In this post, I will analyze the Best Cross-chain Aggregator Apps that support effortless switching of assets among different blockchains.

These services enhance the execution of transactions by combining liquidity from different DEXs and bridges, which allows for minimum costs and maximum profit for users.

If you are looking to minimize slippage, improve speed, or achieve MEV defense, these sophisticated aggregators make trading between chains simpler in DeFi.

Key Features & Best Cross-chain Aggregator Apps List

| Platform | Key Features |

|---|---|

| Rubic | Aggregates over 220 DEXs and bridges, providing access to more than 15,500 trading pairs. |

| LlamaSwap | Meta DEX aggregator comparing multiple aggregators across 22 chains to find optimal swap rates; emphasizes privacy with no additional fees. |

| OpenOcean | Aggregates liquidity from over 285 sources across 23 networks, offering features like limit and stop-loss orders with intelligent routing to minimize gas fees and slippage. |

| ParaSwap | Aggregates liquidity from major DEXs, focusing on reducing slippage and gas costs; offers zero gas cost transactions through ParaSwap Delta and provides MEV protection. |

| 1inch Network | Leading DEX aggregator sourcing liquidity from various exchanges, offering users competitive rates and reduced slippage across multiple blockchains; supports advanced trading features like limit orders and multi-hop swaps. |

| Matcha | Aggregates liquidity from over 130 sources, providing access to more than 6 million tokens; supports limit orders and charges zero fees, ensuring a user-friendly experience; offers cross-chain swaps. |

| KyberSwap | Supports 17 chains and offers features like limit orders; known for good volume and efficient trade executions. |

| CoW Swap | Protects traders against arbitrage, sandwiching, and front-running of orders; offers gasless orders and supports smart contract wallets. |

| Atlas DEX | Powered by Wormhole, supports six blockchains and integrates with 130 platforms, allowing users to stake ATS tokens and perform cross-chain swaps. |

| Rango Exchange | Connects DEXs and cross-chain bridges across 69 blockchains, facilitating efficient asset swaps between both EVM and non-EVM chains; has undergone two security audits and supports 25+ wallets. |

1. Rubic

Rubic acts as a cross-chain and multi-blockchain aggregator. Supporting Ethereum, Binance Smart Chain, Polygon and more, token swaps become hassle-free as liquidity is collected from different DEXs (decentralized exchanges) and best rates are offered.

Rubic also has a simple interface meaning beginners as well as advanced users can operate it seamlessly.

Usually tokens have to be swapped through a centralized exchange, but Rubic enables users to swap tokens straight from the wallet. Users looking for a solution to cross-chain swaps without slippage and high fees will find Rubic to be the best choice.

Rubic Features

– Facilitates multi-chain swaps for over 20 networks.

– Best price aggregation from over 200 DEXs and Bridges.

– Provides Limit orders and gas- fee optimization.

– Issues SDK and API documentation.

