In this article, I will talk about emerging markets which are adopting cryptocurrency at an accelerating pace due to inclusive finance and economic challenges.

I will guide you through the most effective and secure options for purchasing cryptocurrency in places sans banking systems, from picking the optimal platform to dealing with local regulations and law enforcement Step by step instructions will be provided for attempting to buying crypto in previously untouchable areas. Cryptocurrency is a complex system but buying it does not need to be.

How to Buy Crypto in Emerging Markets?

In the past couple of years, cryptocurrencies are increasingly becoming popular in the emerging markets for a different set of reasons like access to crypto financial services, hedging inflation, and gaining access to the global digital economy.

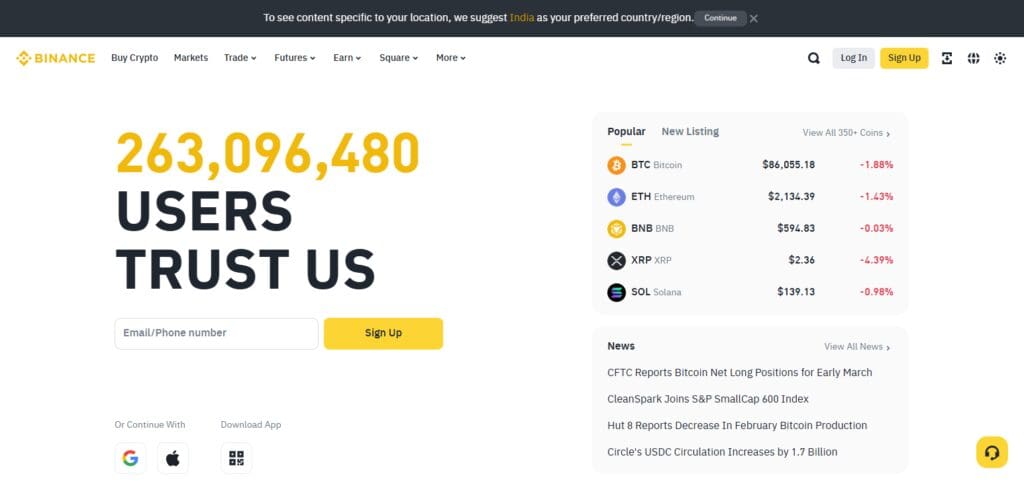

Buying and trading crypto from Binance, a widely known platform, has become quite common in the emerging markets. Here is a step by step guide on how to buy crypto from emerging markets using Binance:

Step 1: Create a Binance Account

Visit the Binance Website or App: Go to www.binance.com or visit your app store to download the Binance App.

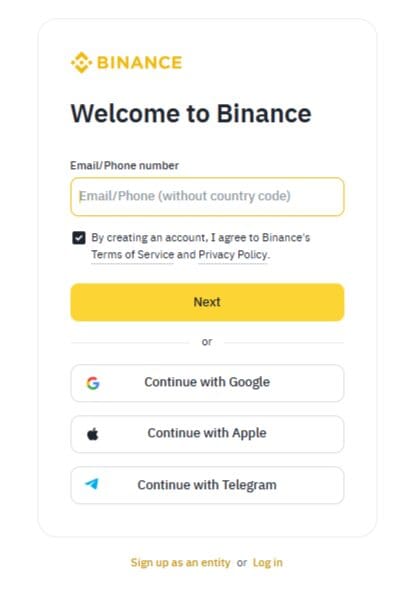

Sign Up: Click on “Register” where you are required to provide your Email or Phone Number. Make sure to pick a strong password.

Verify Your Account: This step involves KYC, where you will need to upload a government issued ID and a selfie. This step is required in order for you to gain higher transaction limits and full access to all Binance features.

Step 2: Secure Your Account

Enable Two Factor Authentication (2FA): Use Google Authenticator, or SMS to add an extra protection layer to your Binance account.

Set Up Anti Phishing Codes: Using this anti phishing code can help you identify legitimate emails from Binance to avoid phishing attempts.

Step 3: Deposit Funds

Select The Way You Would Like To Deposit Money:

Fiat Deposits – You can deposit money using bank transfers, debit and credit cards, and some payment processors in P2P trading of crypto from many developing markets.

Crypto Deposits – Transferring crypto into your Binance wallet is applicable if you already possess crypto.

