This article will cover the Best Defi Insurance Tokens To Watch where I discuss innovations of several projects that are changing the risk management paradigm in DeFi.

Safeguarding digital assets becomes a necessity with the increasing adoption of DeFi. These tokens provide collaborative insurance solutions that improve security, transparency, and trust in the entire crypto ecosystem which makes them fundamental to follow.

Key Point & Best Defi Insurance Tokens To Watch List

| Protocol | Key Point |

|---|---|

| Nexus Mutual | Decentralized insurance for smart contract failures. |

| InsurAce | Multi-chain DeFi insurance with yield optimization. |

| Armor | Pay-as-you-go DeFi cover using Nexus Mutual backend. |

| Bright Union (BRIGHT) | Tokenized coverage with capital-efficient underwriting pools. |

| Etherisc | Framework for building decentralized insurance products. |

| Tidal Finance | High-capacity insurance marketplace for DeFi protocols. |

| Risk Harbor | Automated, code-driven claims and risk management. |

| inSure DeFi | Community-based crypto asset protection against scams and volatility. |

| Uno Re | Decentralized reinsurance and risk investment platform. |

| Cozy Finance | Premium-free automated protection via smart risk vaults. |

1.Nexus Mutual (NXM)

Nexus Mutual (NXM) is arguably one of the best DeFi insurance tokens because it stands out from the class through a unique member-driven model that captures the essence of traditional insurance and turns it into a decentralized version.

It does not integrate smart contract coverage with a protocol, but rather a mutual system where users manage risks, decide claims, unmute shouting so that there is no fraud or falsehood. Transparency, equity, and governance enable balanced community control of resources.

NXM is increasingly viewed as a protective shield within the evolving narrative of Web3 because of real time risk assessment, hyper automation, and stupendous acceptance throughout DeFi frameworks.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance protocol |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for membership and participation |

| Use Cases | Coverage for smart contract failures, exchange hacks, and DeFi risks |

| Governance | Community-driven governance through NXM token holders |

| Security | Audited smart contracts and risk-sharing pool mechanisms |

| Supported Assets | Covers a wide range of DeFi protocols and assets |

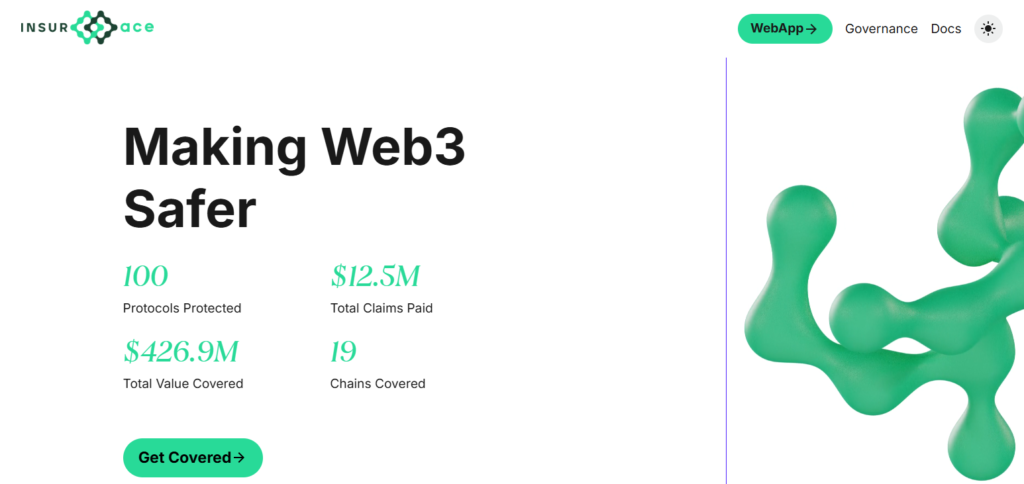

2.InsurAce (INSUR)

InsurAce (INSUR) is among the most promising DeFi insurance tokens to keep an eye on due to its distinct integration of insurance and yield generating features.

This dual-model framework permits users to safeguard their assets and earn profits at the same time, unlike traditional insurance protocols.

