In this article, I will discuss the Most Popular Yield Farming Tokens that offer lucrative opportunities for earning passive income in DeFi. These tokens enable users to stake, lend, and provide liquidity while earning rewards.

With unique features like high APY, low fees, and deep liquidity, these platforms have become essential for maximizing returns in decentralized finance.

Key Point & Most Popular Yield Farming Tokens List

| Platform | Key Point |

|---|---|

| Uniswap | Leading decentralized exchange (DEX) using an automated market maker (AMM) model on Ethereum. |

| Aave | Decentralized lending protocol offering flash loans and variable interest rates. |

| PancakeSwap | Popular BNB Chain DEX with lower fees and high-yield farming. |

| Curve DAO Token | Focuses on stablecoin swaps with low slippage and high liquidity. |

| Compound | Algorithmic money market protocol for lending and borrowing crypto. |

| Synthetix | Enables the creation of synthetic assets that track real-world asset prices. |

| SushiSwap | Community-driven DEX offering yield farming and staking rewards. |

| WOO Network | Provides deep liquidity and low-fee trading for DeFi and CeFi users. |

| Venus | DeFi lending and stablecoin protocol on BNB Chain. |

| Balancer | AMM and portfolio manager allowing custom liquidity pools with multiple tokens. |

1.Uniswap

Uniswap is considered one of the leading yield farming tokens because of the large number of users, it’s liquid, decentralized, and innovative.

The company’s unique liquidity pool model allows users to effortlessly earn passive income through supplying assets to Automated Market Maker (AMM) pools.

Instead of traditional staking, where users lock tokens to earn rewards, Uniswap pays liquidity providers a portion of the trading fees which makes this way of yield farming more sustainable. It’s DeFi and developer love too deep supports helps a lot.

| Feature | Details |

|---|---|

| Platform | Uniswap (Ethereum-based DEX) |

| Token | UNI |

| Yield Mechanism | Liquidity Provision in AMM Pools |

| Rewards | Earn trading fees from liquidity pools |

| Unique Feature | No order book; automated market maker (AMM) model |

| Benefits | High liquidity, decentralized, passive income |

| Blockchain | Ethereum, with Layer 2 integrations |

| Security | Smart contract-based, non-custodial |

2.Aave

Aave is one of the leading tokens in yield farming because of its unique lending and borrowing platform with adjustable interest rates that give out big returns.

Aave’s introduction of flash loans sets new parameters in profit control where no collateral is needed making it different from traditional DeFi platforms.

Yield farmers generate a steady cash flow by providing liquidity to the pools and receiving interest and earning governance tokens in return.

Precise security, extensive liquidity, and multi-chain development makes it one of the most sought after tokens for sustainable returns in the DeFi ecosystem.

| Feature | Details |

|---|---|

| Platform | Aave (Decentralized Lending Protocol) |

| Token | AAVE |

| Yield Mechanism | Lending and borrowing with interest rewards |

| Rewards | Earn interest on supplied assets + AAVE incentives |

| Unique Feature | Flash loans (instant, no collateral required) |

| Benefits | Passive income, flexible rates, deep liquidity |

| Blockchain | Ethereum, Polygon, Avalanche, and more |

| Security | Smart contract-based, audited protocol |

3.PancakeSwap

PancakeSwap’s rapid growth in popularity stems from its unique auto-compounding feature on the BNB Chain that boosts farming revenue.

Its low transaction fees and fast trade speeds enable users to reap farming rewards much more efficiently than on Ethereum based platforms.

