In this article, I will Discuss About the best online banks for international students, especially those that have low fees, are easy to access globally, and enable easy transfer of funds.

For international students, handling finances abroad can be daunting, but the right bank can make a difference. Now, let’s identify the best possible online banking options available for students studying abroad.

Key Points & Best Online Banks for International Students List

| Bank | Key Points |

|---|---|

| Wise | Great for international transfers with low fees; multi-currency account. |

| Revolut | Offers a mobile app for easy banking; international transfers; crypto features. |

| HSBC | Global presence; traditional banking services with international student accounts. |

| N26 | Easy-to-use mobile bank; no fees for international transfers; free ATM withdrawals. |

| Citibank | Extensive international reach; student-friendly accounts with perks. |

| Monzo | Fully digital bank; fee-free card spending abroad; excellent budgeting tools. |

| Bank of America | Strong global presence; offers international student accounts and services. |

| Santander | Low-fee international banking; student-specific accounts with discounts. |

| Charles Schwab | No foreign transaction fees; free ATM withdrawals worldwide. |

| TD Bank | Wide ATM network; offers international student services with low fees. |

10 Best Online Banks for International Students

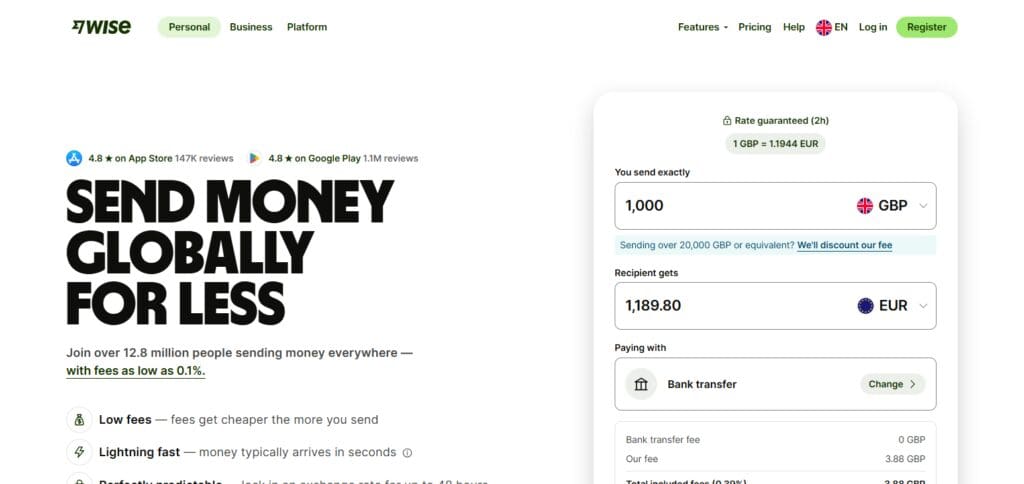

1.Wise

This is perhaps the ideal option for international students owing to their multi-currency accounts and cheap international transfers.

Unlike other service providers, Wise allows you to carry and exchange more than 40 currencies at the true mid-market exchange rate and without any hidden charges.

Their app is easy to use and their pricing is straightforward. They are however lacking in traditional banking services such as loans, and other funding options.

| Feature | Details |

|---|---|

| Account Type | Multi-currency account |

| International Transfers | Low fees, fast transfers across countries |

| Currency Support | Supports over 50 currencies |

| ATM Withdrawals | Free ATM withdrawals up to a monthly limit |

| Fees | Transparent low fees; no hidden charges |

| Mobile App | User-friendly app for managing money, transfers, and spending |

| Global Availability | Available in over 80 countries |

| Debit Card | Multi-currency debit card for spending in multiple currencies |

2.Revolut

Revolut allows the most robust experience for digital banking, their increased plan with over 25 multi-currency accounts s is a bonus when paired with their real-time exchange rates.

It is the most valuable option for students that are abroad owing to the budgeting features. In addition to these features, the free plan offered also includes limited no-fee ATMs, while the premium tiers come loaded with travel bonuses as well.

| Feature | Details |

|---|---|

| Account Type | Digital bank with multi-currency support |

| International Transfers | Fee-free and low-cost international money transfers |

| Currency Support | Supports over 30 currencies, including cryptocurrency |

| ATM Withdrawals | Free ATM withdrawals up to a monthly limit |

| Fees | Transparent, low fees for premium accounts |

| Mobile App | Easy-to-use app for managing accounts, payments, and budgeting |

| Global Availability | Available in over 35 countries |

| Debit Card | Multi-currency debit card for global use |

3.HSBC

With their free incoming wires and extensive networks of ATMs, HSBC is bound to catch your attention first.

They are however not the most favorable carrier when it comes to balance requirements as the stand at $75,000, their premium account option may only be helpful for those supported by family wealth but it is a significant opportunity for international students.

| Feature | Details |

|---|---|

| Account Type | Student accounts with international banking features |

| International Transfers | Competitive fees for international transfers |

| Currency Support | Supports multiple currencies for global banking |

| ATM Withdrawals | Worldwide ATM access with fee-free withdrawals in many regions |

| Fees | Low or waived fees for students with qualifying accounts |

| Mobile App | Feature-rich app for managing accounts, transfers, and payments |

| Global Availability | Available in over 50 countries globally |

| Debit Card | Visa debit card for international use |

4.N26

German based neobank N26 has also entered the field when offering accounts with no monthly fees accompanied by the flexibility of mobile banking, which makes them ideal for European students.