Tariff Your Deposit Currency: Binance accepts a variety of fiat currencies from nearly all regions of the world including but not limited to most developing markets e.g. INR, NGN, BRL, etc.

Complete The Following Steps: You need to complete the deposit procedure as per the shown directions. In the case of card payment, expect to be taken to a payment gateway.

Step 4: Buy Cryptocurrency

Buying Crypto: Moving to the page where you can buy crypto. From the Binance homepage, click on “Buy Crypto” and select the relevant payment option.

The selected cryptocurrencies include blockchain economic system currencies like Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

Input the Quantitative Value: How much money do you want to invest? If you want to pay with cash, how much do you want to pay? Answer to these questions is in the form of fiat money or crypto.

Finalization of the Transaction: Carefully look through the details and confirm purchasing. In an instant the cryptocurrency will be available in your Binance wallet.

Step 5: Now you can start trading or withdrawing your crypto

This is a world popular trading platform for crypto and Binance. You can take the crypto you just purchased and put it towards payments for other tokens, or you can utilize our refined spot, margin, or futures trade options.

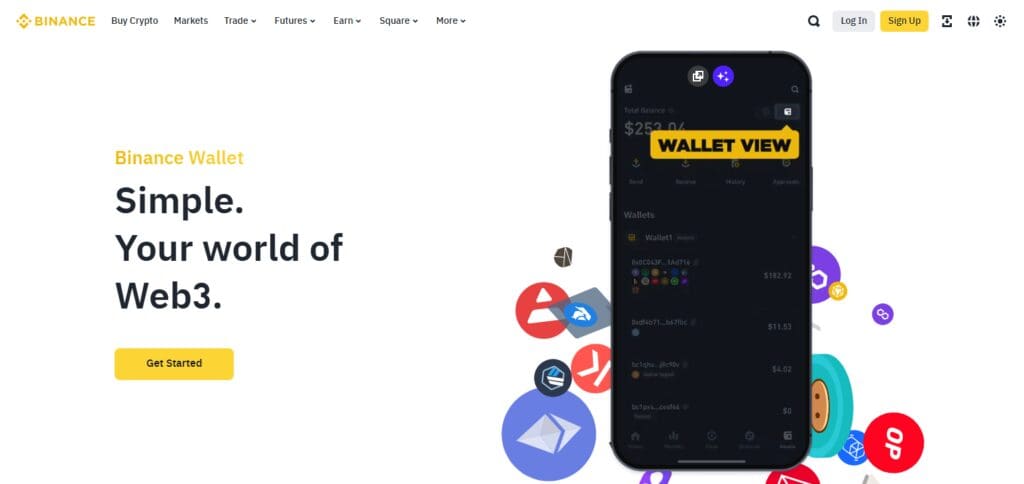

Withdraw to a Wallet: In case you want to safely store your cryptocurrency offline, you can transfer it to a secure hardware wallet or software wallet.

Why Binance Grows in Popularity in Emerging Markets

Various Supported Currencies

It is convenient for users from emerging markets to onboard as Binance supports their local fiat currencies.

Low Cost

Especially with BNB, trading fees on Binance are extremely competitive regardless of other platforms.

Crypto P2P Trading

Users are now able to trade crypto directly with other users with Binance’s peer to peer platform using local currency and payment options.

Educational Platforms

Users from emerging markets are able to learn about cryptocurrency and blockchain technology through Binance Academy’s free learning resources.

Problems Faced in Emerging Markets

Regulatory Challenges

A number of nations have ambiguous or hostile anti-crypto regulations. Always verify local laws prior to trading.

Access to The Internet

Some parts of the world have limited connectivity when it comes to the internet which may restrict access to crypto platforms.

Instability

Currencies value fluctuating is a factor that less experienced investors need to be concerned about.

Tips for Safe and Responsible Crypto Investing

(Due to technical difficulties, the search functionality is not available at the moment.)

Tips for Safer and Responsible Investment in Cryptocurrency

Investing in cryptocurrency is very profitable, even lucrative but carries considerable risks, particularly in fast-paced market scenarios. Some tips are offered to ensure your investment is done safely and responsibly:

Do Your Own Research. (DYOR)

Learn the Fundamentals: Make sure you understand how blockchain technology works along with the basics of the cryptocurrencies that interest you.

Study the Projects Thoroughly: Look into the project’s team, its use case, roadmap, and how supportive the community is.

Avoid Hype-Based Investing: Don’t make investment decisions based on social media or celebrity trends – these aren’t reliable sources.