Its cross-chain functionality and capital effectiveness enhance its use and scalability throughout different DeFi ecosystems. InsurAce’s limitations on coverage costs with strategic capital maximization provides both protection and profit—an innovative approach seldom available in decentralized insurance platforms.

| Feature | Details |

|---|---|

| Platform Type | Decentralized multi-chain insurance protocol |

| Technology | Built on Ethereum and supports multiple chains like BNB Smart Chain, Polygon, and Avalanche |

| Transaction Fees | Low fees with portfolio-based bundled covers |

| KYC Requirements | Minimal KYC required for accessing coverage |

| Use Cases | Coverage for smart contract vulnerabilities, stablecoin depegging, and custodian risks |

| Governance | Community-driven governance through INSUR token holders |

| Security | Audited smart contracts and transparent claim processes |

| Supported Assets | Covers 140+ DeFi protocols across multiple chains |

3.Armor (ARMOR)

Armor (ARMOR) stands out as the foremost DeFi insurance token by providing pay-as-you-go coverage without KYC requirements. Armor’s Smart Cover System situated on top of Nexus Mutual’s infrastructure ensures users assets’ movement across various protocols are consistently protected through dynamic scaling.

Employing this method, users can set real-time coverage requirements and adjust premium payments accordingly, making costs more efficient. Further strengthening its appeal, Armor offers permissionless access to multi-wallet tracking, helping provide intuitive decentralized insurance solutions that are easy to navigate.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance aggregator |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Pay-as-you-go model with no upfront costs |

| KYC Requirements | Minimal KYC required for accessing coverage |

| Use Cases | Coverage for smart contract vulnerabilities and DeFi protocol risks |

| Governance | Community-driven governance through ARMOR token holders |

| Security | Utilizes audited smart contracts and risk-sharing mechanisms |

| Supported Assets | Covers a wide range of DeFi protocols and assets |

4.Bright Union (BRIGHT)

Bright Union (BRIGHT) serves as a useful example of a DeFi insurance token to watch as it has consolidated different options into a single crypto coverage interface.

Through Bright Union, individuals can interact with more than 150 protocols spanning across chains, which allows them to compare and purchase insurances.

At the same time, it enables participants to become insurance liquidity providers and earn stable yields of 15% to 25% APY. This not only increases participation, but also contributes to a safer and more robust DeFi environment.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance aggregator |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Low fees for accessing insurance products |

| KYC Requirements | Minimal KYC required for participation |

| Use Cases | Coverage for protocol hacks, stablecoin depegging, and custodian risks |

| Governance | Community-driven governance through BRIGHT token holders |

| Security | Audited smart contracts and transparent claim processes |

| Supported Assets | Covers multiple DeFi protocols across 15+ chains |

5.Etherisc (DIP)

Etherisc (DIP) is a remarkable DeFi insurance token because of its aim to offer low cost and easy to obtain coverage for small businesses and low-income families. Etherisc uses blockchain technology to improve transparency and security in its insurance services.

Their relationship with other DeFi protocols allow consumers to access insurance on their preferred platforms.

The DIP token enables transaction and governance within the ecosystem which means holders can control the policies, rules, or decisions put in place. These attributes are what differentiates Etherisc among other insurance providers and strengthens it as a market leader.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance platform |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Variable fees based on Ethereum network usage |

| KYC Requirements | Minimal KYC required for participation |

| Use Cases | Coverage for flight delays, crop insurance, and smart contract risks |

| Governance | Community-driven governance through DIP token holders |

| Security | Transparent and audited smart contracts |

| Supported Assets | Covers diverse real-world and crypto-related risks |

6.Tidal Finance (TIDAL)

Tidal Finance (TIDAL) is a DeFi insurance token of note because of its custom insurance marketplace for risk mitigation contracts.

This facilitates underwriters to synthesize insurance pools and policies with dynamic capital efficient terms while improving yield for liquidity providers.

Tidal Finance mitigates several risks in the DeFi space by supporting a wide array of protective policies like smart contract exploits and asset de-pegging. This makes it a notable token to follow in decentralized insurance.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance marketplace |

| Technology | Built on Polkadot blockchain |

| Transaction Fees | Competitive fees with customizable insurance pools |

| KYC Requirements | Minimal KYC required for participation |

| Use Cases | Coverage for smart contract hacks, stablecoin depegging, and protocol risks |

| Governance | Community-driven governance through TIDAL token holders |

| Security | Audited smart contracts and risk-sharing mechanisms |

| Supported Assets | Covers multiple DeFi protocols and assets |

7.Risk Harbor (RISK)

Risk Harbor (RISK) stands out among DeFi insurance tokens because of its automated, transparent, and unprejudiced risk management marketplace. Unlike traditional insurance protocols which depend on manual claim evaluations, Risk Harbor utilizes parametric insurance. Risk Harbor uses set parameters and on-chain data to automatically churn out claims.