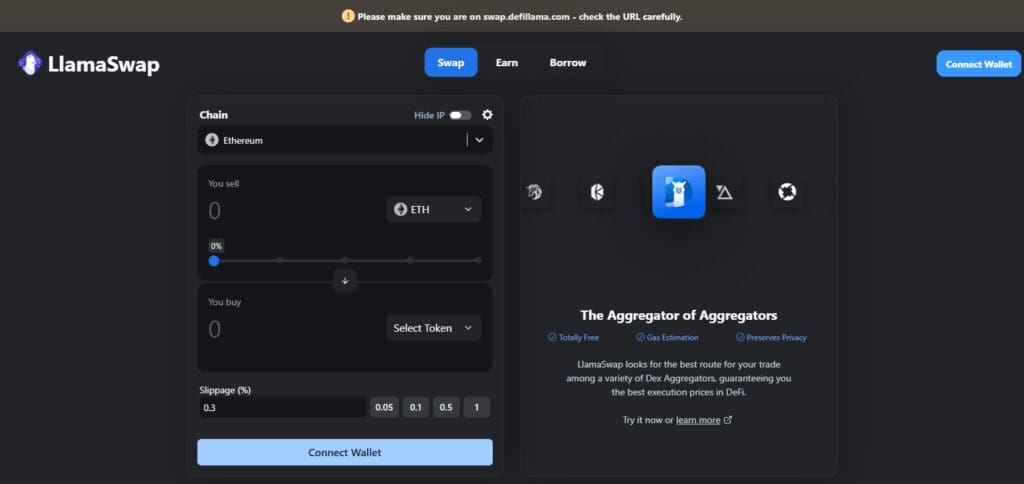

2. LlamaSwap

LlamaSwap is a multi-chain decentralized exchange aggregator. The exchange focuses on providing users with the best rates possible which leads to the best trade being made.

Ethereum, Binance Smart Chain, and Polygon are just some of the many blockchains supported by LlamaSwap.

Thanks to its advanced algorithms and multi-functional interface, the amount of slippage while trading is significantly low.

For traders who wish to fill large orders without causing significant shifts in market prices, LlamaSwap is an optimal choice.

The exchange is also highly efficient for gas optimized limit orders, splitting the user base to both professional and casual traders.

LlamaSwap Features

– Gas-efficient cross-chain swaps.

– Optimal route aggregation from various bridges.

– Supports Ethereum, Layer 2s, and major chains.

– Simple UI with clear processes.

3. OpenOcean

OpenOcean stands out as a premier cross-chain aggregator with multiple blockchains under its purview, including Ethereum, Binance Smart Chain, and Solana.

To optimize trading paths, slippage and returns are calculated alongside other factors using an AI powered routing algorithm. This makes OpenOcean a comprehensive spot and derivative trading platform.

OpenOcean boasts a friendly interface alongside advanced analytics tools, enabling traders to formulate the best possible strategies.

For competitive fees and reliable service, OpenOcean is the go to for users in search of cross-chain trading platforms.

OpenOcean Features

– DEX and CEX liquidity provider aggregation.

– Route finder with intelligent provisioning.

– Allows cross-chain swapping and perpetual trading.

– Network fee only; no additional fees.

4. ParaSwap

Among its other features, ParaSwap serves as a decentralized exchange aggregator for Ethereum, Binance SmartChain and Polygon, allowing users to execute cross-chain token swaps with ease.

Liquidity on ParaSwap is aggregated from numerous DEX to provide cost effective trades, all while maintaining the best rates.

Everyone from casual to expert traders will appreciate the intuitive UI alongside the smooth execution driven by advanced algorithms. Alongside cross-chain swaps, trading fees on ParaSwap are particularly appealing for those wishing to switch to a more secure platform.

ParaSwap Features

– DEX aggregation at lesser price.

– MEV protection for enhanced execution.

– Cross-chain trading with no gas fee swap.

– API available for DeFi applications.

5. 1inch Network

1Inch Network is a well-known decentralized exchange aggregator that offers cross-chain token swaps on Ethereum, Binance Smart Chain, and Polygon.

With its sophisticated algorithm, 1inch splits trades between multiple DEXs for better rates and minimal slippage.

In addition to limit orders and gas fee savings, 1inch is also a versatile trader’s tool. And like other aggregator platforms, 1inch Network provides users with deep analytics for data-driven decision-making.

It specializes in 1Inch Network users who cross trade on different chains and are looking for low-cost and feature-rich trading environments.

1inch Network Features

– Optimal swaps with Pathfinder algorithm.

– 200+ liquidity sources aggregated for cross-chain trading.

– Limit orders, gas-refund, and void-mev are included.

– Developers are supported by wallets and APIs.

6. Matcha

Matcha is an advanced decentralized exchange, also known as a DEX aggregator. With the help of Matcha, users can complete cross-chain token swaps while experiencing low slippage.

Ethereum and Binance Smart Chain, as well as Polygon, are all supported on Matcha. The range of DEXs aggregated by the aggregator ensures that the user is always offered the best rates available.

