I will explain the Best Staking Platforms For Solana in this article, paying attention to both advantages and ease of use.

This article will cater to all preferences, be it self-custodial wallets, liquid staking, or centralized exchanges, so everyone can stake their SOL tokens efficiently and safely.

| Platform | Key Features |

|---|---|

| Phantom | – User-friendly interface- Allows selection of preferred validators- Widely used among Solana users |

| Solflare | – Available on desktop, mobile, and browser extension- Provides detailed analytics to track staking performance |

| Kraken | – Recently resumed staking services for U.S. customers- Supports multiple digital assets including Solana- Offers both bonded and flexible staking options |

| Jito Networks | – Specializes in Maximum Extractable Value (MEV) strategies- Provides JitoSOL tokens for liquidity in DeFi platforms |

| BlazeStake | – Non-custodial protocol endorsed by the Solana Foundation- Spreads stakes across over 200 validators to enhance decentralization |

| Coinbase | – Offers easy and secure staking- Users automatically start earning rewards once they buy Solana- No lock-up periods imposed by Coinbase |

| Marinade Finance | – First to bring liquid staking to Solana- Offers mSOL tokens for use in DeFi applications- Provides Protected Staking Rewards (PSR) and an Auction Marketplace for optimized delegation |

| Lido Finance | – Provides stSOL tokens for liquidity in DeFi- Backed by a trusted protocol with DeFi utility- High liquidity and flexibility |

| JPool | – Backed by the Solana Foundation- Employs a scoring strategy to distribute SOL stake among participating validators- Emphasizes transparency |

| Socean | – Emphasizes a transparent and meritocratic delegation strategy- Integrates with major Solana DeFi protocols |

1. Phantom Wallet

Phantom is an easy-to-use self-custodial wallet made for the Solana blockchain ecosystem. Its users can stake their SOL directly from the wallet by selecting one of the validators from a list.

Phantom gives users access to detailed information about each validator’s performance, allowing users to make informed decisions about whom to stake with.

No extra fees are charged by Phantom for staking; however, each validator may impose a commission on the rewards earned.

Phantom also allows users to integrate hardware wallets such as Ledger, provides customer support through its help center and community channels, and offers customers the ability to secure their funds.

Phantom Wallet

- Key Features:

- A non-custodial wallet can store Solana, Ethereum and Polygon as well as.

- Offers direct SOL staking with different validators of choice.

- Has In-App token swapping with 0.85% change fee + extra network fees.

- Cross platform NFT management for all supported networks.

- Allows users to connect Rhythm wallets for additional protection.

- Fees:

- Staking: Phantom wallet does not charge extra fees, though the validators’ commissions might.

- Token Swaps: Charge extra 0.85% for every Token Swapped + network charges.

2. Solflare Wallet

Another notable offering within the Solana ecosystem is Solflare wallet, available on both web and mobile. It also allows native staking, enabling users to delegate their SOL to validators from directly within the wallet interface.

Solflare offers users detailed analytics to monitor their staking activities and does not impose additional fees for staking, though commissions from the validators may apply.

The wallet is compatible with Ledger hardware wallets and provides customer support through email, along with an extensive knowledge base.

Solflare Wallet

- Key Features:

- Custom made non-custodial wallets make for the Solana blockchain.

- Provides Native SOL staking and advanced detail checking features.

- Users can buy, store, send and swap SOL and SPL tokens.

- Detailed NFT support with cool Metadata.

- Together with Rhythm wallets to enhance security.

- Fees:

- 0.002 SOL network fee for opening a stakeable account (cancelable upon closure), will be returned upon account closing. More charges from the validators might be taken.

- Token Swaps: Fees are determined by the prevailing market conditions and are displayed at the time of fee payment.

3. Kraken

A centralized cryptocurrency exchange, Kraken now offers staking services to its US customers. Customers can stake their SOL at Kraken for an estimated annual percentage yield (APY) ranging between 6-12%.

With a 3 day unbonding period, bonded staking has a higher yield than flexible staking with immediate unstaking.

The platform provides multi-channel customer support including live chat, help center articles, and robust security measures.

Kraken

- Key Features:

- Centralized exchange has staking options for multiple cryptoassets including Solana.

- Staking is available through Kraken Pro to users from 37 states and 2 territories in the United States.

- Bonded staking with flexible staking and a 3-day unbonding period.

- Fees:

- Staking: Kraken estimates its APY for Solana staking is between 6-12% which isn’t supported by explicit fee details in the provided information.

