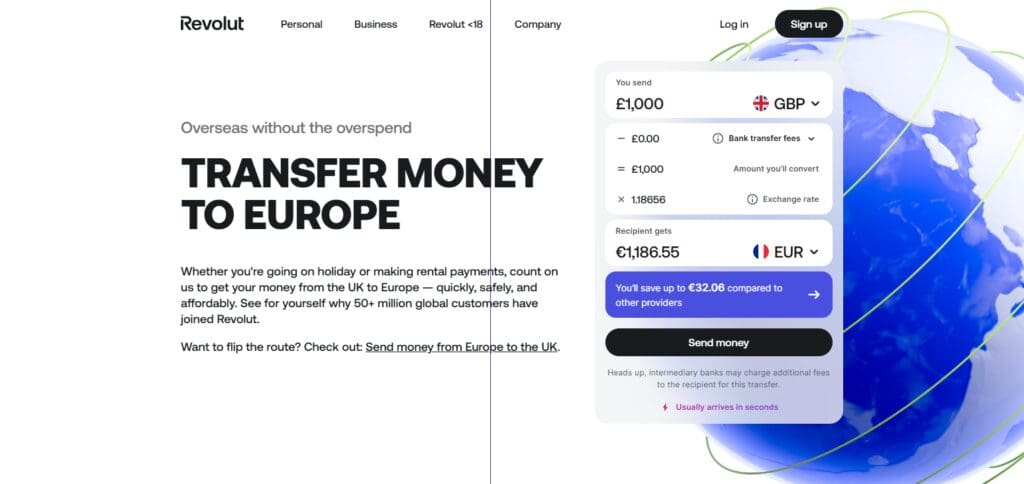

5. Revolut (UK, Europe, Global)

With multi-currency accounts supporting more than 30 currencies at real exchange rates, Revolut is entirely digital.

It’s a great account option for travelers and digital nomads looking to save, as users are able to exchange up to a certain limit per month without hidden fees.

There’s also a multi-currency debit card available which makes it easy to spend while traveling abroad without high conversion charges. Revolut’s payment solutions can be used cross-borders by businesses.

Additionally, its app improves budgeting and currency spending through alerts to help users optimize expenses. Fast transfers paired with a user-friendly experience make Revolut a frontrunner for those with advanced banking needs.

Revolut (United Kingdom, Europe, Global) Features

- More than 30 currencies are supported.

- Free currency conversion services, but only to limited extents.

- Works great for nomads and people who travel a lot for business.

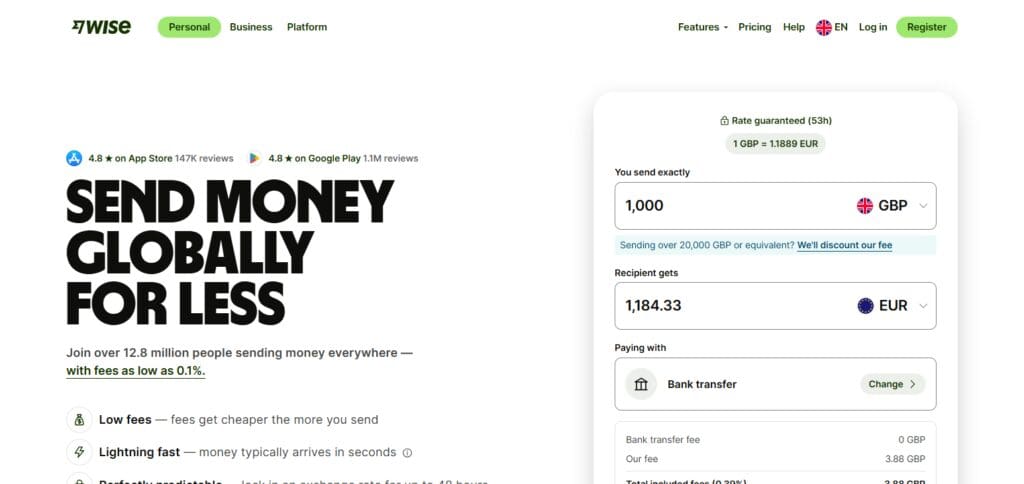

6. Wise (UK, Global)

Wise (formerly TransferWise) is among the most straightforward multi-currency accounts holders, having the freedom to keep 50+ currencies at the mid market rate.

