I Want To Talk About Kamino Finance, a high-tech DeFi platform on Solana that disrupts the way liquidity is managed and yields are optimized.

Automated strategies, leveraged liquidity, and an understandable interface make Kamino Finance state-of-the-art.

For both new and experienced Defi users. Follow me for more as I show you the unique solutions and advantages it provides.

What is Kamino Finance?

Kamino Finance was created to offer users the easiest possible way of providing liquidity and earning yield on-chain.

The protocol’s one-click, auto-compounding concentrated liquidity strategies quickly became the most popular LP products on Solana and laid the foundation for what Kamino is now.

Today, Kamino is a first-of-its-kind DeFi protocol that unifies Lending, Liquidity and Leverages into a single, secure DeFi product suite.

Kamino Finance Overview

| Feature | Description |

|---|---|

| Platform Type | Solana-based DeFi platform |

| Core Features | Automated liquidity management, lending, borrowing, leverage |

| Concentrated Liquidity | Allows users to allocate assets in specific price ranges |

| Automated Strategies | Tools for setting and forgetting automated DeFi strategies |

| Leveraged Liquidity | Users can provide leveraged liquidity, increasing potential returns |

| Collateral Use | Concentrated liquidity positions can be used as collateral |

| User-Friendly Interface | Intuitive design for easy navigation |

| Launch Year | 2024 |

How It Works

Multiply allows a user to open a leverage position where they can increase their exposure to a yield-bearing asset by borrowing the underlying asset.

(eg. Increase exposure to JitoSOL by borrowing SOL). This is enabled by two K-Lend mechanisms: eMode and flash loans.

What is emode?

Multiply vaults also take advantage of Elevation Mode (eMode). This K-Lend mechanism allows for higher loan-to-value ratios (i.e. higher leverage) between assets that are pegged in price.

For example, in a JitoSOL/SOL Multiply vault, JitoSOL is supplied, and SOL is borrowed.

This position is then looped up to a target leverage amount. Typically, these assets have a 75% LTV, allowing for 4x leverage. However, with eMode, their LTV can be raised to 90%, allowing for up to 10x leverage.

How do flash loans work?

Flash loans are a DeFi innovation that enables you to take a loan without posting collateral, given that the loan is repaid within that same transaction.

In multiply, a user inputs their deposit amount and target leverage (Multiplier) amount. Using these values, the protocol can identify how much SOL needs to be borrowed in the flash loan. Then:

- SOL is borrowed

- SOL is swapped to the target asset (e.g. JitoSOL)

- Target asset is supplied in K-Lend

- SOL is borrowed against the target asset

- Borrowed SOL is used to repay the initial flash loan

- The position is open at the target leverage

What are the fees?

Every action in Multiply uses the K-Lend flash loans mechanism, which incurs no fee.

Users also pay the borrow APY on the debt asset in their position – note that this is already factored into the Net APY.

Multiply txns also entail swaps via Jupiter, which may incur some slippage costs.

Products of Kamino Finance

Clients of Kamino Finance are provided with a range of unique DeFi products that not only enhance returns but also ease of use.

Automated Liquidity Vaults

Optimize liquidity management using bots.

Kamino Lend

Enables users to lend and borrow money.

Multiply Vaults

Users can take leverage positions against the borrowed underlying assets.

Long/Short Vaults

It permits users to open long or short positions in many assets.

DIY Vault Creator

Features designed for users to construct vaults in accordance with their preferences.

Kamino Finance Major Features

Concentrated Liquidity Management

It allows users to strategically position their funds within a certain range of prices, improving capital utilization.

Automated Strategies

It offers capabilities to create automated DeFi strategies and leave them unattended while managing market yield.

Lending and Borrowing

It has brought the lending and borrowing feature, making it easy for users to lend and borrow assets.

Leveraged Liquidity

Users can also give out liquidity with leverage, which increases their return on investment.

Collateral Use

Concentrated liquidity positions can also be used for other financial activities by lending it out as collateral.

User-Friendly Interface

It provides a simple-to-use interface and experience for both new and old users of the platform.

