In this article I will explain How To Earn Travel Rewards With Banking in this article. With the appropriate credit cards and spending optimizations, as well as exploring certain loyalty programs, great travel rewards can be achieved.

From earning points and redeeming miles to exclusive perks, there is no denying that strategic banking can transform routine activities into gateways to marvels.

What Is Travel Rewards?

The travel rewards can be described as incentives provided for loyalty by airlines, hotels, credit cards and essentially all other travel-related companies. They can be earned by booking flights, spending at hotels or even using a particular credit card.

Program participants can earn travel-affiliated bonuses such as unused or partially paid tickets, hotel reservations, automobile rentals, and even upgrades. These programs along with other services make traveling economically efficient and better.

Furthermore, customers can enjoy priority boarding, special lounge accesses, other purchased services and free for-their-use bonuses which significantly improve their travel experience.

How To Earn Travel Rewards With Banking

Use Travel Credit Cards

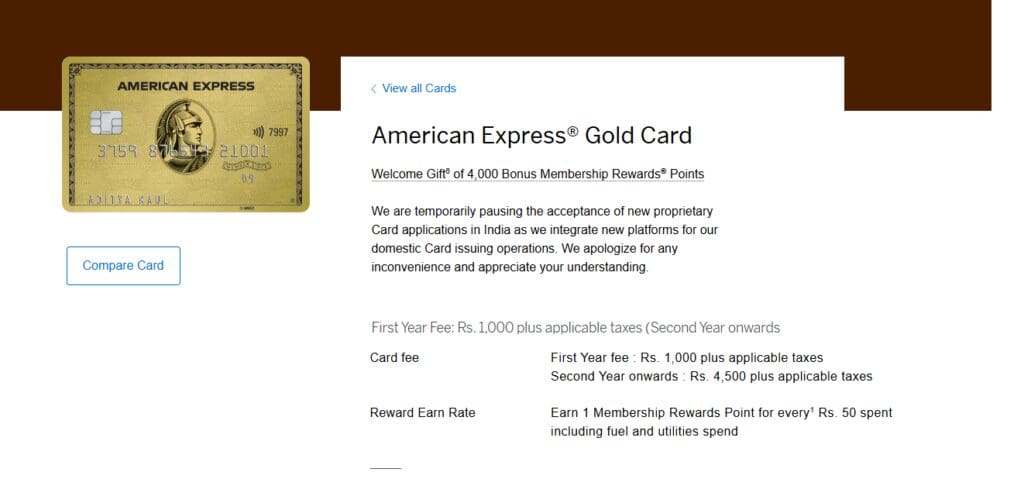

Get an American Express travel rewards card such as Amex Gold or the Amex Platinum. These credit cards allow you to earn Membership Rewards points from eligible spending that can redeemed for hotels and flights, or other items like gift cards. Airlines also issue co-branded options such as Delta SkyMiles® Amex.

Optimize Spending

Increase travel rewards earn rate even further by using Amex cards with bonus points promotion in certain areas. For example, Amex Gold earns an additional 4x on dining and 3x on flights booked directly with airlines. Ensuring that the adequate credit card is used for each purchase makes it possible to earn points quicker for travel redemptions.

Use Shopping Portals

Earn points through airline portals operated by American Express Membership Rewards. Featured retailers provide more points per dollar spent which attains can significantly boosts rewards points. Participating in everyday activities such as travel, online shopping, or even making purchases through the portals helps offer more points.

Send Adequate Money

Refer best earns Open an American Exspress calls enables you increase the amount earns every refund. So obtaining the first two cards will give me huge boosted points which is also very valuable in terms of my saving points for travel redemption goals.

Open a Business Credit Card

If you run a business, it may be beneficial to apply for the Amex Business Gold or Business Platinum, depending which card best applies. These cards have higher benefits on business spending like advertising, shipping, and travel, letting you earn enough points for flights, hotels, or other travel-related upgrades.

Types of Travel Rewards Programs

Different forms of travel rewards programs offer various benefits to accommodate distinct preferences and needs. Allow me to explain each of them in brief:

General Travel Rewards Programs:

Carried out by banks or financial institutions with dedicated credit cards. Travel rewards can be earned through various airlines, hotels, car rentals and even vacation packages. Chase Ultimate Rewards program is a prominent example.

Airline Loyalty Programs:

- Individual programs operated by airlines aimed to facilitate rewarding their high value clients, frequent travelers.

- Consumers accumulate miles based on flights taken and spending done through airline’s partners.

- Emirates Skywards, Delta SkyMiles are some examples.

Hotel Loyalty Programs:

- Points earned is specific to chain of hotels, on bed nights.

- Free nights and other incentives provided offer of exchange for points of awarded.