In contrast to conventional banks, Wise uses a low fee and no hidden markup system, along with rapid global transfers.

A prepaid debit card is also available for straightforward transactions in differing currencies.

Businesses gain the most from batch payments and accounting integration. Wise is good for freelancers, expatriates, and even small businesses that need to deal with several currencies at a time without paying a fortune for banking services. Unlike traditional banks, it does not hide fees behind excessive pricing.

Wise (United Kingdom, Global) Features

- More than 50 currencies can be held within one account.

- Expenses for conversion compared to the real exchange rate are very low.

- Comes with a debit card allowing easy access to funds.

7. DBS (Singapore, Asia, Global)

For those with greater involvement in the Asian region, DBS is a favorable choice because of its multi-currency account that supports over 12 currencies.

Having a DBS account also allows free transfers between other DBS accounts, thus lowering transaction costs.

Customers have the opportunity to convert their currencies at competitive forex rates, along with real-time forex tracking tools. International spending through travel cards is also made easier with a DBS multi-currency account.

With local dominance in Singapore, DBS has been expanding globally which is highly beneficial for businessman traveling within Asia. Their digital banking system allows easy currency control and cross-border transactions.

DBS (Singapore) Features

- Multi-currency accounts allowing users to hold more than twelve currencies.

- No charges for transfers between DBS issued accounts.

- Better than average foreign exchange rates for traders.

8. UOB (Singapore, Asia, Global)

Designed for frequent travelers and international businesses, UOB multi-currency account supports over 10 currencies. The account has competitive exchange rates and no-charge interbank transfers within Singapore.

The account is part of UOB banking ecosystem which allows them to further manage and mitigate forex risk through seamless currency conversions.

UOB issues travel friendly linked debit accounts with lower conversion fees for overseas spending.

The bank’s powerful presence in Southeast Asia makes it easy for businesses operating in the region to deal in multiple currencies.

Furthermore, UOB provides internatioal business clients with forex services to enable effective currency volatility hedging.

UOB (Singapore) Features

- Banks has possession of over 10 currencies.

- Transfers using other local banks in Singapore do not incur charges.

- Favors trading companies operating in Asia.

9.OCBC (Singapore, Asia, Global)

Individuals who travel regularly or earn their income in foreign currency are best suited for OCBC’s multi-currency savings account which has no minimum balance requirement for more than eight currencies.

This account enables holders to hold, convert, and enjoy competitive market rates. Customers can link a multi-currency debit card to make fee free purchases around the globe.

OCBC extends its services to businesses offering forex alerts, hedging, and user friendly online banking with international transactions made simple. Being based in Asia allows OBCA to service clients with diverse currency portfolios more efficiently.

OCBC (Singapore) Features

- Currency saving accounts available in more than 8 currencies.

- Certain accounts user restrctions do not need to mantain a balance.

- Mobile Banking application offers simple ways to manage foreign exchange.

10.Bank of America (US, Global)

Multi-currency business accounts offered by Bank of America are ideal for companies conducting international transactions as they use these accounts to receive, hold, and pay in different currencies while having the option of mitigating forex risks.

This ensures a seamless transaction for importers, exporters, and multinational corporations as it is integrated with global payment systems.

Along with a dedicated forex advisory, multi-currency services at Bank of America includes treasury solutions and risk management.

It might be business-oriented, but the account is useful for firms working with foreign client or suppliers.

Being one of the best banking institutions in the world, especially in the United States, it is the preferred choice for corporate multi-currency control.

Bank of America Features

- Business multi currency accounts

- Protection against foreign exchange movements

- Linked with global payment services

Conclusion

Selecting a multi-currency account depends on whether your use case is travel, business, forex trading, or international transactions.

DBS, UOB, and OCBC are good options if you’re dealing with the Asian market. Standard chartered, barclays, citibank and hsbc are good options for businesses and individuals who require reliable global banking.

Revolut and Wise are modern digital solutions that have low fees and real rates and are perfect for freelancers and travelers.

For businesses needing forex hedging and treasury management, bank of america stands out. Choosing the right bank makes managing money internationally very easy.