Token Info

Planned Distribution Overview

- Ticker: KMNO

- Total Supply: 10,000,000,000

- Estimated Initial Circulating Supply: 1,000,000,000

- Initial Community Distribution: 750,000,000

- TGE: April 30th, 2024

KMNO Utility

Staking

Kamino holders will be able to stake their KMNO natively on Kamino — this can enable users to earn staking boosts, which will boost their current points earnings.

Governance

Should Kamino establish protocol governance, the KMNO token can be implemented as the primary token to engage in specific parts of the protocol’s decision-making.

This could include voting on user reward campaigns, protocol grants, revenue allocations, or certain aspects of protocol risk management.

Kamino Finance Pros & Cons

Pros

Improved Capital Usage: Centralized liquidity management gives the demand that helps distribute assets within strict price levels, enhancing returns1.

Automatic Yield Maximization: Elimination of the complications associated with yield maximization through the use of predesigned DeFi strategies.

All Embedded Within One Platform: Users can lend, borrow, provide and use liquidity all in one platform.

Designed for Easy Use: Workable even and most easy with novices and well-acquainted persons.

High Liquidity Offerings: Liquidity providers are offered asymmetric liquids that aid in unique returns.

Cons

Heavy Learning Curve for Users: New users in DeFi will find the functions very hard to learn owing to the complexities involved.

Risk arising from the Market: Like other DeFi Platforms, it also carries the risks of market fluctuations and other risks related to the smart contracts.

Few Supported Assets: This may not endorse as many types of assets as other sites do.

Team and Investors

Team

At this time, no information has been provided about the development team of Kamino Finance. CoinCu will make appropriate corrections as soon as official data from the project will be made available.

Investor and partners

As of this moment, information about investments in the Kamino Finance project is not available.

At this moment, however, Kamino is working on significant projects in the Solana ecosystem, such as Raydium, Marinade Finance, Jupiter, etc.

Kamino Finance Alternatives

Yearn Finance

Provides automated yield farming strategies to increase returns.

Zapper. fi

Offers crypto investors a DeFi dashboard to manage and oversee their investments over different protocols

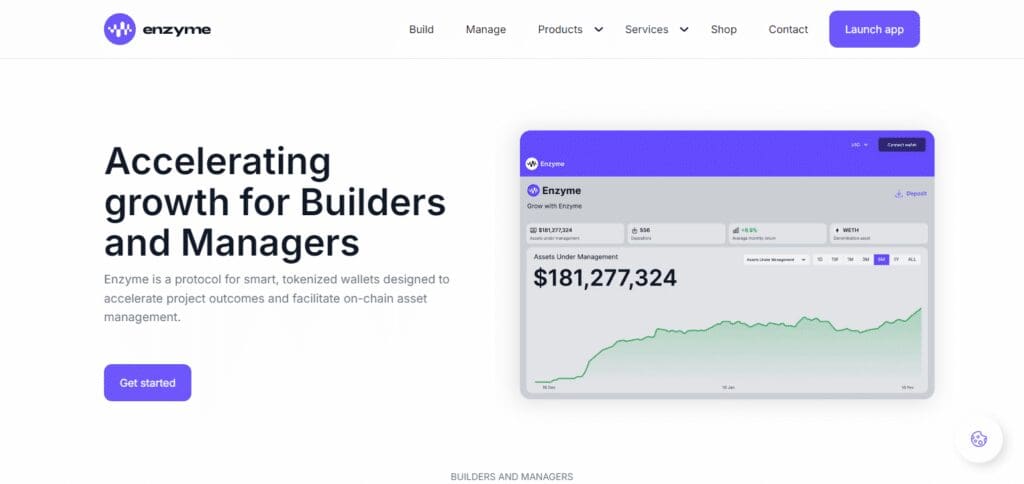

Enzyme Finance

Further focused on DeFi, Enzyme is a protocol that enables users to build and manage investment portfolios in a completely transparent manner.

Conclusion

As for the final remark, Kamino Finance proposes the integration of advanced DeFi technologies with traditional financial operations – it provides a full range of services from smart liquidity provision to leveraged trading.

The platform is very convenient and attractive to both beginner and experienced users of DeFi because of its novelty.

By improving the capital efficiency ratio and enhancing the provision of growth-oriented financial tools

Kamino Finance seeks to become and remain contemporary in the DeFi business, which is constantly changing.