- Example: Courtyard by Marriott Bonvoy, Hilton Honors.

Credit Card Co-Branded Programs:

- Co branded travel rewards credit cards attached to specific airline or hotel.

- With the card, consumers earn accelerated rewards such as bonus miles or hotel points from purchases.

- American Express issues the American Airlines AAdvantage credit card.

Car Rental Rewards Programs:

- Grant points or discounts for rentals done with specific companies.

- Qualifying for certain rewards promises better value with the offered rewards.

- Hertz Gold Plus Rewards is an example.

Shopping Portals Offering Reward Programs:

- Boost travel incentives by purchasing goods through an airline or credit card portal.

- Airline miles and extra reward points are often advertised for spending at select stores.

Dining and Experience Programs:

- Travel incentives are accumulated through select restaurants and experience partners.

- Perfect for accumulating travel points alongside everyday spending.

Using Credit Cards for Maximum Rewards

Exercising control over your credit cards can help accrue amazing rewards and benefits. Here are a few ways to make the most out of your credit card rewards:

Know The Rewards Structure of Your Card: Make an effort to understand the categories with the highest earning potential, such as travel, reviews for restaurants, or the grocery top up. Employ the proper card for certain purchases to increase points and cashback.

Maximize Bonuses from Sign Ups: Numerous credit cards provide enticing bonuses for new members. Strategize your spending to meet the required threshold while keeping costs in check.

Time Major Purchases with Bonus Promotions: Vacation expenditures and new appliance purchases can be planned around the time credit cards provide promotional bonuses.

Use Your Card to Pay Bills: Adopting a rewards accumulating mindset over time can be done by using cards for regular expenses such as utility bills and other services.

Mix Different Card Variants: Having several cards—the other one focused on rewards like cash back while the other provides bonuses for travels—improves diversified spending.

Monitor Bonus Caps: Add caps for spending bonuses to your monitoring list so that you can manage your expenses optimally.

Strategically Set Redemption Decisions: Redemption options include, but are not limited to: travel services, as well as statement credit, which provide astounding value and should be opted for.

Stick To Paying Balances Monthly: As long as amassing rewards isn’t countered by assorted fees, paying off the card every month avoids the burden of interest charges.

Tips for Sustained Travel Reward Earnings

Here are some important suggestions that can help you earn travel rewards continuously:

Choosing Appropriate Travel Rewards Program: Choose a credit card or a banking option that is aligned with your travel movements like flying with specific airlines or booking specific hotels.

Sign-up Bonuses: Initial merit bonuses often offer points or miles; optimally plan large expenditures without having to overspend.

Spend Category Specific: To earn more rewards, use dining, travel and groceries cards that offer bonus points consistently.

Set payment to automatic: Rechargeable bills can be linked to accounts that offer reward points, thus giving chances to accumulate effortlessly.

Value Optimization: To ensure maximum merit value, strategically redeem points or miles for flights, accommodations, or upgrades.

No Fees: Stop paying interest which diminishes earned rewards by eliminating interest-bearing charges that result from unbalanced credit card payments.

Program follow up: Reward structures or redemption policies often change, always be mentally prepared to alter your earning strategy.

Increase reward origin diversity: To maximize returns on every purchase made, use multiple cards and programs.

Benefits of Travel Rewards With Banking

Less Money Spent Traveling: Points and miles earned over time can be used to pay for flights, hotels, and other travel related expenses.

Additional Benefits: Free complimentary upgrades, boarding, and access to waiting lounges are given throughout the airport which enhances the travel experience.

Redemption Flexibility: Accommodations, vehicles, cash and even repayable funds put into used accounts can be redeemed as rewards underneath this program.

Rewards for Sign Ups: A single sign up is capable of earning a person ample rewards which encourages sign ups through enticing offers.

Universal Access: Gained perks and rewards through banking are accessible throughout the globe encouraging ease in travel/exploration.

Smart Spending: Epic efficiency is gained when everyday purchases, including groceries, are spent to earn travel rewards.

Conclusion

Acquiring travel rewards through banking needs pointing your spending towards the right financial reward programs in conjunction with your travel objectives. When done right with the correct banking tools, appropriate credit cards, strategically placed sign-on bonuses, and specific spending peripheries, rewards can be continually earned point and mile wise.

Moreover, effective banking automating bill payments and partnering with savings accounts dedicated to travel ensures constant benefits. Methods such as strategic spending and targeted redemptions further enhance the value received from your efforts towards banked funds.

Staying up to date with program changes and actively managing account fees ensures that rewards are secured along with optimized revenues.

When tracking funds regularly, efficient planning alongside these steps transforms banking from a simple administrative task into an invaluable asset that can be leveraged to amplify visit frequency and access to dream destinations.