On the downside, they support multiple currencies through their Wise integration but, then again, cash withdrawal fees on simpler plans make them less attractive for users who prefer cash.

| Feature | Details |

|---|---|

| Account Type | Digital bank with free and premium student accounts |

| International Transfers | Free and low-cost international transfers |

| Currency Support | Supports multiple currencies |

| ATM Withdrawals | Free withdrawals from ATMs in Europe; limited free withdrawals worldwide |

| Fees | No fees for basic account; premium accounts available with added features |

| Mobile App | Intuitive mobile app for managing finances and payments |

| Global Availability | Available in 24 European countries and expanding globally |

| Debit Card | Mastercard debit card for global spending |

5.Citibank

Citibank’s worldwide coverage and multicurrency existences appeal to students who prefer physical banking.

It has fee waivers for ATM withdrawals at Citibank branches and does not charge for foreign transactions. However, the foreign wire transfer fee ($35) for accounts not linked to Citibank is quite steep.

| Feature | Details |

|---|---|

| Account Type | Student accounts with global banking options |

| International Transfers | Competitive rates for international transfers |

| Currency Support | Supports multiple currencies |

| ATM Withdrawals | Access to over 65,000 ATMs worldwide |

| Fees | Low or waived fees for students with qualifying accounts |

| Mobile App | Mobile app for managing accounts, payments, and international transfers |

| Global Availability | Available in over 100 countries worldwide |

| Debit Card | Visa debit card with global acceptance |

6.Monzo

A digital bank from the UK, Monzo allows free spending outside the UK and offers a budgeting feature in its app.

It is useful to students from the UK studying in Europe because they can withdraw from EEA ATMs without fees, although limits for non-EEA withdrawals (£200 per month) and 3% fees afterwards may not be so attractive.

| Feature | Details |

|---|---|

| Account Type | Digital-only bank with free and premium accounts |

| International Transfers | Fee-free international money transfers within certain limits |

| Currency Support | Supports multiple currencies for global transactions |

| ATM Withdrawals | Free ATM withdrawals worldwide with a limited monthly allowance |

| Fees | No monthly fee for basic accounts; premium options with added features |

| Mobile App | User-friendly app for managing accounts, spending, and budgeting |

| Global Availability | Available for residents in the UK and limited availability in the EU |

| Debit Card | Mastercard debit card for international use |

7.Bank of America

Bank of America has student-friendly accounts with no maintenance charges for customers under 24 years old.

While its large branch network throughout the U.S. is an advantage, its global usability is limited by the international fees and low support for multicurrency accounts in comparison to digital banks.

| Feature | Details |

|---|---|

| Account Type | Student checking accounts with global banking features |

| International Transfers | Competitive rates for international transfers |

| Currency Support | Supports multiple currencies |

| ATM Withdrawals | Access to over 16,000 ATMs in the U.S. and fee-free withdrawals at partner ATMs internationally |

| Fees | Low or waived fees for students with qualifying accounts |

| Mobile App | Mobile app for managing accounts, transfers, and payments |

| Global Availability | Available in over 35 countries globally |

| Debit Card | Visa debit card for international use |

8.Santander

With no monthly charge and basic banking services, Santander’s Student Value Checking is very attractive to students.

Its international presence is certainly helpful, but its limited multi-currency capabilities makes it more suitable for students who intend to remain in one country rather than those who plan to travel.

| Feature | Details |

|---|---|

| Account Type | Student accounts with international banking features |

| International Transfers | Low-cost international transfers with competitive rates |

| Currency Support | Supports multiple currencies for global transactions |

| ATM Withdrawals | Free ATM withdrawals at Santander ATMs globally and partner ATMs |

| Fees | Low or waived fees for students with qualifying accounts |

| Mobile App | Mobile app for managing accounts, payments, and transfers |

| Global Availability | Available in over 10 countries, including Europe and Latin America |

| Debit Card | Visa debit card for international spending |

9.Charles Schwab

For students from the United States studying abroad, Charles Schwab is ideal. They do not charge for foreign transactions and refund all ATM fees regardless of location.

Their low foreign transaction fee is appealing to many, but not having a brokerage account might deter some clients.

| Feature | Details |

|---|---|

| Account Type | Checking accounts with global banking features |

| International Transfers | Low-cost international transfers with competitive exchange rates |

| Currency Support | Supports multiple currencies |

| ATM Withdrawals | Free worldwide ATM withdrawals with no foreign transaction fees |

| Fees | No monthly fees for checking accounts |

| Mobile App | User-friendly mobile app for managing accounts and transfers |

| Global Availability | Available in the U.S., with global ATM access |

| Debit Card | Visa debit card for international use |

10.TD Bank

The Convenience Checking account at TD Bank removes fees for students between the ages of 17 and 23, provides mobile banking, and does not require a minimum balance.

This is beneficial for students in the United States, but it does not have strong features internationally, making it difficult for frequent travelers to use.

| Feature | Details |

|---|---|

| Account Type | Student checking accounts with global banking features |

| International Transfers | Low-cost international transfers with competitive exchange rates |

| Currency Support | Supports multiple currencies |

| ATM Withdrawals | Access to over 1,300 ATMs in the U.S. and fee-free partner ATMs internationally |

| Fees | Low or waived fees for students with qualifying accounts |

| Mobile App | Mobile app for managing accounts, transfers, and payments |

| Global Availability | Available in the U.S., with international services |

| Debit Card | Visa debit card for international use |

Conclusion

To sum up, Selecting the right online bank for international students revolves around inexpensive fees, ease of access around the globe, and simple transfer procedures.

Wise, Revolut, HSBC and a multitude of other banks offer fantastic benefits including fee-free international transfers, ATM accessibility, and even student accounts.

Make sure to evaluate your needs, as well as your location, in order to establish the most cost effective banking solution.