Matcha uses advanced and competitive algorithms in combination with ease of use design principles. With these tools, all levels of traders can interact with Matcha with ease.

The possibility of gas fee saving and limit orders enable greater flexibility in trading. Matcha’s affordable fees and security features make it suitable especially for users who need an efficient platform for cross-chain swaps.

Matcha Features

– Build by 0x protocol to facilitate deep liquidity.

– Smart order routing with private trading.

– Cross-chain multi-swaps with low slippage.

– Straightforward user interface.

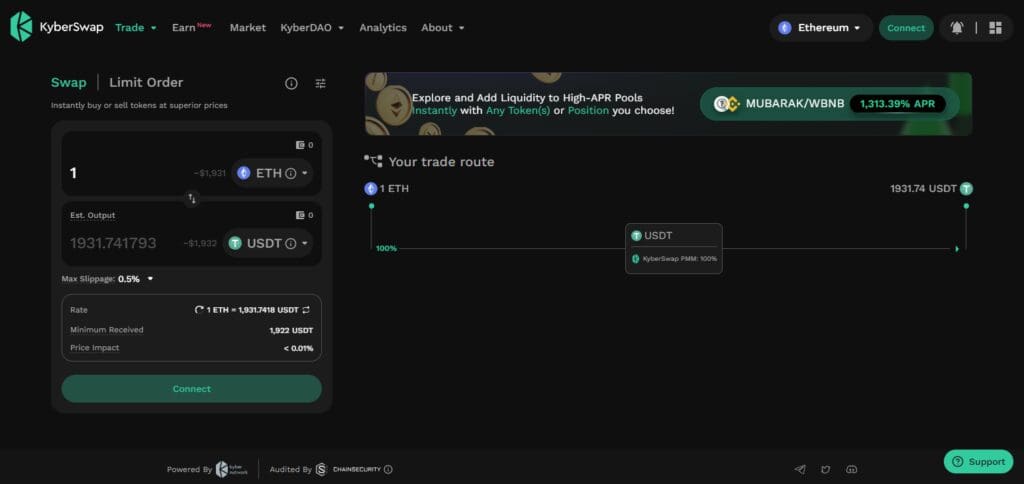

7. KyberSwap

With KyberSwap, users can execute cross-chain token swaps for Ethereum, Binance Smart Chain, and Polygon using their decentralized exchange aggregator.

Its high-grade algorithm splits trades across diverse DEXs to provide optimal prices as well as lower slippage. Limit orders and gas optimization are advanced features that KyberSwap users can utilize.

Additionally, users can leverage the trades using the comprehensive analytics tools offered through the user-friendly interface.

Overall, the platform is tailored for customers who wish to capitalize on cross-chain trading while enjoying advanced options at reasonable costs.

KyberSwap Features

– Obtains the best prices from different DEXs.

– Uses varying fee structures to maximize profits.

– Enables liquidity provision with concentrated liquidity pools.

– Supplies limit orders, and advanced analytic tools for professional traders.

