This article discusses Kelp DAO, a new platform developed to enhance liquid restaking and yield farming.

Kelp DAO comes with unique features such as the liquid restaking token rsETH, automated yield optimization using Gain Vaults and disbursing rewards as Kelp Miles, offering a solution for value maximization in the DeFi space.

About Kelp DAO

Kelp DAO is a DeFi platform specializing in liquidity restaking and yield farming on EigenLayer. It enables liquid restaking of ETH and other assets thanks to the rsETH token.

With Kelp DAO, users can benefit from automated yield farming, Kelp Miles, airdrop point earnings, and other incentives for restaking, making it the optimal solution for maximizing rewards in the Kelp ecosystem.

Kelp DAO Overview

| Attribute | Details |

|---|---|

| Restaking Token | rsETH |

| Restaking Platform Used | EigenLayer |

| Networks Supported | 10+ EVM networks, including Ethereum, Optimism, Base, Arbitrum, and more. |

| Accepted Deposits | ETH, ETHx, stETH, rsETH |

| Additional Features | Gain: Automated yield optimization and L2 airdrop points farming. |

| Governance Token | KELP (unreleased) |

| Fees | 10% on restaking rewards |

| Audits | SigmaPrime, Code4rena, and MixBytes. |

How rsETH works?

Restakers stake their LST to mint rsETH tokens indicating fractional ownership of the underlying assets

rsETH contracts distribute the deposited tokens into different Node Operators that operate with the Kelp DAO

Rewards accrue from the various services to the rsETH contracts. The price of rsETH token assumes the underlying price of the various rewards and staked tokens

Restakers can swap their rsETH tokens for other tokens on AMMs for instant liquidity or choose to redeem underlying assets through rsETH contracts

Restakers can further leverage their rsETH tokens in DeFi

Key Features of Kelp DAO

Kelp DAO was developed with the objective of maximizing profits and flexibility for restaked assets. To reach this goal, Kelp DAO merges liquid token products with ready-made solutions from the DeFi world.

Liquid Restaking Token (rsETH)

The primary liquid restaking token for Kelp is rsETH which represents the claim on ETH, ETHx and stETH deposits that are placed in Eigenlayer and earns both EigenLayer Points and Kelp Miles. It is instantly marketable which means one does not have to undergo the standard waiting period for EigenLayer withdrawals.

Yield and Airdrop Points Farming

Kelp DAO offers automated tools to gain additional yield and airdrop points boosting productivity in the Layer 2 ecosystem, so it developed Kelp ‘Gain,’ a tool that automatically manages that productivity.

After depositing ETH, stETH, ETHx, or rsETH, users don’t have to worry about anything because they have their additional claim on LSTs and LRTs. AgETH is a token of the vault’s deposits promise.

Rewards and Incentives

Participating actively in the platform’s ecosystem for Kelp DAO brings additional rewards like incentives and Kelp Miles.

Security and Risk Management

The security of user funds is some of the major problems Kelp DAO aims to resolve including thorough risk management. By distributing assets across various Node Operators and concentrating on managing the reward, Kelp DAO minimizes risks.

Kelp DAO Product

Kelp DAO has developed a range of products that cater specifically to the needs of decentralized finance (DeFi) participation, which include liquid staking, yield capturing, and restaking. Here are some of the primary offerings:

rsETH (Liquid Restaking Token)

The flagship product of Kelp DAO is rsETH, a liquid restaking token that denotes the claim over deposits made in EigenLayer.

As a restaker, Kelp DAO participants rsETH tokens are tradable in the open market, which provides a range of value and liquidity options.

While simultaneously earning benefits like EigenLayer and Kelp Miles, users receive rewards that enhance the value of being a participant.