Farmed tokens can also be put to use in Syrup Pools, which increases staking options. Additionally, with a fully developed ecosystem of NFTs and lotteries, PancakeSwap possesses larger liquidity while capturing significant sections of the DeFi sector and, as a result, creating deeply rooted financial farming incentives.

| Feature | Details |

|---|---|

| Platform | PancakeSwap (BNB Chain DEX) |

| Token | CAKE |

| Yield Mechanism | Liquidity provision, staking, and farming |

| Rewards | Earn trading fees, CAKE staking rewards |

| Unique Feature | Low fees, fast transactions, auto-compounding |

| Benefits | High APY, multiple earning options, user-friendly |

| Blockchain | BNB Chain |

| Security | Smart contract-based, audited protocol |

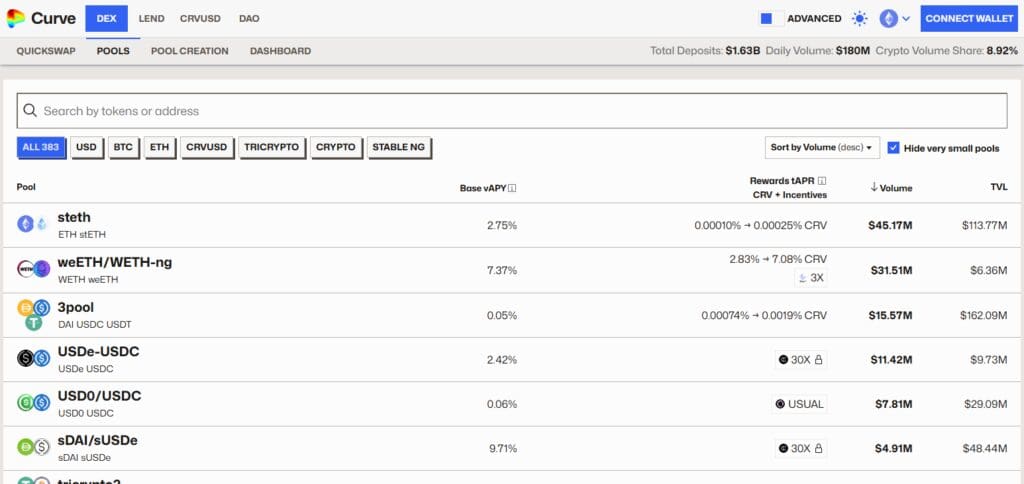

4.Curve DAO Token

Curve DAO Token is highly rated for yield farming because it seeks out stablecoin liquidity pools, harvesting rewards with very little risk. Unlike other AMMs, Curve captures yield while minimizing impermanent loss by having deep liquidity and low slippage trades.

Its veCRV staking model increases the profit share for long-standing holders, ensuring long term rewards. Curve has established itself as a go to option for yield farming and eye-catching returns as it integrates with major DeFi protocols.

