In this article i will discuss the How to Earn Stablecoin Interest Without Lockups, access your funds any time, and still increase your returns.

Unlike fixed-term deposits or traditional staking, no-lockup options allow for greater access to your funds. I aim to identify the leading platforms, strategies, and important considerations for passive earnings with stablecoins.

What is Lockups ?

Lockups are a particular period of time wherein transferring or withdrawing funds is not permitted. In cryptocurrency and finance, lockups are used very often in lending, staking, and investment platforms to ensure stability and liquidity.

Users with locked funds may earn higher interest rates, but their flexibility to access their assets and spend them is restricted. Without lockups, investors can earn interest while having full control of their funds. Platforms that provide interest without withdrawing funds have such options and are called DeFi and CeFi platforms.

How to Earn Stablecoin Interest Without Lockups

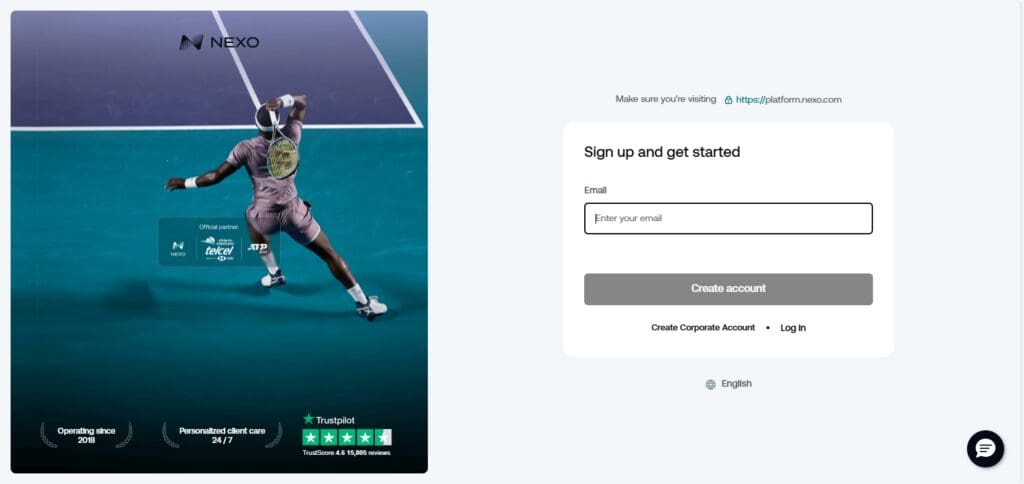

Generating interest on stablecoins with no cap on accounts is one way to earn. This is how you can do it using Nexo.

Create an Account

Create an account on Nexo. After earning an account, complete the verification so that you can enjoy all the available perks.

Deposit Stablecoins

Transfer your USDT, USDC, or DAI stablecoins to your Nexo wallet. Since these stablecoins are backed with fiat currencies, they will experience minimum fluctuations.

Enable Interest Earning

The moment your funds are deposited, Nexo pays out interest on the funds. Nexo’s is more flexible because users aren’t locked into tough terms for withdrawals.

Track Your Earnings

Log onto the Nexo online app or use the website to track the interest payment Nexo pays you daily on Nexo’s competitive rates.

Withdraw Anytime

Just like with many other instruments, there are no lockups, meaning funds can be withdrawn anytime, which adds to the liquidity.

Key Factors to Conside

Interest Rates & Yield Management

Variability due to market conditions. Do a round comparison of the stable platforms to find the best yield across the market.

Platform Security & Risks

Check that there are proper audits, robust protection measures, and funding for the unverified platform. Stay away from untrusted or high-risk platforms.

Considerations Related to Law

Look into the jurisdiction of the platform in your country to sidestep problems with compliance or legal restrictions.

Fees & Other withdrawal Related Issues

Check what the minimum balance and withdrawal timeframes are to see if these balances are acceptable with no extra hidden fees.

Tips to Maximize Earnings

Invest On Several Platforms

Allocate money to various CeFi and DeFi platforms to minimize risk and increase rewards.

Beware Of APY Variance

Keep track of changing interest rates. Funds may need to be transferred to the highest-paying accounts.

Choose Established Platforms

Use well-audited and secure platforms to minimize chances of scams and loss of funds.

Reinvest Profits

Meticulously reinvest earned profits to earn higher interest and interest over time.

Reduce Costs

Stay away from high withdrawal and transaction cost platforms to maximize net returns.

Pros & Cons

Pros:

Having Full Liquid Cash – Users can withdraw or move their funds at any time ad there are no restrictions.

Mobility – Changing platforms in pursuit of better interest rates is all too easy.

Stable Passive Income – Earning returns with little to no effort is the dream, and that is what this brings.

Peace of Mind – Exposure to the volatile world of crypto is reduced due to stable coins.

Cons:

Lower No Lockup Plan Interest Rates – No-lockup options frequently come with earning less interest than locked plans.

Centralized Platform Risks – Security vulnerabilities and insolvency risks exist amongst CeFi and DeFi platforms.

Quota Risks – Certain lawmakers can impact earnings and access to some platforms which is a risk.

Conclusion

To summarize, earning interest on stablecoins without any lockup restrictions provides full control over your funds while generating passive income.

Reputable CeFi and DeFi platforms alongside regular interest monitoring will expand your earnings without being locked into long-term contracts.

No-lockup options, although providing lower yields in comparison to locked alternatives, enhance liquidity and security for those valuing accessibility. With proper risk management and research, stablecoin interest earnings can be optimized efficiently.