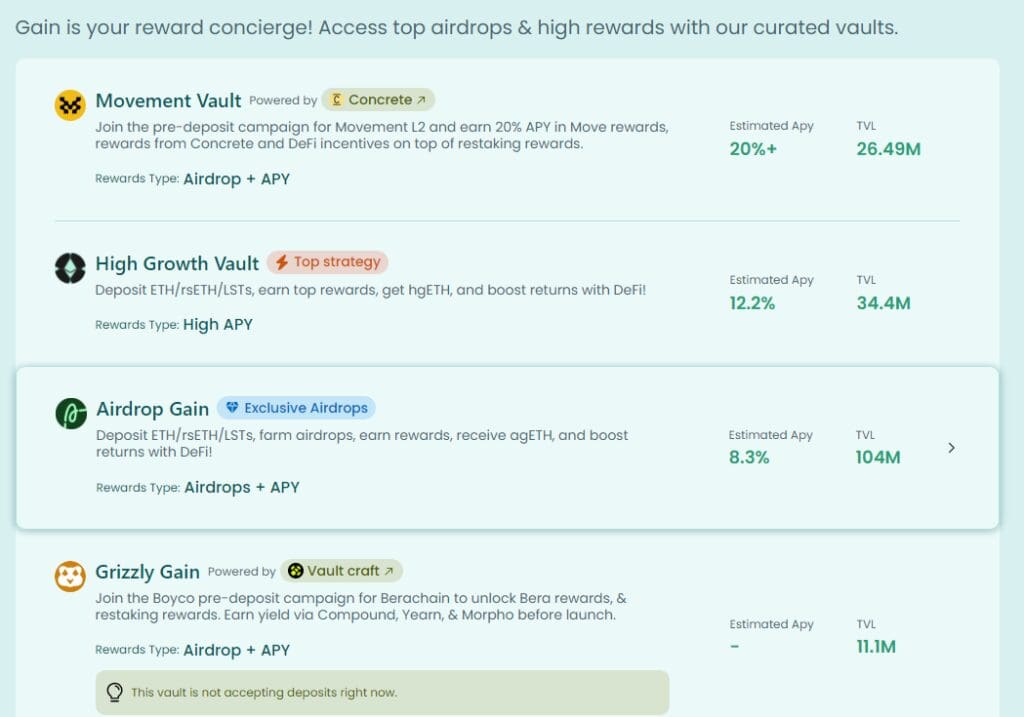

Gain Vaults

Gain is Kelp DAO’s automated yield capturing, or in other words earning tool. Users can deposit tokens like ETH, stETH, ETHx, and rsETH into Gain Vaults, which allows the participants’ assets to be leveraged for yield generation and even for receiving points airdropped on Layer 2 networks.

Without needing the user’s help, Gain increases profit margins earned by the participants.

Kelp Miles

Kelp Miles is an incentive program which aims to motivate user participation in the active governance of Kelp DAO. Points earned through engagement on the platform can be used for governance or exchanged for rewards which greatly helps in enhancing engagement and participation.

Governance Token (KELP)

The primary aspect of Kelp DAO is leveraged through the KELP token, which enables active participation in the Shaggle ecosystem. By holding the token that is yet to be released, users will have the ability to unlock Kelp DAO’s governance system.

Fees within Kelp DAO

Like other staking services, Kelp DAO takes a small cut from profits earned through the provisioned services. Here are some important key fees to note:

rsETH Rewards Fee: Kelp DAO has a set fee of 10% on rewards obtained through ETH deposits. This fee is charged on the earnings gained through restaking activities on EigenLayer.

LST Deposits: There are no charges for the depositing of Liquid Staked Tokens (LSTs) like ETHx or stETH. The only cost imposed is the usual gas fee associated with transactions.

Future Rewards or Airdrops: Relevant to users, especially those with Kelp Miles or EigenLayer Points, Kelp DAO does not pass any fees onto airdrops or rewards users may receive from owning various tokens. Users keep all additional rewards that Kelp DAO or any impacted protocol gives.

Gain Vaults: A modest 2% annual fee is applicable to deposits in Gain vaults used by that allows users to optimize yield and airdrop points over various Layer 2 networks.

$KEP (Kelp Earned Points) is designed to be a game-changer in the restaking landscape. It is a token for an EigenLayer Point earned by Kelp where 1 $KEP = 1 EL Point. Users have complete autonomy to store, trade, and utilize their accrued EigenLayer Points as they see fit.

What is $KEP?

Restakers can claim their $KEP tokens on Kelp dApp starting 28th Feb. Each week, the restakers can claim $KEP for the EigenLayer Points they earned the previous week.

Why is Kelp DAO releasing $KEP?

As Kelp DAO, they want to create more on-chain opportunities for our users to leverage and benefit from the EigenLayer points. However, users are free to choose whether they want to claim $KEP and participate in DeFi or keep their EL points balance as is.

Is $KEP issued by EigenLayer?

$KEP is a token issued by Kelp DAO and is not issued by EigenLayer. $KEP is neither a governance token for Kelp DAO nor for EigenLayer. Simply put, $KEP is a token for EigenLayer Points that Kelp’s restaker earns.

Kelp DAO Founders

Amitej G and Dheeraj B founded Kelp DAO after building Stader Labs, a leading multi-chain liquid staking platform with a staggering $440 million in TVL.

Their track record with Stader Labs does not only make them key contenders of innovation in DeFi, but also proves their expertise in liquid staking infrastructure.

Customer Service

Kelp DAO offers a robust customer service system despite being a decentralized protocol. It features a support ticket system powered by MetaCRM, allowing users to submit requests easily.

Each support ticket is linked to a wallet address, eliminating the need for email addresses and ensuring that your support history is accessible every time you connect to the app. When I reached out with a question about the rewards dashboard, I received a detailed response in just a few minutes.

For basic inquiries, Kelp DAO provides a comprehensive “Docs” page that explains the protocol’s functionality in clear, simple terms. Additionally, the “Resources” page offers a collection of articles addressing common questions about restaking and using Kelp DAO, making it easier for users to find relevant information.

Conclusion

Kelp DAO’s innovative approach to Decentralized Finance includes liquid restaking tokens, yield optimization, and automated rewards’ farming. In combination with EigenLayer, Kelp DAO enables its users to restake ETH alongside other assets while remaining liquid, earning Kelp Miles, and having yield optimized in layer 2 networks.

Automated yield farming through ‘Gain’ vaults positions Kelp DAO at the forefront of flexible and secure yield farming. However, as other DeFi platforms have shown us, adopting these strategies without understanding the value capture mechanisms and risks can be detrimental.

All in all, Kelp DAO offers great opportunities for those willing to refine their staking strategies and dive into the ever expanding world of DeFi.