| Feature | Details |

|---|---|

| Platform | Curve Finance (Stablecoin-Focused DEX) |

| Token | CRV |

| Yield Mechanism | Liquidity provision in low-slippage pools |

| Rewards | Earn trading fees, CRV staking rewards |

| Unique Feature | Optimized for stablecoin swaps, minimal impermanent loss |

| Benefits | High efficiency, deep liquidity, long-term staking incentives |

| Blockchain | Ethereum, with Layer 2 integrations |

| Security | Smart contract-based, audited protocol |

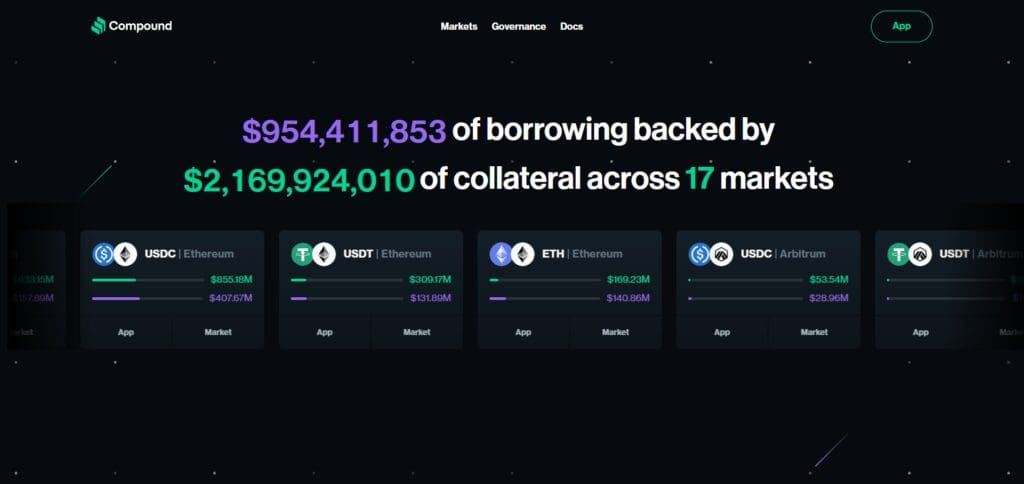

5.Compound

Since compound was the first to offer yield farming tokens, it has certainly become the leader in the space. It allows for users to earn passive income through supplying assets to liquidity pools.

The innovation lies with its always changing interest rates model; unlike traditional lending systems, rates are no longer static and are decided based on the supply and demand of assets in the pool.

To add further motivation, the protocol already offers COMP token rewards to all the active participants of their system.

Moreover, the platform is fully governed through self-enforcing smart contracts of the distributed network, meaning that there will not be a middleman. There is also enough liquidity for yield farming with Compound, which allows it to be at the forefront of Student Number DeFi.

| Feature | Details |

|---|---|

| Platform | Compound (Decentralized Lending Protocol) |

| Token | COMP |

| Yield Mechanism | Lending and borrowing with algorithmic interest rates |

| Rewards | Earn interest on supplied assets + COMP incentives |

| Unique Feature | Dynamic interest rates based on supply and demand |

| Benefits | Passive income, deep liquidity, decentralized governance |

| Blockchain | Ethereum |

| Security | Smart contract-based, audited protocol |

6.Synthetix

Synthetix enable users to stake SNX and mint synthetic assets which is why SNX is the top yield farming token.

Users can now acess real world assets without actually owning them. Instead of traditional yield farming, Synthetix utilizes deep liquidity and multi-asset trading which sets it apart from the rest in DeFi.

Along with that, the integration with layer 2 scaling improves efficenecy and lowers costs for farmers. Moreover, the sustainability of YF rewards through trade fees and inflationary perks motives users to earn.