4. Jito Networks

Jito is tackling the negative effects of Maximum Extractable Value (MEV) on validators through their liquid staking platform on Solana.

In order to reclaim some MEV profit for stakers, Jito delegates staked assets to MEV-enabled validators. Users receive JitoSOL tokens which can be traded on DeFi platforms.

With a rewards fee of 4% and withdrawal fee of SOL 0.10, APY stands at approximately 6.96%. Support can be accessed through their community channels and official website.

Jito Networks

- Key Features:

- Liquid staking service with the goal of reducing the overall impact of Maximum Extractable Value on the protocol.

- Delegates staked assets to MEV-enabled validators with the goal of redistributing the profits from the MEV back to the stakers.

- JitoSOL tokens are issued to the users and can be used on multiple DeFi applications.

- Fees:

- Reward fee of 4% per profit received.

- 0.10% SOL withdrawal fee.

5. BlazeStake

Endorsed by the Solana Foundation, BlazeStake is a non-custodial stake pool protocol. Users can withdraw SOL from the stake pool instantly or set for a delayed fee unblocking process where they will incur lower fees. It distributes stakes to over 200 validators to boost decentralization.

BlazeStake provides an APY of around 6.23%, with an instant withdrawal fee of 0.3% and a delayed withdrawal fee of 0.1%. Support is offered through the official site and documentation of the company.

BlazeStake

- Key Features:

- Non-custodial stake pool protocol supported by the Solana Foundation.

- Distributes stakes over 200 validators to promote decentralization.

- Supported options for staking include immediate unstaking and delayed unstaking.

- Fees:

- 0.3% instant withdrawal fee.

- 0.1% delayed withdrawal fee.

- 5% Epoch fee.

6. Coinbase

Coinbase is a centralized exchange that allows users to stake SOL (Solana). Through a Coinbase account, users can stake SOL and earn estimated rewards of 5.25% APY.

Additionally, Coinbase does not have any extra lockup periods other than those imposed by the network.

The exchange has various other security measures in place and also has customer support through a help center and email.

Coinbase

Key Features

- Centralized exchange provides staking services for Solana.

- Users can stake SOL directly through their Coinbase accounts.

- No added lock up periods apart from those mandated by the network.

Fees

- Reward rate is around 5.25% APY. Information provided does not outline specific fee structures.

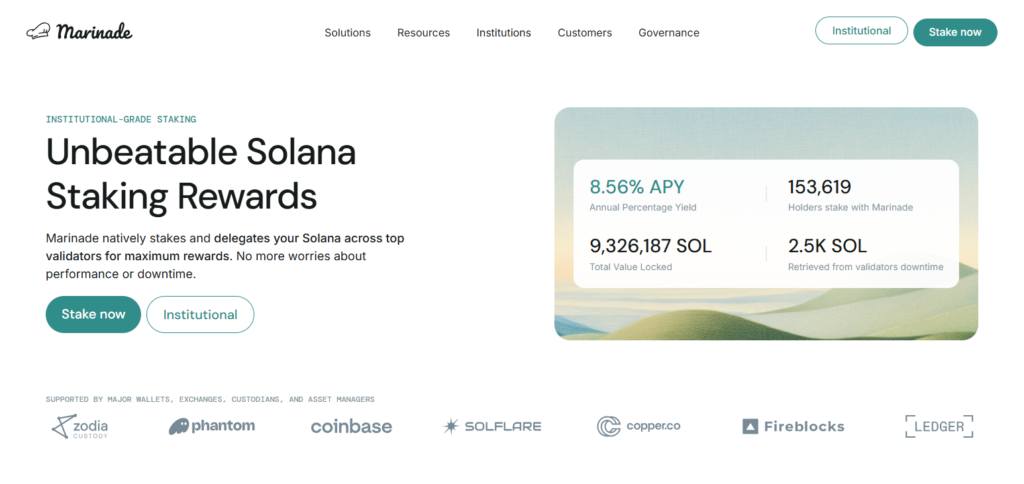

7. Marinade Finance

Marinade Finance has enabled users to stake SOL directly with validators, allowing users to fully control their assets. This removes risks associated with smart contracts.

Furthermore, Marinade also has an auction marketplace that can automatically delegate SOL to several high-performing validators to maximize earnings.

The platform is subject to changing fees and APY depending on the conditions of the network. Support is offered via the official website and other community channels.

Marinade Finance

Key Features:

- Stake automation platform that links SOL holders to the best staking rates.