Invest What You Are Prepared to Lose And Start Greatly Reduced.

Allocate a Small Investment Firstly: If you are a new trader in crypto, put a small investment that can assist you in learning with the market.

Put Your Unconsumed Earnings At Risk Only: Take care never to invest money that you cannot afford to waste such as your saving payments for priorities like bills or rent.

Make Use of Wallets and Platforms that you Trust.

Trade in Piut(A Reputable Exchange): Binance, Coinbase and Kraken are very reputable platforms designed with your safety and security in mind.

Secure Your Wallet: Keeping your cryptocurrency in wallets that support two-way authentication is highly recommended. For the vast majority of users, hardware wallets (e.g. Ledger, Trezor) are ideal for long-term storage, while software wallets suited for mobile devices can be used for smaller and more active amounts.

Diversify Your Portfolio

Spread Your Investments: Cumulatively investing in a single currency not only puts your entire portfolio at risk, but also increases the likeliness of sustained financial losses. In order to ensure the reduced potential for financial losses, users are encouraged to spread their investments across different assets (e.g. Bitcoin, Ethereum, etc.) and cryptocurrencies.

Balance Risk and Reward: Users can also balance out high risk investments by putting a percentage of their portfolio to various stablecoins or much less volatile assets.

Be Aware of Scams and Frauds

Avoid Phishing Scams: Fake websites, emails, and instant messages from strangers can be tricky. Protective measures should be put in place to guard against phishing scams. Always use a secure computer/laptop to access your information and double check on any URLs that are sent to you.

Beware of “Get Rich Quick” Schemes: If something sounds too good to be true, it most likely is so it is best to avoid it altogether. Your one stop-shop for permanent investment returns is nothing but a hostile environment.

Verify Contracts and Addresses: One good rule of thumb is to always double check on wallet addresses and smart contracts before any funds are sent.

Stay Updated on Market Trends and News

Follow Reliable Sources: Ensuring constant and consistent information flow from credible crypto news forums and blogs should be maintained.

- Monitor Market Trends: Staying informed of the market is essential, however, do not make any snap decisions within a short time range.

Understand the Risks of Volatility

Prepare for Price Swings: Cryptocurrency values are subject to extreme fluctuations, so brace yourself for vast changes.

Avoid Emotional Trading: Follow your investment plan and do not let fear and greed dictate your actions.

Keep Your Private Keys Secure

Never Share Your Keys: The only way to access your cryptocurrency is through your private keys. Store them safely offline and do not disclose them to anyone.

Use Backup Methods: Keep your recovery phrases written down and secure them in an offline storage to ensure that they are not accessed by anyone.

Be Mindful of Taxes and Regulations

Understand Local Laws: Find out the rules surrounding cryptocurrency in your region, and always pay your taxes.

Keep Records: For taxation purposes, be sure to keep track of all your transactions.

Have a Long-Term Perspective

Think Long-Term: The crypto world is new, so treat it like a new business venture and avoid taking any unnecessary risks.

Evade Overspending

Use Margin Accounts Wisely: Employing margin can enhance your profit margins, but also more drastically increase your losses. Use bank margin accounts only when you are completely knowledgeable about the potential risks that come with them.

No Investing with Debt: Do not use credit or loans for the purpose of investing in cryptocurrency.

Always be Learning

Inquiries Always Answered: The field of cryptocurrency is always shifting. Make sure to continue your learning on evolving technologies, new market trends, and other projects.

Become Part of an Online Base: Participate in communities devoted to cryptocurrency found on Twitter, Reddit or Discord to broaden your knowledge base.

Conclusion

In conclusion, purchasing cryptocurrency within developing markets enables you to take part in the broader digital economy, enjoy financial services, and safeguard yourself from economic shocks.

Platforms such as Binance have created hassle-free region-specific onboarding, trading and storage for crypto by accepting local currencies, charging low fees, and providing automated trading features such as P2P.

Regardless, investing in crypto calls for increased caution. Make sure you are up to date on local regulations, properly secure your assets, and stay away from scams. With the aid of trusted platforms, personal responsibility in cryptocurrency is achievable, especially in emerging markets.

Do remember to always proceed with caution, especially in emerging markets, as the potential for Bitcoin’s transformational power is incredible. Also, remember to ease into the market, secure your funds, and adjust portfolios accordingly to make the most out of your crypto experience.