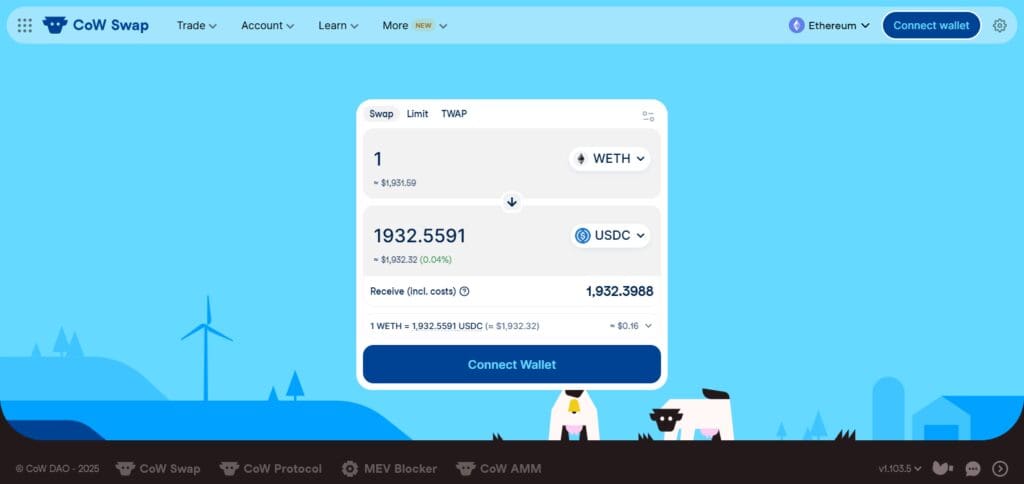

8. CoW Swap

CoW Swap works as a decentralized exchange aggregator that services Ethereum, Binance Smart Chain, Polygon, and many other chains, providing users with unlimited cross-chain token swaps with lower slippage.

With CoW Swap, users can benefit from liquidity supplied by different DEXs which allows for more competitive rates.

The UI was also designed to be friendly towards novice traders that want to take up the more complex opportunities in crypto.

Advanced gas optimization along with limit orders are some of the best features CoW Swap offers. Overall, CoW Swap is a must for users looking to capitalize on low-cost cross-chain swaps.

CoW Swap Features

– Collects gas fees with weekday batch auctions to reduce MEV.

– Works with peer-to-peer orders for better rates.

– Combines liquidity from diverse DEXs for the best price.

– Allows for private, gasless trading.

9. Atlas DEX

Atlas DEX is an aggregator of decentralized exchanges that provides users the ability to swap tokens across Ethereum, Binance Smart Chain, Polygon, and other supported blocks.

Using a smart algorithm, Atlas DEX splits every trade into smaller trades across multiple DEXs.

This guarantees the best rates with the least possible slippage. Atlas DEX is quite beneficial for traders due to its versatile tools such as limit order setting and gas optimization.

Atlas DEX’s intuitive interface along with comprehensive analytics lets users make well-informed decisions. It’s perfect for users who want low fees, advanced feature capabilities alongside competitive pricing for cross-chain trades.

Atlas DEX Features

– Focuses on cross-chain swaps through multiple bridges.

– Combines and collects liquidity from various DEXs.

– Compatible with important blockchains and tokens.

– Prioritizes safety and quick execution.

10. Rango Exchange

Rango Exchange is an aggregator of DEXs that allows users to perform cross-chain token swaps with little to no slippage.

It is supportive of Ethereum, Polygon, Binance Smart Chain, and many more. Rango Exchange uses multiple DEXs to source liquidity and offer their clients the best rates on the market.

Thanks to Rango’s advanced algorithms, trading is performed seamlessly. Coupled with the friendly interface, it guarantees accessibility to all levels of trading professionals.

Other features such as limit order setting and gas optimization are also gladly provided by Rango Exchange. Those looking for a reliable platform for efficient cross-chain token swaps on competitive fee rates will find these greatly beneficial.

Rango Exchange Features

– Connects bridges and DEXs for easier swaps.

– Hundreds of supported blockchains and assets over 50.

– Fantastic interface with the best routes available.

– Integrates Decentralized Finance platforms and wallets.

Conclusion

The greatest cross-chain aggregator sites like Rubic, Rango Exchange, and Atlas DEX improve interoperability within the DeFi ecosystem by enabling effortless, fast, and inexpensive asset swaps on various blockchains. Other platforms, however, such 1inch Network, ParaSwap, and Open Ocean are specialized in smart routing and deep liquidity pooling.

Meanwhile, LlamaSwap and CoW Swap are unmatched in gas efficient and MEV protected trading. Then there are KyberSwap and Matcha who have set a benchmark with their exceptional trading tools and liquidity management, but are surpassed by the former in cost efficiency.

However, the ultimate deciding factors as to which aggregator to choose will always be supported chains, transaction fees, and overall user experience.

As these multi-chain platforms continue to broaden the features available to users, these aggregators will spearhead the revolution towards effortless cross-chain trading as DeFi expand even further.