| Feature | Details |

|---|---|

| Platform | Synthetix (Decentralized Synthetic Asset Protocol) |

| Token | SNX |

| Yield Mechanism | Staking SNX to mint synthetic assets (Synths) |

| Rewards | Earn staking rewards + trading fees from Synth transactions |

| Unique Feature | Enables exposure to real-world assets without holding them |

| Benefits | High-yield staking, deep liquidity, multi-asset exposure |

| Blockchain | Ethereum & Optimism |

| Security | Smart contract-based, audited protocol |

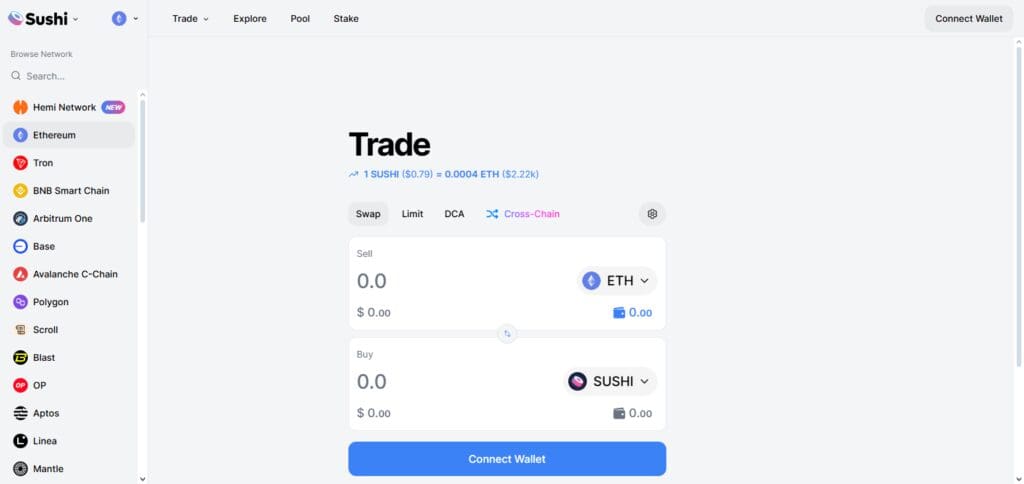

7.SushiSwap

Owing to its community-centric methodology and varied earning prospects, SushiSwap is considered to be among the most best yielding farming tokens. Like all DEXs, it does not shy away from offering SushiBar staking where platform users stake tokens of SUSHI to earn a portion of the revenue pools.

Its expansion into multiple chains improves accessibility and features like Onsen pools further strengthen liquidity incentive structures. By constantly changing and beating the competition, SushiSwap remains one of the leaders in DeFi yield farming through verte sustainable rewards.

| Feature | Details |

|---|---|

| Platform | SushiSwap (Decentralized Exchange – DEX) |

| Token | SUSHI |

| Yield Mechanism | Liquidity provision, staking in SushiBar |

| Rewards | Earn trading fees, SUSHI staking rewards |

| Unique Feature | SushiBar staking (xSUSHI) earns a share of platform fees |

| Benefits | Multi-chain support, community-driven, diverse yield options |

| Blockchain | Ethereum, BNB Chain, Polygon, and more |

| Security | Smart contract-based, audited protocol |

9.WOO Network

WOO Network claims yet another title of being the top yield farming token, achieved due to its remarkable margin liquidity and their fee-less trade system that reaches farming profits’ peak.

Distinct from the customary DeFi platforms, it synthesizes CeFi and DeFi liquidity, thus ensuring reduced slippage and increased profits.

Upon staking WOO tokens, users gain additional rewards, governance rights, and other secretive yield opportunities. The presence of institutional-grade infrastructure and cross-chain integrations makes it unparalleled and efficient for yield farmers.

| Feature | Details |

|---|---|

| Platform | WOO Network (Liquidity and Trading Platform) |

| Token | WOO |

| Yield Mechanism | Staking WOO for rewards and fee discounts |

| Rewards | Earn staking rewards, trading fee rebates |

| Unique Feature | Deep liquidity with zero-fee trading for stakers |

| Benefits | High APY, CeFi & DeFi integration, institutional-grade liquidity |

| Blockchain | Ethereum, BNB Chain, Polygon, Arbitrum |

| Security | Smart contract-based, audited protocol |

10.Venus

Venus revolutionizes farming by lending against collateral, all while earning impressive yields on supplied assets, alongside low fees, fast transactions, and improved security. It combines algorithmic stablecoins who’s collateral is on BNB Chain with decentralized lending.

Its XVS staking and governance reward integration significantly reduces the risk of overheating and increasing gas fees to farming opportunities within the DeFi space.

| Feature | Details |

|---|---|

| Platform | Venus (Decentralized Lending and Stablecoin Protocol) |

| Token | XVS |

| Yield Mechanism | Lending, borrowing, and staking XVS |

| Rewards | Earn interest on supplied assets + XVS incentives |

| Unique Feature | Combines lending with algorithmic stablecoin minting |

| Benefits | High APY, low fees, isolated risk model |

| Blockchain | BNB Chain |

| Security | Smart contract-based, audited protocol |

Conclusion

In conclusion Uniswap, Aave, PancakeSwap, and other well-known yield farming tokens offer a range of earning opportunities via staking, lending, and providing liquidity.

Every platform has something different to offer like low fees, high APY, or even sharp liquidity. Users are able to gain passive income while lowering risks for participating in the ever-evolving DeFi landscape.