- Permits both liquid staking with mSOL tokens and native staking without smart contract exposure.

- Offers auction marketplace for enhanced delegation and guaranteed staking rewards.

Fees:

- Fees are variable depending on network status. Information provided does not outline specific fee structures.

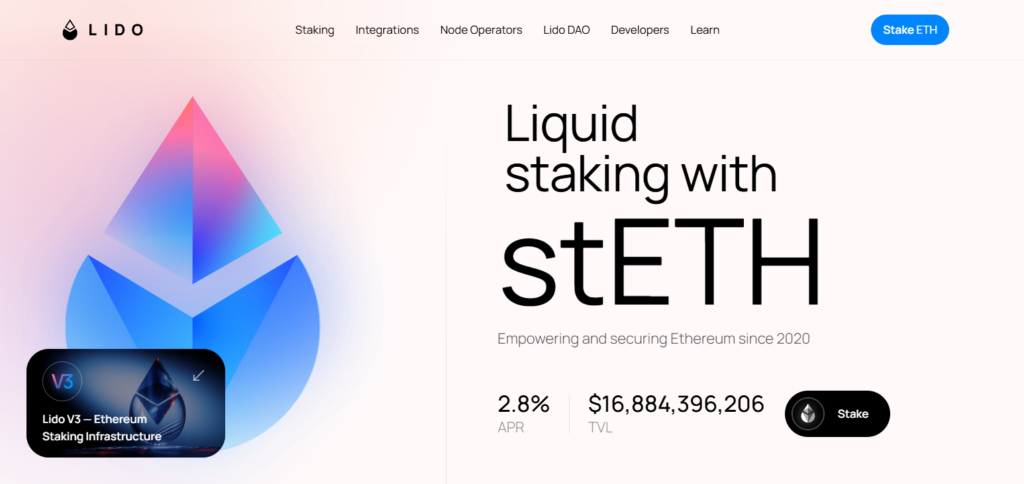

8. Lido Finance

Lido Finance is a liquid staking solution which allows users to stake SOL and receive stSOL tokens in return, which are liquid and can be used across many DeFi platforms.

This provides liquidity to staked assets and allows the user to earn staking rewards while still being able to access the staked asset.

Lido also charges a fee of 10% on the staking rewards and the APY is dependent on network conditions. Support can be accessed on the provided website and community forums.

Lido Finance

Key Features

- Liquid staking solution permits users to stake SOL for stSOL tokens.

- stSOL tokens support multiple DeFi platforms, granting liquidity to staked assets.

Fees:

- 10% fee on staking rewards.

9. JPool

JPool is a stake pool created by Solana Foundation which utilizes a scoring strategy to allocate SOL stakes on participating validators.

The platform aims to maximize returns by monitoring validator performance and reallocating stakes.

JPool has an APY of about 8.26% and charges a fee of 5% of the rewards for each epoch. Support is accessible through their official website and documentation.

JPool

Key Features:

- Stake pool established by the Solana Foundation which uses a scoring method to allocate SOL amongst validators.

- Constantly evaluates validators for optimal performance to ensure best returns.

Fees:

- 5% of rewards per epoch.

10. Socean

Socean is a liquid staking platform that has a transparent and meritocratic delegation strategy. It integrates with the major Solana DeFi protocols which allow the user to make use of their staked assets on many platforms.

Socean has an APY of about 7.25% and charges a 0.06% withdrawal fee, along with a 2% ongoing management fee on the returns. Support is provided through the official website as well as community channels.

Socean

Key Features

- Liquid staking platform focusing on clear and merit based delegation system.

- Combines with other DeFi protocols on Solana.

Costs

- 0.06% withdrawal fee.

- 2% ongoing management fee on returns.

Conclusion

Staking of Solana (SOL) provides an opportunity to passively earn income and strengthens the security of the network. Individual stakers have different preferences when it comes to the level of control, liquidity, and user-friendliness they want, which affects their choice of platforms.

Non-custodial wallets like Phantom and Solflare allow for direct user-controlled staking which guarantees asset control. Those wishing for simplicity, user-friendly interfaces, and integrated services can turn to centralized exchanges like Kraken and Coinbase.

Platforms to the side of Jito Networks and Marinade finance offer increased liquidity with their liquid staking tokens allowing engagement in decentralized finance (DeFi) activities while still earning staking rewards.

Evaluating ROI, annual percentage yield(APY), fees, security measures of the system, and overall reputation of the platform is crucial. Conducting thorough research will help select a platform that fulfills your investment needs and risk tolerances.