Their method guarantees the best and fastest payouts without bias which strengthens their trust in the system. Furthermore, Risk Harbor allows underwriters to earn yields on their staked assets which increases capital efficiency and protects risks. This grants the insurance takers high returns while also benefitting the liquidity providers within the DeFi space.

| Feature | Details |

|---|---|

| Platform Type | Decentralized risk management marketplace |

| Technology | Built on Ethereum and supports multiple chains like Arbitrum, Avalanche, Fantom, and Aurora |

| Transaction Fees | Dynamic pricing based on market demand |

| KYC Requirements | Minimal KYC required for accessing coverage |

| Use Cases | Coverage for smart contract vulnerabilities, liquidity risks, and protocol attacks |

| Governance | Community-driven governance through RISK token holders |

| Security | Automated and impartial claims process using audited smart contracts |

| Supported Assets | Covers a wide range of DeFi protocols across multiple chains |

8.inSure DeFi (SURE)

inSure DeFi (SURE) is distinguishable from other DeFi insurance tokens because it offers community-based crypto portfolios protection against scams, sharp devaluation, and theft. Its proprietary model of computing dynamic premiums captures demand externally and along with set market conditions, maintains equitable insurance costs.

The inSure DAO controls the ecosystem, and the inSure platform enables open governance, through voting on fund claims, proposals, or community-driven initiatives, referred to through tokens by the DAO. Apart from that, users can trade SURE tokens on decentralized marketplaces and earn lucrative staking yields, augmenting the security and profitability of the ecosystem.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance ecosystem |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Dynamic pricing model based on supply and demand |

| KYC Requirements | Minimal KYC required for accessing coverage |

| Use Cases | Insurance for crypto portfolios, protection against scams, and devaluation risks |

| Governance | Community-driven governance through SURE token holders |

| Security | Transparent claims process and audited smart contracts |

| Supported Assets | Covers a wide range of crypto portfolios and assets |

9.Uno Re (UNO)

Uno Re (UNO) is the first of its kind in the space of DeFi insurance that allows users to trade and invest in the risk and reinsurance ecosystem unlike anything prior available through traditional means.

With its Cover Portal, crypto assets are insured in a streamlined manner through a graphic interface that promotes effortless protection. Employing AI technologies for risk evaluation and justification of multi-chain asset support fortifies Uno Re’s position in Defi_Uno Re in it’s security, transparency and leadership in decentralized insurace systems.

| Feature | Details |

|---|---|

| Platform Type | Decentralized insurance and risk management platform |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Competitive fees based on coverage type |

| KYC Requirements | Minimal KYC required for accessing coverage |

| Use Cases | Coverage for stablecoin depegging, validator slashing, and DeFi exploits |

| Governance | Community-driven governance through UNO token holders |

| Security | Audited smart contracts and transparent claim processes |

| Supported Assets | Covers a wide range of DeFi protocols and assets |

10.Cozy Finance (COZY)

Cozy Finance (COZY) is a standout DeFi insurance token with it’s market-first features like customizable easy access coverage pools that allows participants to both create and partake in cover pools designed for specific risk zones.

Cozy automates and makes payments visible which guarantees users swift payouts far better than traditional claim systems, Cozy users are guaranteed greater satisfaction.

Furthermore, Cozy’s architecture maximizes the usage of capital, offering significant returns for the providers of protection while striking a fair risk-reward equilibrium. Because of these, Cozy Finance has positioned itself at the frontline of changes within the decentralized insurance systems.

| Feature | Details |

|---|---|

| Platform Type | Decentralized peer-to-peer protection solution |

| Technology | Built on Ethereum blockchain |

| Transaction Fees | Competitive fees based on protection markets |

| KYC Requirements | Minimal KYC required for participation |

| Use Cases | Coverage for smart contract failures, hacks, and exploits |

| Governance | Community-driven governance through COZY token holders |

| Security | Transparent and automated claim processes using audited smart contracts |

| Supported Assets | Covers a wide range of DeFi protocols and assets |

Conclusion

In summary As DeFi is on the rise, the need to safeguard assets from emerging threats simultaneously increases.

The leading DeFi insurance tokens like Nexus Mutual, InsurAce, Armor, Unslashed Finance, Etherisc, Tidal Finance, Risk Harbor, inSure DeFi, Uno Re, and Cozy Finance are pioneers on the path of decentralized protection and each one offers something different.

These protocols are automating claims, customizing coverage, providing access to reinsuring and efficiently utilizing capital which is transforming the financial safeties in Web3. These protocols are essential to remain resilient in crypto in the long-run.